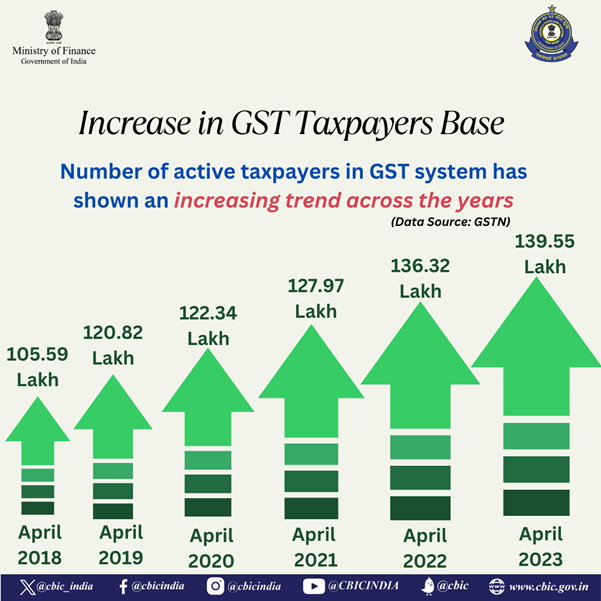

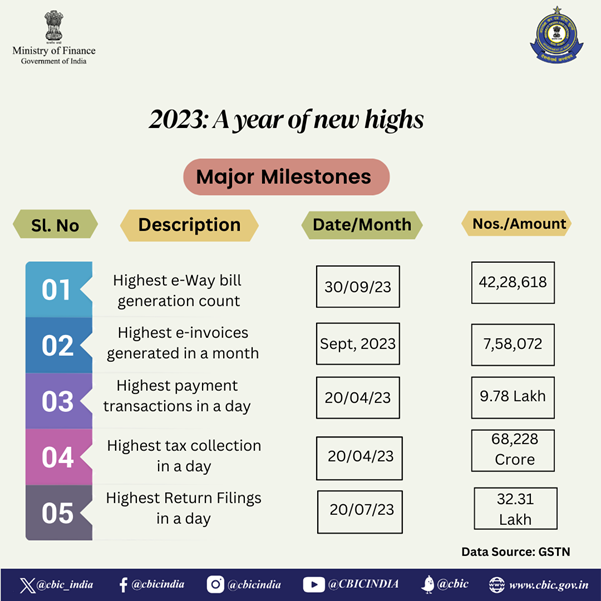

The Central Board of Indirect Taxes and Customs (CBIC), Department of Revenue, Ministry of Finance, has achieved significant milestones in enhancing the efficiency and integrity of the Goods and Services Tax (GST) system. Goods and Services Tax (GST) not only completed six successful years of implementation but also broke all records of previous collections and achieved the highest ever tax revenue collection for April 2023 at Rs 1.87 lakh crore.

Leveraging data analytics and artificial intelligence, the CBIC has strengthened the registration process by implementing a risk rating system for applicants, ensuring thorough verification to prevent fraudulent entries. Additionally, geo-tagging of business locations, system-based suspension of registrations for non-filers, and risk-based processing of refund applications showcase CBIC's commitment to curbing malpractices.

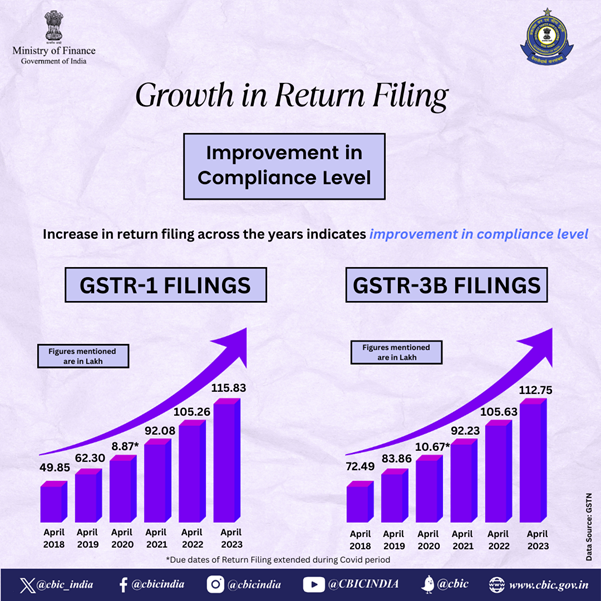

To streamline the filing process, sequential filing of GSTR-1 and GSTR-3B has been mandated, promoting timely returns and smooth availability of input tax credit. Special drives against fake registrations, system-based mechanisms for intimation of mismatches, and a new functionality for unregistered persons to apply for temporary registration demonstrate CBIC's dedication to compliance.

