Criteria for income to be considered as export turnover

Last updated: 27 November 2021

Court :

High Court of Karnatka

Brief :

Appeal filed under section 260A of the Income Tax Ac,1961

Citation :

ITA 337/2019

IN THE HIGH COURT OF KARNATAKA AT BENGALURU DATED THIS THE 22ND DAY OF OCTOBER, 2021 PRESENT THE HON'BLE MRS.JUSTICE S.SUJATHA AND THE HON'BLE MR. JUSTICE E.S.INDIRESH I.T.A.No.337/2019

BETWEEN :

1 . PRINCIPAL COMMISSIONER OF OF INCOME TAX-7, BMTC COMPLEX KORAMANGALA, BENCALURU

2 . THE DY. COMMISSIONER OF INCOME TAX CIRCLE-7(1)(1), BMTC COMPLEX KCRAMANGALA, BENGALURU

(BY SRI E.I.SANMATHI, ADV.)

AND :

M/s TATA ELXSI LTD., ITBP ROAD, HOODY, WHITEFIELD, BANGALORE-560048 PAN: AAACT7872Q

APPELLANTS

RESPONDENT

(BY SRI T.SURYANARAYANA, ADV.)

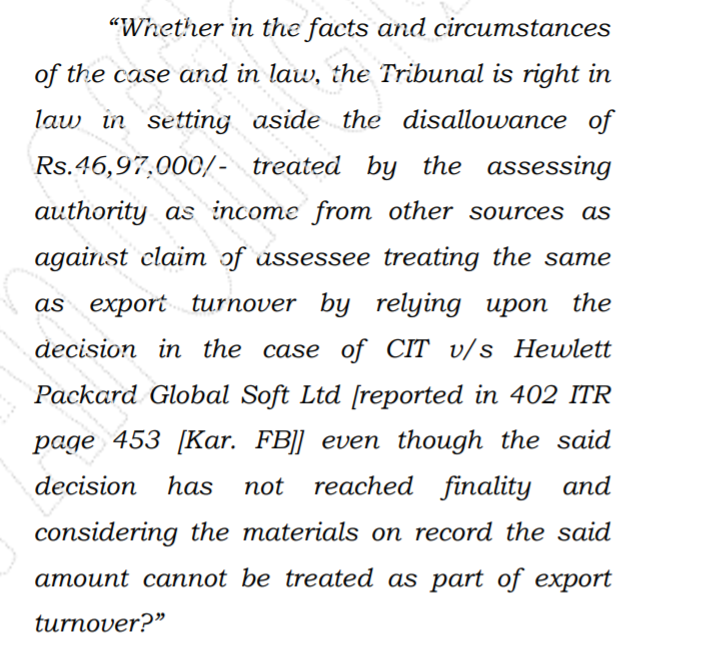

THIS INCOME TAX APPEAL IS FILED UNDER SECTION 260-A OF INCOME TAX ACT 1961, ARISING OUT OF ORDER DATED 05.12.2018 PASSED IN ITA NO.1517/BANG/2017 (ANNEXURE-A) FOR THE ASSESSMENT YEAR 2011-2012, PRAYING TO A. DECIDE THE FOREGOING QUESTION OF LAW AND/OR SUCH OTHER QUESTIONS OF LAW AS MAY BE FORMULATED BY THE HONBLE COURT AS DEEMED FIT. B. SET ASIDE THE APPELLATE ORDER DATED 05.12.2018 PASSED

Please find attached the enclosed file for the full judgement.

Poojitha Raam Vinay

Published in Income Tax

Views : 122

Comments

Trending Online Classes

-

DT & Audit (Exam Oriented Fastrack Batch) - For May 26 Exams and onwards Full English

CA Bhanwar Borana & CA Shubham Keswani

CA Bhanwar Borana & CA Shubham Keswani -

IDT LIVE Exam Oriented Batch | May 2026, Sept 2026 & Jan 2027

CA Arpita Tulsyan

CA Arpita Tulsyan

CAclubindia

CAclubindia