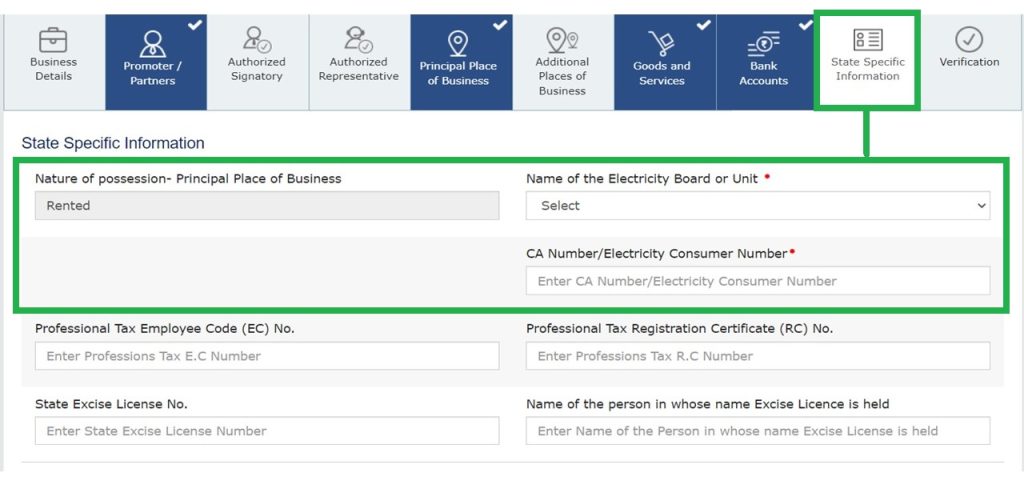

Goods and Services Tax Network (GSTN) has introduced new tabs in the 'State Specific Information' section of the GST registration form to collect Consumer Agreement (CA) or Electricity Consumer (EC) numbers. This is a mandatory requirement for all applicants who are applying for GST registration.

The GSTN has introduced these new tabs to improve the accuracy and efficiency of the GST registration process. By collecting CA/EC numbers, the GSTN will be able to verify the identity of applicants and ensure that they are registered in the correct state. This will help to prevent fraud and ensure that only genuine taxpayers are registered under GST.

Here are some of the benefits of providing your CA/EC number while applying for GST registration:

- It will help to verify your identity and ensure that you are registered in the correct state.

- It will help to prevent fraud and ensure that only genuine taxpayers are registered under GST.

- It will help to improve the accuracy and efficiency of the GST registration process

CAclubindia

CAclubindia