Moreover, measures like transfer of balance in electronic cash ledgers, exemptions for small taxpayers, and facilitation of intra-state supply through e-commerce operators underscore the CBIC's efforts to support businesses and improve cash flows. Noteworthy is the extension of GST exemptions for satellite launch services and simplification of late fee structures.

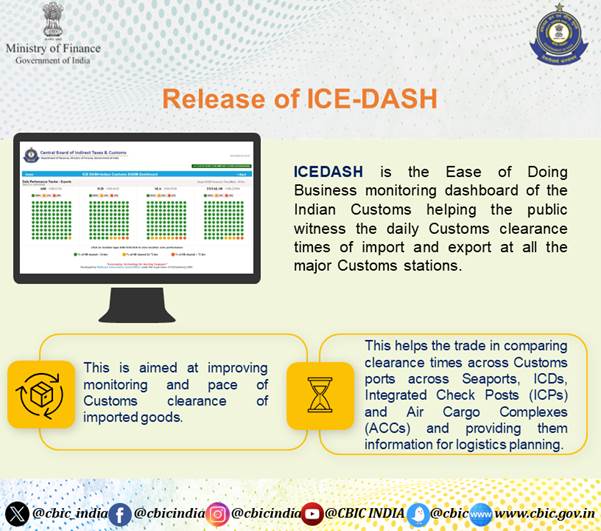

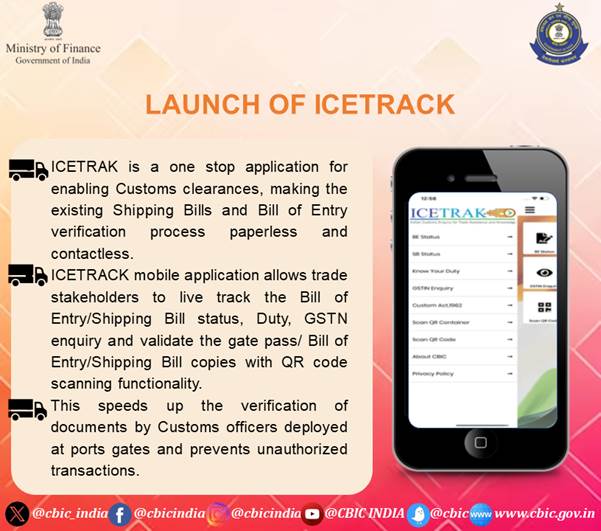

On the customs front, CBIC has initiated regulatory and policy reforms, including the rationalization of customs duty rates and steps towards decriminalization. Technological advancements like ICEGATE 2.0 and the Anonymised Escalation Mechanism showcase a commitment to modernisation and user-friendly interfaces. Infrastructural initiatives, such as pre-gate processing facilities and modernisation of control laboratories, further enhance operational efficiency. The CBIC's efforts reflect a holistic approach to tax administration, aiming for transparency, Ease of Doing Business, and compliance.

CENTRAL BOARD OF INDIRECT TAXES AND CUSTOMS (CBIC)

GOODS AND SERVICES TAX (GST)

RISK RATING OF REGISTRATION APPLICATIONS

To ensure that fraudulent elements are prevented from entering into GST system, registration process has been strengthened by use of data analytics and artificial intelligence to identify risky applicants so that their detailed verification, including physical verification can be conducted by the field officers before taking a decision on their application for registration.

THE FACILITY OF GEO TAGGING of the place of business of the applicant for the registration as well as existing registered persons has been provided on the portal.

SYSTEM BASED SUSPENSION OF REGISTRATION is done in cases where returns are not filed for continuous period of 6 months.

RISK RATING OF REFUND APPLICATIONS

GST refund applications are being assigned risk rating based on data analytics and risk parameters, so that detailed verification can be conducted by the tax officers while processing such risky refund applications so as to ensure that undue/ineligible refunds are not sanctioned to the fraudulent taxpayers.

