Chartered Accountant

1572 Points

Joined August 2008

eTDS statement for 2012-13 first quarter is to be filed on or before July 15,2012. Few important changes and points to remember are given below

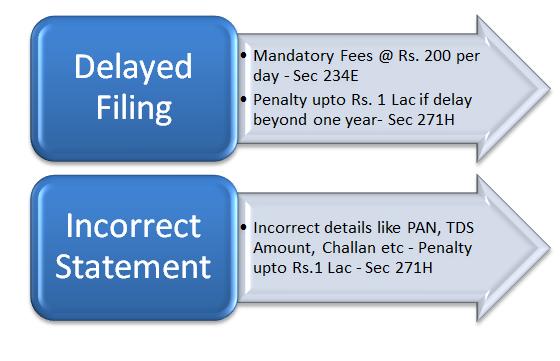

Mandatory Fees and Penal provisions

File eTDS Statement in time or pay late filing fees ( Section 234E)

From 1st July 2012, failure to submit eTDS statement in time will result in fees

-

A mandatory fees of Rs. 200 per day is applicable for any delay in furnishing of eTDS statement.

-

Total fees will be limited to the amount of TDS deducted

-

Such fees must be paid before filing of eTDS statement and shown appropriately therein.

Penalty for late filing or incorrect filing ( Section 271H)

Effective July 1, 2012

-

A delay beyond one year will result in penalty ranging from Rs. 10,000 to 1 lac.

-

Failure to file eTDS statement or filing incorrect details like PAN, challan details, TDS amount will also result in penalty being levied ranging from Rs. 10,000 to 1 lac

From the above, it is clear that this time when you fie eTDS statement, you need to file in time and also ensure that you are not filing incorrect details in the statement

FVU Version 3.5

-

Effective July 1, 2012 , eTDS file must be validated with file validation utility version 3.5 for current filing

-

For statements pertaining to FY upto 2009-10, there no change in the fvu and and same version <> will continue

-

There is only one change brought about by fvu 3.5 and it is in respect of BIN – Book Identification Number.

Book Identification Number – BIN

BIN consists of the following:

-

Receipt Number: Seven digit unique number generated for each Form 24G statement successfully accepted at the TIN central system.

-

DDO Serial Number: Five digit unique number generated for each DDO record with valid TAN present in the Form 24G statement successfully accepted at the TIN central system.

-

Date: The last date of the month and year for which TDS/TCS is reported in Form 24G. Date will be in DD/MM/YYYY format.

AO has to communicate the BIN details to the respective DDO.BIN is to be quoted by the Drawing and Disbursing Officer (DDO) in transfer voucher details in their quarterly TDS/TCS statements.

FVU 3.5 will verify structural validation for BIN quoted by the Govt. deductors (where TDS/TCS is deposited by book entry). BIN should be the same that has been provided by TIN on upload of Form 24G by respective PAO/DTO.