The Goods and Services Tax (GST) framework has introduced new guidelines regarding the handling of records on the Invoice Matching System (IMS) dashboard, aiming to improve clarity and streamline the GSTR-2B reconciliation process.

Key Highlights of the New Guidelines

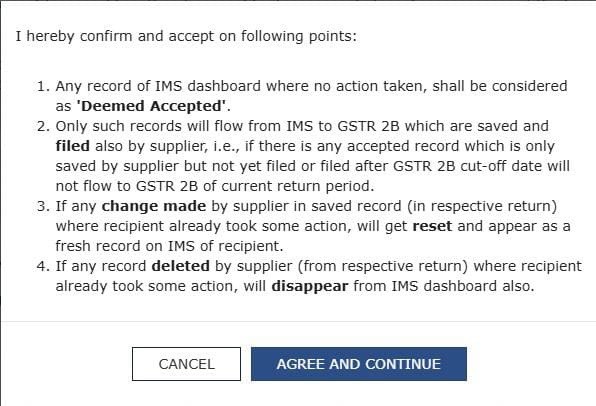

- Deemed Acceptance: Any IMS record where no action has been taken by the recipient will now be considered as 'Deemed Accepted.' This automatic acceptance applies to cases where users have not responded to records listed on the dashboard.

- Flow of Records to GSTR-2B: Only records that are saved and filed by the supplier will flow from IMS to GSTR-2B. Accepted records that have been saved but not filed by the supplier or filed post the GSTR-2B cut-off date will not be included in the current return period’s GSTR-2B. This measure ensures that only fully processed records are included in the final reconciliation.

- Handling of Supplier Changes: If a supplier makes changes to a saved record in their respective return, and the recipient has already taken action on that record, it will reset in the IMS. This modified record will appear as a new entry for the recipient, allowing for a fresh review of any updated data.

- Deleted Records: When a supplier deletes a record from their return after the recipient has already acted on it, that record will also disappear from the recipient's IMS dashboard, ensuring an updated and accurate record display.

These measures are expected to reduce discrepancies in GST compliance, making it easier for businesses to manage input tax credits and streamline their tax filing process. Tax professionals recommend reviewing IMS dashboard records promptly to avoid 'Deemed Acceptance' and ensure accurate record-keeping.

CAclubindia

CAclubindia