SEQUENTIAL FILING OF GSTR-1 AND GSTR-3B

Filing of GSTR-l has been made mandatory before filing of GSTR-3B for a tax period with effect from 01.10.2022. Also, sequential filing of GSTR-1 has been mandated w.e.f. 01.10.2022. Thus, GSTR-l as well as GSTR-3B have been made totally sequential tax period wise. This would ensure timely furnishing of returns and will smoothen the availability of the input tax credit to the recipient.

A SPECIAL ALL INDIA DRIVE LAUNCHED AGAINST FAKE REGISTRATIONS during the period 16.05.2023 to 15.07.2023, jointly by Central and State tax authorities in close coordination. Detailed guidelines issued for the implementation of the said drive vide Instruction no. 01/2023-GST dated 04.05.2023.

SYSTEM BASED MECHANISM OF INTIMATION OF MISMATCHES in liability between GSTR-1 and GSTR-3B above a certain threshold (Rs 25 Lakh and 20% at present) has been provided for enabling the taxpayer to either pay the differential liability or explain the difference. This will help in self-regulation and reconciliation on part of the taxpayers themselves, without intervention of tax officers. Similar System based mechanism has been provided for excess availment of ITC in FORM GSTR-3B vis-a-vis that made available in FORM GSTR-2B above a certain threshold (Rs 25 Lakh and 20% at present).

A NEW FUNCTIONALITY HAS BEEN MADE AVAILABLE on the common portal which allows unregistered persons to take a temporary registration and apply for refund. Also, the manner and procedure for filing of refund applications by unregistered persons in certain circumstances has been prescribed vide Circular no. 188/20/2022-GST dated 27.12.2022.

MEASURE FOR IMPROVING CASH FLOW: Provision has been made to provide for transfer of balance in electronic cash ledger of a registered person to electronic cash ledger of a distinct person. This provision would help taxpayer in easily transferring unutilized balance in cash ledger between the registered persons having same PAN, without need for filing refund claim with tax officers. This would provide case of doing business and would improve liquidity and cash flows of such taxpayers.

GST COUNCIL IN ITS 47th MEETING recommended for allowing unregistered suppliers and composition taxpayers to make intra-state supply of goods through E-Commerce Operators (ECOS), subject to certain conditions. The requisite amendments in the GST Act have been made by Finance Act, 2023 and the it has been notified w.e.f. 01.10.2023 vide Notification No. 34/2023-CT dated 31.07.2023 as per the recommendation made by the GST Council. Lakhs of small taxpayers would be benefited from the waiver of requirement of mandatory registration. This would open the huge e-commerce market for them to sell their goods without getting mandatory registration upto threshold turnover of registration. Extension of the benefit of making intra-state supply of goods through an E-commerce Operator (ECO) to the composition taxpayers shows government's commitment to support small businesses.

VIDE NOTIFICATION NO. 18/2022- CENTRAL TAX dated 28.09.2022, w.e.f. 01.10.2022, amendments have been brought in the CGST Act to extend the time period for rectification/amendment of returns/ issuance of credit notes and for availment of input tax credit unto 30th day of November following the end of the financial year to which such details pertain. Earlier it was allowed up to the due date for furnishing of return for the month of September. This provides additional time to the taxpayers for rectification/amendment of returns. Issuance of credit notes and for availment of input tax credit.

LATE FEES FOR DELAYED FILING of FORM GSTR-9/ GSTR-9C by registered persons having turnover upto Rs. 20 crore has been rationalised by linking it to the taxpayers' aggregate turnover in the relevant Financial Year.

