Are services provided to Government entities classified as exempted services?

Last updated: 27 November 2021

Court :

GST, BANGALORE , KARNATAKA

Brief :

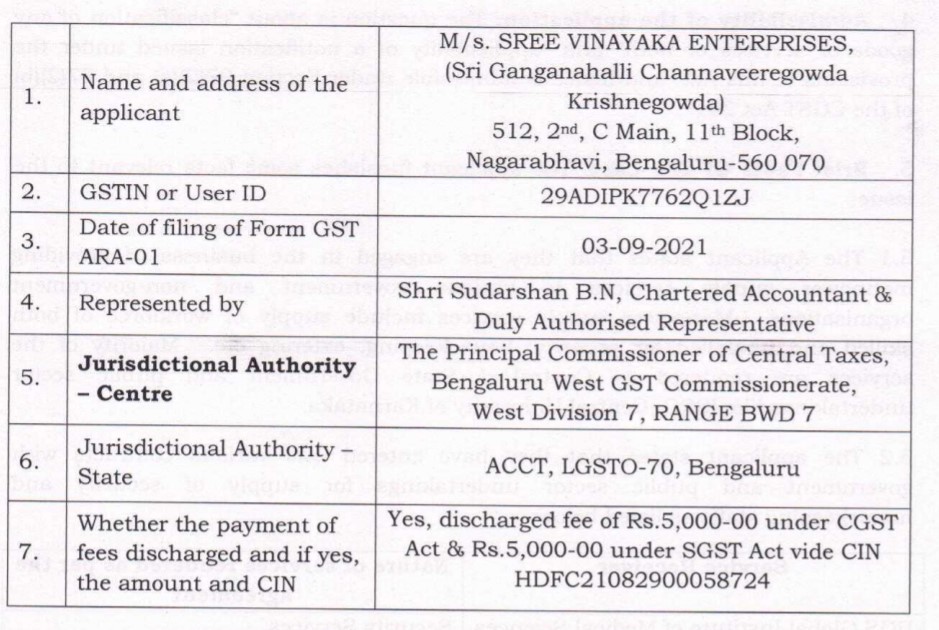

Whether the applicant is correct in classifying the services provided to the Government entities as exempted services? Whether the applicant is correct in claiming exemption under Sl.No.3 of Notification 12/2017 dated 28th June 2017 for the said exempted services?

Citation :

KAR ADRG 60/2021

THE AUTHORITY FOR ADVANCE RULING IN KARNATAKA GOODS AND SERVICES TAX VANIJYA THERIGE KARYALAYA, KALIDASA ROAD GANDHINAGAR, BENGALURU - 560 009

Advance Ruling No. KAR ADRG 60/ 2021 Dated: 29.10.2021

Present:

1. Dr. M.P. Ravi Prasad Additional Commissioner of Commercial Taxes Member (State)

2. Sri. T. Kiran Reddy Joint Commissioner of Customs & Indirect Taxes Member (Central)

Please find attached the enclosed file for the full judgement.

Poojitha Raam Vinay

Published in GST

Views : 99

downloaded 206 times

Comments

Trending Online Classes

-

DT & Audit (Exam Oriented Fastrack Batch) - For May 26 Exams and onwards Full English

CA Bhanwar Borana & CA Shubham Keswani

CA Bhanwar Borana & CA Shubham Keswani

CAclubindia

CAclubindia