Introduction

In a move aimed at improving user accessibility and providing enhanced insights, the Income Tax Department has recently revamped the placement of the "Know Your Refund Status" feature on the income tax e-filing portal. The feature, previously accessible in the pre-login mode, has now been shifted to the post-login mode, requiring users to log in to the e-filing portal for access. This strategic relocation offers taxpayers a more comprehensive view of their refund status with additional details.

Key Changes and Improved Access

- Login Requirement: The revamped feature now necessitates users to log in to the income tax e-filing portal, ensuring a more secure and personalized experience.

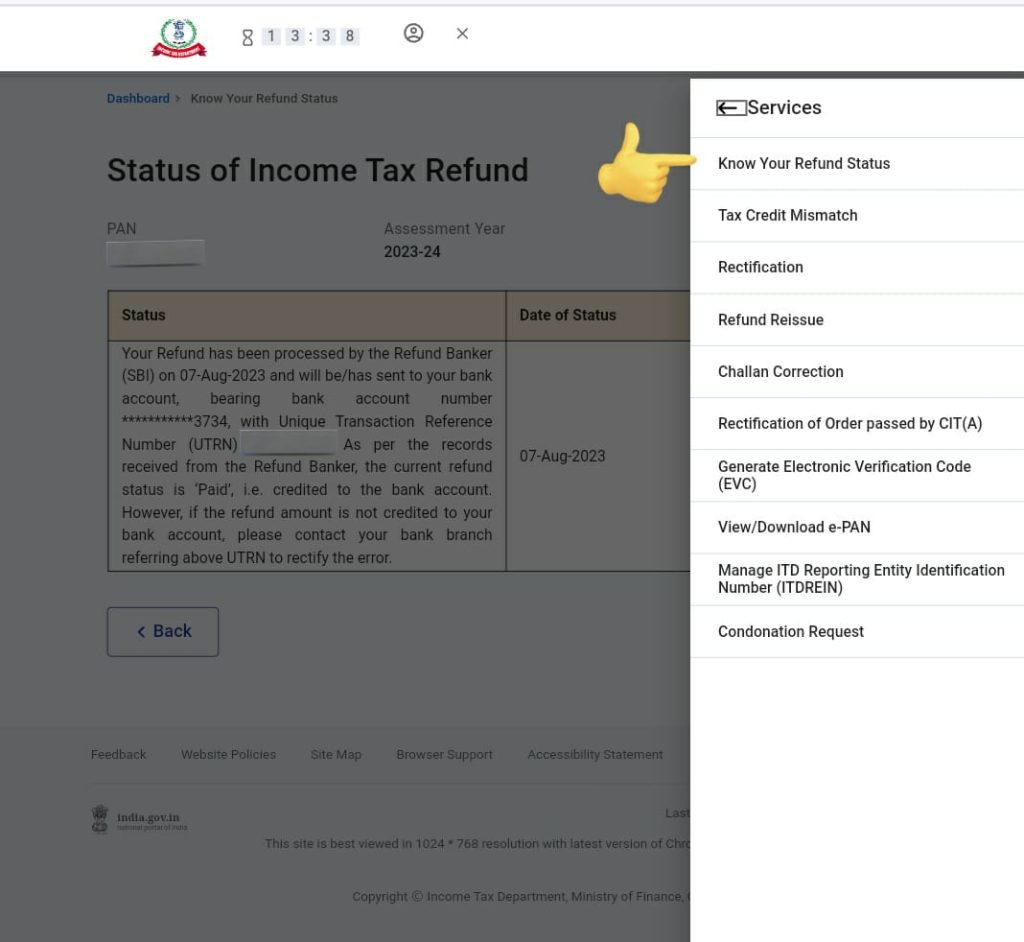

- Navigation Path: Once logged in, users can easily locate the "Know Your Refund Status" feature by navigating to the Services section on the e-filing portal.

- Enhanced Details: The feature, now available post-login, provides users with more detailed information, including the Date of Refund and the last four digits of the bank account where the refund is credited.

- User-Friendly Interface: With the relocation of the feature, the user interface has been streamlined, making it more intuitive and user-friendly, thus enhancing the overall taxpayer experience.

How to Access "Know Your Refund Status"

- Log in to the income tax e-filing portal.

- Navigate to the Services section.

- Locate and select the option for "Know Your Refund Status."

Benefits of the Revamped Feature

- Transparency: The additional information provided, such as the Date of Refund and bank account details, adds transparency to the refund process, keeping taxpayers informed about the status of their refunds.

- Efficiency: The relocation of the feature to post-login mode ensures that users who actively engage with the e-filing portal can conveniently access this vital information in one centralized location.

- Security: Requiring users to log in enhances the security of sensitive financial information, aligning with standard online security practices.

Conclusion

The Income Tax Department's decision to relocate the "Know Your Refund Status" feature to post-login mode represents a proactive step towards improving user experience and transparency. The enhanced details provided within the feature contribute to a more informative and user-friendly interface, empowering taxpayers with crucial insights into the status of their refunds. This move aligns with the ongoing efforts to streamline digital services and leverage technology for a more efficient and secure tax filing process. Taxpayers are encouraged to explore these new features for a seamless and informed e-filing experience.

CAclubindia

CAclubindia