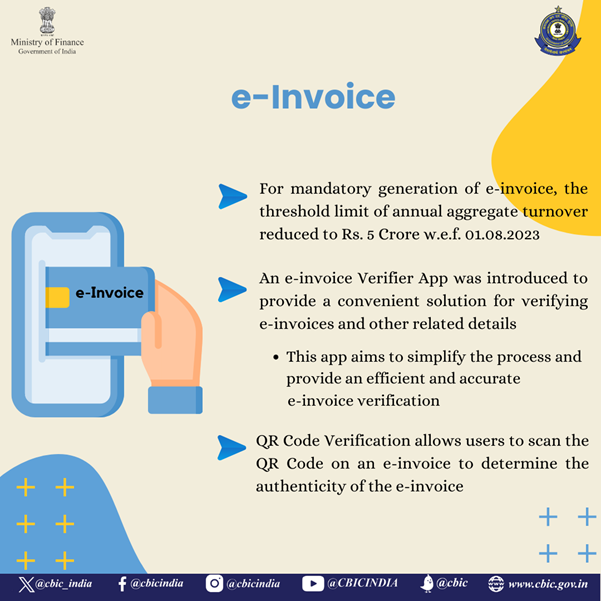

E- INVOICING SYSTEM WAS INTRODUCED IN INDIA with effect from O1.10.2020 for B2B transactions as well as exports, for taxpayers with annual aggregate turnover of Rs. 500 crore and above. This threshold has been reduced progressively over a period of time and was reduced to Rs 10 crores from 01.10.2022. This threshold limit has been further reduced to Rs 5 crore with effect from 01.08.2023 vide notification no. 10/2023-Central Tax dated 10.05.2023.

AS A RELIEF TO THE TAXPAYERS FROM HIGH LATE FEES, vide Notification No. 07/23-CT dated 31.03.2023, late fee payable for delayed filing of FORM GSTR-9 / GSTR-9C for FY 2017-18 to FY 2021-22 was capped to maximum of Rs. 20,000/- (Rs. 10,000/- + Rs. 10,000/-) if filed between 01.04.23 to 30.06.23 and the due date was further extended till 31.08.2023 vide Notification No. 25/2023-CT dated 17.07.2023. Further, vide Notification No. 08/23-CT dated 31.03.2023, late fee payable for delayed furnishing of final return in FORM GSTR-10 was capped to maximum of Rs. 1,000/- (Rs. 500/- + Rs. 500/-) if filed between 01.04.23 to 30.06.23 and the due date was further extended till 31.08.2023 vide Notification No. 26/2023-CT dated 17.07.2023.

VIDE NOTIFICATION NO. 06/2023-CT dated 31.03.2023, a conditional amnesty scheme was provided for deemed withdrawal of best judgement assessment orders issued under Section 62, in the cases where a valid return was not furnished within 30 days from the date of service of such assessment order issued on or before 28.02.2023, if the pending return is filed on or before 30.06.2023. Further, such date for filing of pending return was extended till 31.08.2023 vide Notification No. 24/2023-CT dated 17.07.2023.

VIDE NOTIFICATION NO. 03/2023-CT dated 31.03.2023, for such registrations which were cancelled for non-filing of returns on or before 31.12.2022 and application for revocation was not filed or appeal has been rejected or appeal is pending within the specified time, the time limit for filing of application for revocation of cancellation of registration, was extended till 30.06.2023. Further, vide Notification No. 23/2023-CT dated 17.07.2023, the time limit for filing of application for revocation of such cancellation of registration, was extended till 31.08.2023.

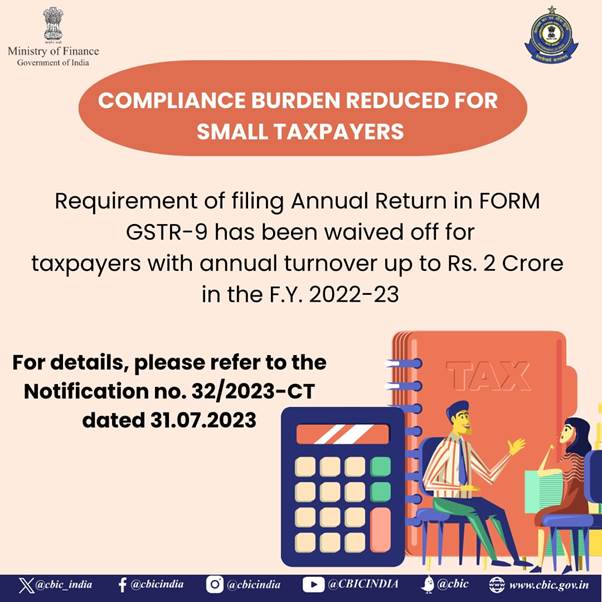

VIDE NOTIFICATION NO. 32/2023-CT dated 31.07.2023 the registered person, whose aggregate turnover in the financial year 2022-23 is up to two crore rupees, has been exempted from filing annual return for the said financial year.

