The government has brought the Goods and Services Tax Network (GSTN) under the Prevention of Money Laundering Act (PMLA). This means that the GSTN can now share information with the Enforcement Directorate (ED) and the Financial Intelligence Unit (FIU) under the PMLA.

The PMLA is a law that was enacted in 2002 to prevent money laundering. It defines money laundering as "the process of converting illegally obtained proceeds into legitimate assets". The PMLA gives the ED and the FIU the power to investigate and prosecute money laundering cases.

The inclusion of GSTN under the PMLA will allow the ED and the FIU to access information about GST taxpayers. This information can be used to investigate cases of money laundering involving GST. For example, if the ED or the FIU suspects that a GST taxpayer is using fake invoices to evade taxes, they can access information from the GSTN to verify the authenticity of the invoices.

The changes to include GSTN under the PMLA have been made under Section 66 of the PMLA, which provides for disclosure of information. Section 66 of the PMLA states that any person who is in possession of any information that is relevant to an investigation under the PMLA is required to disclose that information to the ED or the FIU. This includes information that is held by the GSTN.

The notification issued by the government on July 7, 2023, also provides for the sharing of information between the GSTN and the ED and the FIU. This means that the ED and the FIU can share information with the GSTN if they find that any GST assessee is involved in suspicious forex transactions or other GST offences.

The sharing of information between the GSTN and the ED and the FIU will help to improve the coordination between the different agencies and will make it easier to investigate cases of money laundering involving GST. It will also help to deter people from engaging in such activities.

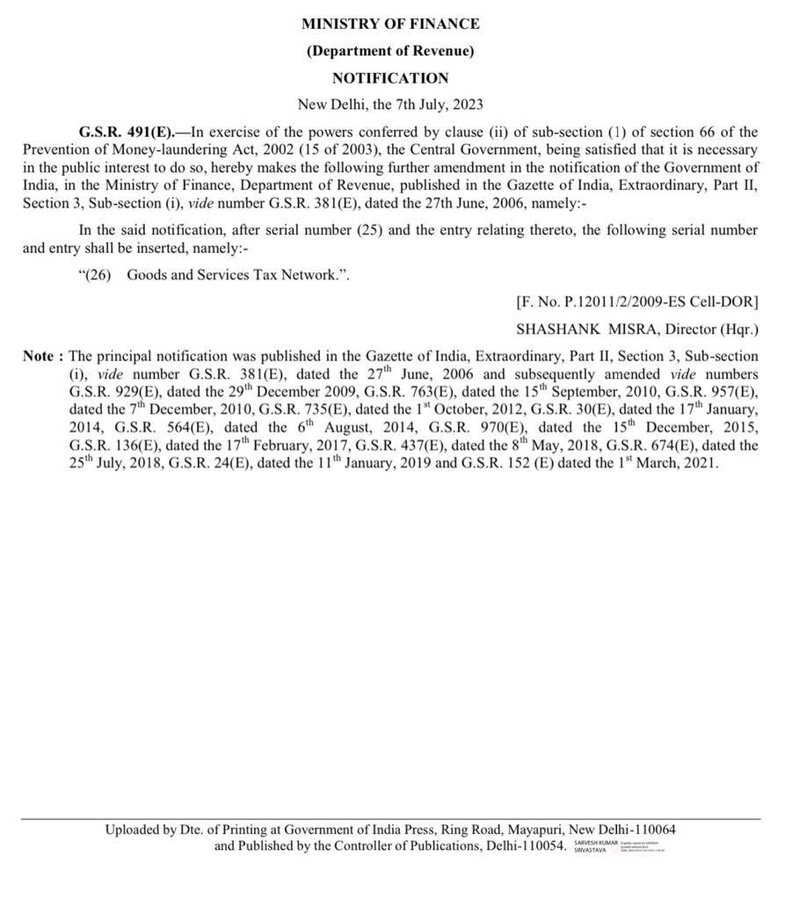

Official copy of the notification has been mentioned below

Here are some of the benefits of sharing information between the GSTN and the ED and the FIU

- It will help to track the movement of money and goods across the country.

- It will make it easier to identify and investigate cases of money laundering.

- It will help to recover the proceeds of crime.

- It will deter people from engaging in money laundering activities.

CAclubindia

CAclubindia