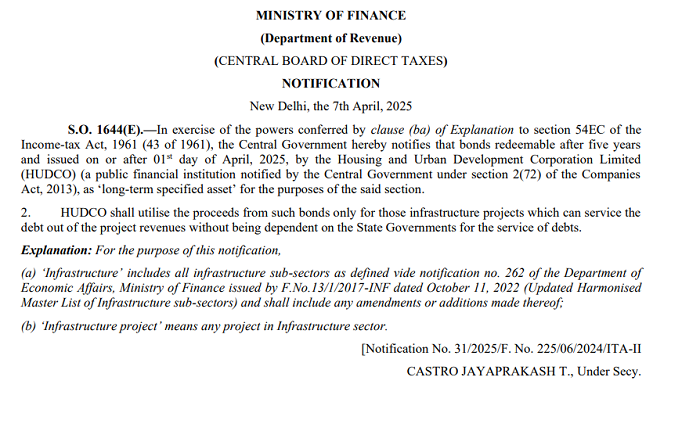

The Ministry of Finance, through the Central Board of Direct Taxes (CBDT), has notified bonds issued by the Housing and Urban Development Corporation Limited (HUDCO) as a 'long-term specified asset' under Section 54EC of the Income-tax Act, 1961. The notification-S.O. 1644(E) dated April 7, 2025-specifies that these bonds must be redeemable after five years and issued on or after April 1, 2025.

This move allows taxpayers to claim exemption from capital gains tax by investing in HUDCO bonds under the provisions of Section 54EC.

Key Highlights

- Issuer: Housing and Urban Development Corporation Limited (HUDCO)

- Eligibility: Bonds issued on or after April 1, 2025

- Redemption: Bonds must be redeemable after five years

- Purpose: To be classified as 'long-term specified asset' under Section 54EC

- Project Funding: Proceeds from the bonds must be used only for infrastructure projects that are self-sustainable, i.e., capable of servicing their debt through project revenues without depending on State Government guarantees or support.

What Qualifies as 'Infrastructure'?

According to the notification, the term "infrastructure" will follow the definition provided in the Updated Harmonised Master List of Infrastructure sub-sectors issued by the Department of Economic Affairs on October 11, 2022 (Notification No. 262), including any future amendments.

This step reinforces the government's commitment to:

- Promoting capital inflow into long-term infrastructure projects

- Encouraging capital gains reinvestment in tax-exempt instruments

- Ensuring fiscal sustainability by targeting only revenue-generating infrastructure ventures

What It Means for Investors

Investors looking to avail capital gains tax exemption under Section 54EC for FY 2025-26 can now consider investing in HUDCO bonds, provided they meet the notified conditions. This provides a secure and tax-efficient avenue for parking long-term capital gains while contributing to India's infrastructure growth.

Official copy of the notification is as follows

CAclubindia

CAclubindia