VIDE NOTIFICATION NO. 33/2023-CT dated 31.07.2023, ‘Account Aggregator’ has been notified as the systems with which information may be shared by the common portal based on consent provided by the registered person/taxpayer. This will help MSMES in getting credit/business loan based on their GST registration.

IN ORDER TO SIMPLIFY AND DECRIMINALISE certain provisions of the GST Act, based on the recommendation of GST Council, amendments have been made in provisions of CGST Act, 2017.

CONSTITUTION OF GOODS AND SERVICES TAX APPELLATE TRIBUNAL: The requisite amendment in CGST Act, 2017, as recommended by the GST Council, for constitution of GST Appellate Tribunal has been made. Further action for functioning of the Tribunal is being taken.

WITH A VIEW TO FURTHER ENHANCE EASE OF DOING BUSINESS, GTAS who pay duty on RCM basis have been given an option to pay GST under forward charge mechanism. As a trade friendly measure, GTAS are not required to file declaration for paying GST under forward charge every year. If they have exercised this option for a particular financial year, they shall be deemed to have exercised it for the next and future financial years unless they file a declaration that they want to revert to reverse charge mechanism (RCM).

GST EXEMPTION ON SATELLITE LAUNCH SERVICES supplied by ISRO, Antrix Corporation Limited and New Space India Limited (NSIL) has been extended to such services supplied by organisations in private sector also to encourage Start-Ups.

THE ISSUE OF GST ON ONLINE GAMING decided by the GST Council in its 51st GST Council meeting giving finality to long pending issue.

THE 52ND GST COUNCIL HAS RECOMMENDED TO EXEMPT SERVICES of water supply, public health, sanitation conservancy, solid waste management and slum improvement and upgradation supplied to Governmental Authorities.

MERA BILL MERA ADHIKAAR SCHEME has been launched as a pilot project in select States/ UTs providing for rewards to the persons uploading B2C invoices on the Mera Bill Mera Adhikaar Application to encourage consumers to demand GST invoices for their purchases, fostering transparency and accountability in commercial transactions.

VIDE CIRCULAR NO. 199/11/2023-GST dated 17.07.2023, it has been clarified that Input Services Distributor (1SD) mechanism is not mandatory for distribution of input tax credit of common input services procured from third parties to the distinct persons as per the present provisions of GST law, and also to clarify issues regarding taxability of internally generated services provided by one distinct person to another distinct person.

AMENDMENT HAS BEEN MADE IN RULE 9 AND RULE 25 of CGST Rules, 2017 to do away with the requirement of the presence of the applicant for the physical verification of business premises and also to provide for physical verification in high risk cases even where Aadhaar has been authenticated.

ON RECOMMENDATION OF GST COUNCIL, certain amendments have been made in the CGST Act 2017 and IGST Act 2017 vide Central Goods and Services Tax (Amendment) Act, 2023 and the Integrated Goods and Services Tax (Amendment) Act, 2023 with effect from 01.10.2023 to provide clarity on the taxation of supplies in casinos, horse racing and online gaming. These amendments inter alia provide level playing field to the suppliers of online money gaming based in India vis-à-vis the suppliers of online money gaming located outside India supplying online money gaming to the recipients in India. Registration has been made mandatory for such overseas suppliers of online money gaming and provisions have been made for punitive action against such suppliers, including blocking of their websites, in case of contravention of provisions under GST law. Further, the Council inter alia decided that a review of effect of these amendments on trade & industry and other stake holders would be undertaken by the Council after six months of the implementation, based on the status report encompassing revenue data and stakeholders' feedback.

