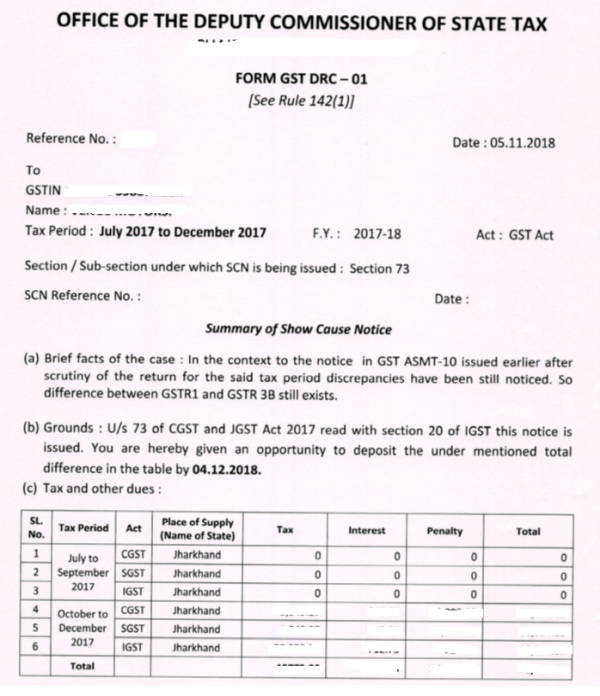

Hi! I'm a taxpayer and due to some mistake in GSTR i've received SCN under Section 73 of GST act and I need help regarding the same.

I made some searches on internet and i came to know that

As per Section 73(8) where any person chargeable with tax under sub section (1) pays the said tax alongwith interest payable within 30 days of issue of SCN, no penalty shall be payable and all proceedings in respect of the said notice shall be deemed to be concluded.

But, As per Section 73(11) "Notwithstanding anything contained in sub section (6) or sub section (8), penalty under sub section (9) shall be payable where any any amount of self assessed tax or any amount collected as tax has not been paid within a period of thirty days from the due date of payment of tax.

So, i am confused between all these sub-sections. In which creteria i stand? Do i need to pay only the tax and interest or i have to pay the tax and interest along with the penalty.

Please help me get this confusion cleared. Thanks in advance.

CAclubindia

CAclubindia