Became CMA. Working towards CA Final Nov 2012.

Menu

Forum Search

Share your results CWA inter & final June 2012

s CWA inter results r out?

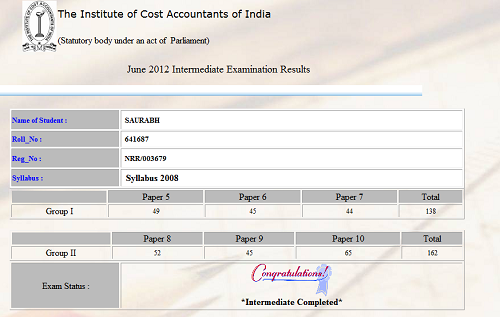

i have cleared my inter in 1st attempt..........

|

The Institute of Cost Accountants of India |

| (Statutory body under an act of Parliament) |

|

June 2012 Intermediate Examination Results

|

![]()

| Name of Student : | TEHSINKHAN YUSUFKHAN PATHAN |

| Roll_No : | 154860 |

| Reg_No : | WRR/018700 |

| Syllabus : | Syllabus 2008 |

|

Paper 5

|

Paper 6

|

Paper 7

|

Total

|

|

|

Group I

|

80

|

56

|

68

|

204

|

|

Paper 8

|

Paper 9

|

Paper 10

|

Total

|

|

|

Group II

|

82

|

64

|

65

|

211

|

|

Exam Status :

|

*Intermediate Completed* |

i am also passed my inter exam but marks are very loww

Thanx Almighty.. Cleared Inter in my 1st attempt..

|

The Institute of Cost Accountants of India |

| (Statutory body under an act of Parliament) |

|

|

June 2012 Intermediate Examination Results

|

![]()

| Name of Student : | AHAMED B |

| Roll_No : | 440080 |

| Reg_No : | SRR/046556 |

| Syllabus : | Syllabus 2008 |

|

|

Paper 5

|

Paper 6

|

Paper 7

|

Total

|

|

Group I

|

55

|

54

|

56

|

165

|

|

|

Paper 8

|

Paper 9

|

Paper 10

|

Total

|

|

Group II

|

65

|

41

|

65

|

171

|

|

Exam Status :

|

*Intermediate Completed* |

|

The Institute of Cost Accountants of India |

| (Statutory body under an act of Parliament) |

|

June 2012 Intermediate Examination Results

|

![]()

| Name of Student : | RAMANAMMA MAKANA |

| Roll_No : | 463120 |

| Reg_No : | SRR/052532 |

| Syllabus : | Syllabus 2008 |

|

Paper 5

|

Paper 6

|

Paper 7

|

Total

|

|

|

Group I

|

53

|

54

|

54

|

161

|

|

Paper 8

|

Paper 9

|

Paper 10

|

Total

|

|

|

Group II

|

54

|

19

|

18

|

91

|

|

Exam Status :

|

*GROUP-1 Completed* |

|

Note: The Institute of Cost Accountants of India is not responsible for any inadvertent error that may have crept in the results being published in NET. The results published on net are for immediate information to the examinees. These can not be treated as original marksheets. |

| Instructions : |

|

![]()

NOW I AM QUALIFIED CHARTERED ACCOUNTANT AND COST ACCOUNTANT.

MY QUALIFICATIONS ARE ACA CMA AND B.COM

I scored 189 in group 1 and 129 in group 2 our of which i have got just 9 in indirect taxes which is much below my expectations.

Become a CMA. Got 222 marks in Stg.3

I have cleared Inter Group II in my first attempt, with the help of guidance available in CACLUB.

|

The Institute of Cost Accountants of India |

| (Statutory body under an act of Parliament) |

|

|

June 2012 Intermediate Examination Results

|

![]()

| Name of Student : | V. SAI KRISHNA PRASAD |

| Roll_No : | 331339 |

| Reg_No : | SRR/027215 |

| Syllabus : | Syllabus 2008 |

|

|

Paper 8

|

Paper 9

|

Paper 10

|

Total

|

|

Group II

|

53

|

58

|

65

|

176

|

|

Exam Status :

|

*GROUP-2 Completed* |

| Originally posted by : rajee | ||

|

MY MARKS ARE 40 IN FINANCIAL ACCOUNTING, 62 IN COMMERCIAL LAW AND AUDITING, 35 IN INDIRECT TAX AND SOME OF THEM TELL ME PUT REVALUATION AND SOME TO REWRITE THE EXAMS OTHERTHAN COMMERCIAL LAW. SO PLS GUIDE ME. WHAT I HAVE TO DO NOW? WHICH ONE IS BETTER TO ME. PLS REPLY ME |

|

Start preparing for Fin Actg and Applied Dct Tax, for the Dec 2012 exams, right away. Do not waste your time, money and energy on anything else. Success will be yours!

Leave a Reply

Your are not logged in . Please login to post replies

Click here to Login / Register

Recent Threads

- GSTR 2B ( MULTIPLE MONTHS )

- Eway bill generation for export material.

- International Tax clarification UK.

- E way bill expired penalty

- Best SME Focused AIF Funds in India for High Growt

- How does employee management software help in stat

- Clarification Required – Section 18 of Wage

- How to split freelance project income with a frien

- 194a for A y 2024-25

- Compensation & Benefits

Related Threads

CAclubindia

CAclubindia