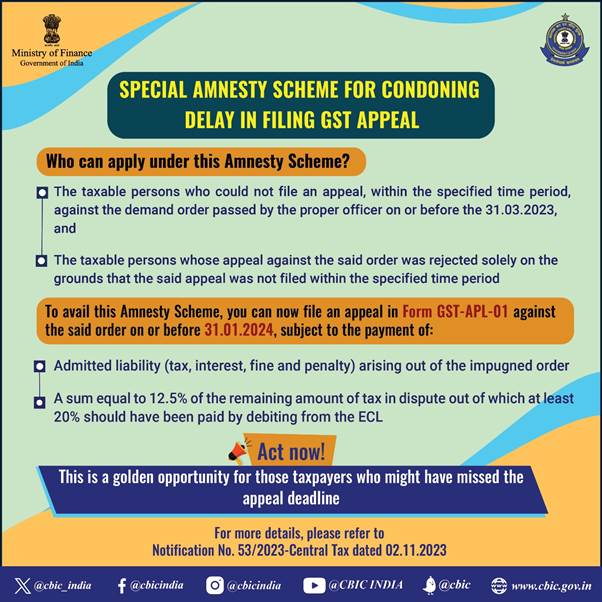

AMNESTY SCHEME FOR FILING OF APPEALS AGAINST DEMAND ORDERS IN CASES WHERE APPEAL COULD NOT BE FILED WITHIN THE ALLOWABLE TIME PERIOD: The Council has recommended providing an amnesty scheme for taxable persons, who could not file an appeal under section 107 of the CGST Act, 2017 against the demand order passed on or before the 3lst day of March, 2023, or whose appeal against the said order was rejected solely on the grounds that the said appeal was not filed within the time period specified in sub-section (1) of section 107. In all such cases, filing of appeal by the taxpayers will be allowed against such orders upto 31st January 2024, subject to the condition of payment of an amount of pre-deposit of 12.5% of the tax under dispute, out of which at least 20% (i.e. 2.5% of the tax under dispute) should be debited from Electronic Cash Ledger. This will facilitate a large number of taxpayers, who could not file appeal in the past within the specified time period.

PROVISION FOR AUTOMATIC RESTORATION OF PROVISIONALLY ATTACHED PROPERTY AFTER COMPLETION OF ONE YEAR: The Council has recommended an amendment in sub-rule (2) of Rule 159 of CGST Rules, 2017 and FORM GST DRC-22 to provide that the order for provisional attachment in FORM GST DRC-22 shall not be valid after expiry of one year from the date of the said order. This will facilitate release of provisionally attached properties after expiry of period of one year, without need for separate specific written order from the Commissioner.

CUSTOMS

(A) REGULATORY AND POLICY INITIATIVES: -

RATIONALIZATION OF NUMBER OF BASIC CUSTOMS DUTY RATES: The number of basic customs duty rates on goods, other than textiles and agriculture, were reduced to 13 from 21. This was done as a trade facilitation measure to ease tax compliance for importers.

REGULARISATION OF REGULATORY COMPLIANCE FOR OFFENCES UNDER CUSTOMS ACT,1962: CBIC undertook key steps in decriminalization by revising the guidelines for arrest, prosecution, and bail in relation to offences punishable under Customs Act, 1962 by enhancing the threshold value limit for offences related to outright smuggling of baggage, gold from the present threshold of Rs. 20 to Rs. 50 Lakhs for the purpose of arrest. Similarly, in respect of commercial frauds, the monetary threshold for purposes of arrest has been raised from Rs. 1 Crore to Rs. 2 Crore. (Refer Circular No. 12/2022-Customs dated 16.08.2022 and Circular No. 13/2022-Customs dated 16.08.2022 and Circular No. 15/2022-Customs dated 23.08.2022)

CENTRAL REPOSITORY FOR ALL NON-TARIFF MEASURES: From time to time, a multitude of government agencies generate Non-Tariff Measures (NTMS) pertinent to their domain, in different forms, and which serve a multitude of purposes including protection of consumer health (standards, certification, labelling), safeguarding the environment (import bans). CBIC created a mechanism based on the globally accepted UNCTAD methodology for issuance of a Centralized Control Number (CCN) for mapping NTMS issued by all PGA. These CCNs act as a central repository for ready reference for trade as well as departmental officers about the existence of NTM which have been issued by different PGAS. CBIC has already conducted a number of sensitization and awareness sessions with PGAS. The NTMS and associated CCNS across a number of PGAS have been published on the tax information portal for the information and adherence by trade upto Mar 2023.

STANDARDISED EXAMINATION ORDER: In its endeavour to ensure uniformity in Customs processes across the ports, CBIC has decided to introduce Risk based uniform examination orders at all Customs stations across the country. CBIC has implemented system-generated centralized examination orders in a phased manner, in cases where the cargo is selected for examination by the Risk Management System (RMS). The functionality of Standard Examination Order is expected to enhance the uniformity in examination, and lower the time taken in the process as well as reduce associated costs.

