The Central Board of Direct Taxes (CBDT) recently released a corrigendum, marked as Notification No. 22/2024 dated February 21, 2024, amending Notification No. 19/2024 dated January 31, 2024. This corrigendum serves to provide clarity and notify six specific changes and aspects concerning the Income Tax Return (ITR) Forms, namely ITR-2, ITR-3, and ITR-5, for the Assessment Year (A.Y.) 2024-25.

Official copy of the notification has been mentioned below

MINISTRY OF FINANCE

(Department of Revenue)

(CENTRAL BOARD OF DIRECT TAXES)

CORRIGENDUM

New Delhi the 21st February, 2024

INCOME-TAX

G.S.R. 120(E). - In the notification of the Government of India, Ministry of Finance, Department of Revenue (Central Board of Direct Taxes), published in the Gazette of India, Extraordinary, Part II, Section 3, subsection (i), vide number G.S.R. 83(E), dated 31st January, 2024:-

(i) at page number 148, in item 1, for the bracket, figures and words "(1) These rules may be called the Income-tax (Amendment) Rules, 2024.", the bracket, figures and words "(1) These rules may be called the Income-tax (Second Amendment) Rules, 2024." shall be substituted;

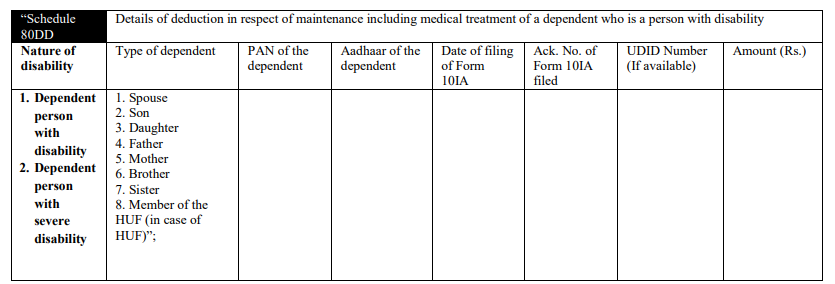

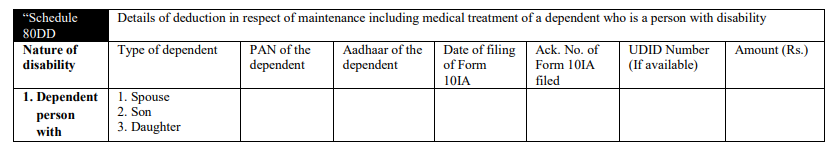

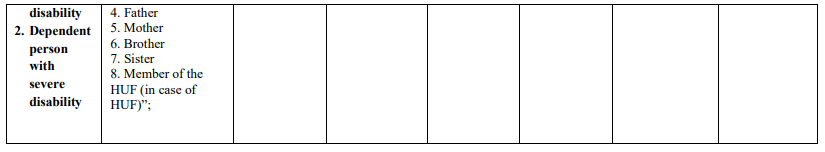

(ii) at page number 171, in Form ITR-2, in Schedule 80DD, a new column, "Amount (Rs.)" shall be inserted and accordingly, for the Schedule 80DD, the following schedule shall be substituted, namely: -

(iii) at page number 229, in Form ITR-3, in Schedule 80DD, a new column, "Amount (Rs.)" shall be inserted and accordingly, for the Schedule 80DD, the following schedule shall be substituted, namely: -

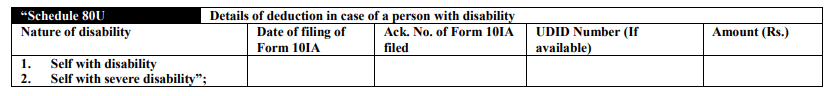

(iv) at page number 230, in Form ITR-3, in Schedule 80U, a new column, "Amount (Rs.)" shall be inserted and accordingly, for the Schedule 80U, the following schedule shall be substituted, namely:-

(v) at page number 271, in Form ITR-5, in schedule CG, in row B, in sub-row (1), in item (d), for the figures, letters and symbols "54EC/54G/54GA", the figures, letters and symbols "54D/54EC/54G/54GA" shall be substituted;

(vi) at page number 274, in Form ITR-5, in Schedule CG, in row B, in sub-row (10), in the table below item (a), in row (ii), for the figures, letters and symbols "54D/54G/54GA/54GB", the figures, letters and symbols "54D/54G/54GA" shall be substituted.

[Notification No. 22/2024 F. No. 370142/47/2023-TPL]

PANKAJ JINDAL, Jt. Secy

Impact and Implications

The issuance of the corrigendum by the CBDT underscores the importance of maintaining accuracy and compliance in tax filings. Taxpayers, tax professionals, and other stakeholders are advised to carefully review the changes and updates outlined in the corrigendum to ensure adherence to the revised requirements for filing ITR-2, ITR-3, and ITR-5 forms for the A.Y. 2024-25.

Conclusion

The CBDT's issuance of the corrigendum represents a proactive step towards enhancing clarity and transparency in the tax filing process. By addressing identified discrepancies and providing comprehensive guidance, the corrigendum aims to facilitate smooth and accurate tax compliance while minimizing the risk of errors or non-compliance among taxpayers.

CAclubindia

CAclubindia