24*7 CUSTOMS CLEARANCE: Indian Customs is committed to ensure service delivery to the cross-border trading community round the clock. In this endeavour, the CBIC has enabled the facility of 24x7 Customs clearance across numerous seaports and air cargo complexes across the country. Presently, this facility is available at 20 seaports and 17 airports. Further, no Merchant Over Time (MOT) charges are required to be collected in respect of the services provided by the Customs officers at 24 X 7 Customs Ports and Airports. Now this facility has also been extended to the ICDS. (Refer Circular No. 11/2022-Customs dated 29.07.2022)

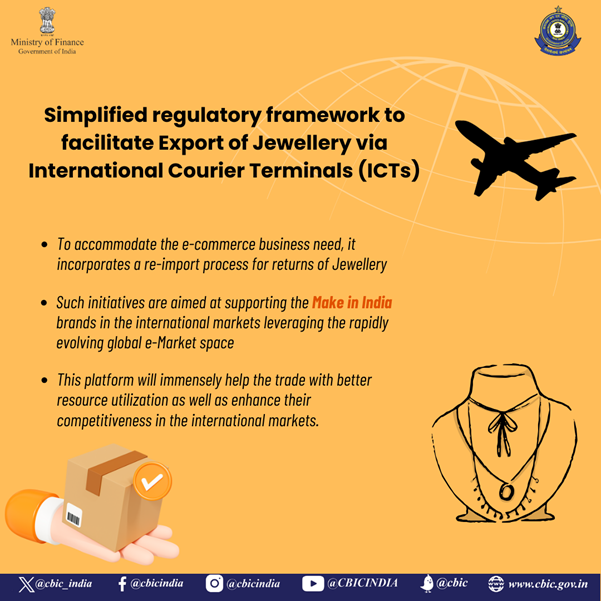

E-COMMERCE PROCEDURE FOR JEWELLERY RE-IMPORT: Implementation of a simplified regulatory framework to facilitate export of Jewellery through e-Commerce was announced in the Budget for the year 2022. Accordingly, CBIC has laid down a simplified regulatory framework for e-Commerce exports of Jewellery via International Courier Terminals (1CTS). To accommodate the e-commerce business need, it incorporates a reimport process for returns of Jewellery. The procedural and legislative changes introduced for facilitating e-Commerce exports of Jewellery through Courier Terminals are aimed at supporting the Make in India brand in the international markets and enhancing the competitiveness of Indian Jewellery exports leveraging the rapidly evolving global e-Market space. (Refer Circular No. 09/2022-Customs dated 30.06.2022).

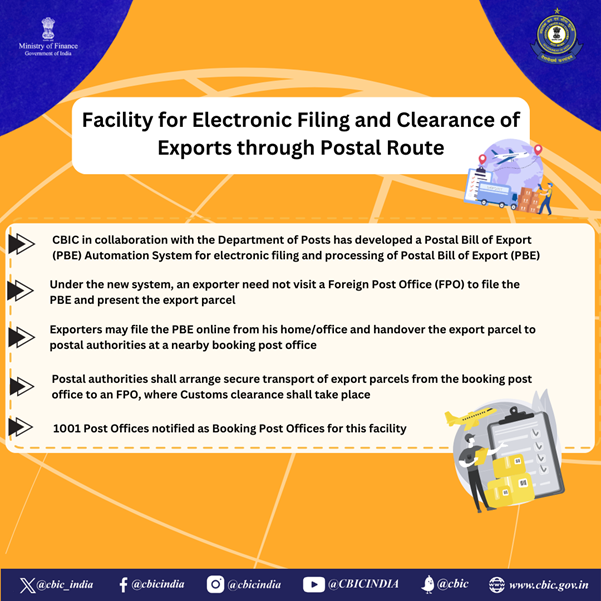

ELECTRONIC FILING AND CLEARANCE OF EXPORTS THROUGH POSTAL ROUTE: Department of Posts, in collaboration with CBIC, has developed a Postal Bill of Export (PBE) Automation System for electronic filing and processing of Postal Bill of Export (PBE). Under the new system, an exporter need not visit a Foreign Post Office (FP0) to file the PBE and present export parcel. Rather, he is enabled to file the PBE online from his home/office and handover the export parcel to postal authorities at a nearby booking post office. Postal authorities shall arrange secure transport of export parcel from booking post office to an FPO, where Customs clearance shall take place. (Electronic Declaration and Processing) Regulations, 2022 have been notified. (Refer notification 104/2022-Customs N.T. dated 09.12.2022)

(B) TECHNOLOGICAL INITIATIVES

INDIAN CUSTOMS ELECTRONIC COMMERCE/ELECTRONIC DATA INTERCHANGE (ICEGATE) 2.0: 1CEAGTE 2.0 website is a complete bilingual website which has been designed to provide contemporary user interface for enhanced user experience. New feature ‘widget’ is also being provided to show important information such as Message filing status, details of tickets, refunds, and duty payments etc. in personalised dashboard without going for enquiries. Data available in the widgets is also downloadable. Customised notifications facility is being provided to the registered users to choose the events for which they want to receive notifications. Registered users can file their documents themselves using online Web forms on ICEGATE as well which is an advancement from earlier offline webforms.

ANONYMISED ESCALATION MECHANISM (AEM): As a measure of Trade Facilitation and quick grievance redressal, CBIC has implemented Anonymized Escalation Mechanism for ICEGATE registered users where one can submit grievances pertaining to delay in Bill of Entry clearance under faceless assessment. The delay in clearance subsequently is escalated to the concerned Faceless Assessment Officers. The Anonymised Escalation facility also enables users to track the status of grievances submitted by them till the eventual resolution.

ELECTRONIC CASH LEDGER: The Electronic Cash Ledger (ECL) has enabled the importer, exporter, or any person liable to pay duty, fees etc., to deposit an advance with the Government instead of transaction wise payment as being done at present, which could be used to pay his liabilities under this Act or under any other law for the time being in force. It has enabled a facility to deposit amount in advance to be credited into ECL which will be accounted for in Public Account of India. The deposit shall be noninterest bearing. Such deposit is utilized for payment of duties and other sums relating to Customs by duly debiting seamlessly from the ECL.

SYSTEM OF E-SCRIP FOR REMISSION OF DUTIES AND TAXES ON EXPORTED PRODUCTS (RODTEP): The system of E-scrips in RODTEP has been enabled recently. This enables issue of Export Rebate in the form of a transferable duty credit/ electronic scrip (e-scrip) which is maintained in an electronic ledger by the Central Board of Indirect Taxes & Customs (CBIC). This revamped end-to-end automated scheme aims to provide a boost to Indian exports by providing a level playing field to domestic industry abroad.

(C) INFRASTRUCTURAL INITIATIVES: -

CUSTOMS PRE-GATE PROCESSING FACILITY AT, KOLKATA PORT: Due to the issue of restricted last mile 24X7 connectivity at the Port gate, trade used to face perennial congestion at the entry gates of Kolkata port. With aim of reducing the dwell time of export containers and reduce the congestion at port, pre-gate facility measuring 25,900 sq.m was notified as Parking Facility for export bound containers, permitting all road-borne export load containers, including container stuffed and sealed at Container Freight Stations (CFSS) and Direct Port Entry (DPE)-facilitated cargo, to be routed through this facility.

UPGRADATION & MODERNISATION OF CENTRAL REVENUES CONTROL LABORATORIES (CRCL)

Central Revenues Control Laboratory (CRCL) assists the field formations in chemical analysis of samples of various trade commodities to enable appropriate assessment of duties. These laboratories also assist in enforcement of Customs Act, NDPS Act, GST Laws, Central Excise Act, and other allied Acts including for the purpose of environment protection, food safety, etc. CBIC has inducted advanced testing equipment in the Central Revenues Control Laboratory (CRCL) with the aim of enhancing the in-house testing capability of the Customs leading to faster import and export clearances.

JACKET WITH CAMERA FOR USE BY THE VESSEL BOARDING OFFICER

The Boarding officers act as the face of Indian Customs because they are the first Government Official to deal with foreign vessel on its first arrival to Indian ports. The performance of their duties and the interaction during the course of his/ her duties require maintaining of absolute transparency, legitimacy and accountability. Therefore, it has been decided to use a jacket worn Camera for the Boarding officers at the port w.e.f 15/04/2023. This will provide transparency, while carrying on physical checks on board and also provide evidence in case of an offence or suspected offence.

CAclubindia

CAclubindia