Menu

ONE INVOICE MISSED IN AUG 2018 . HOW TO FILE IN SEPT 2018 ?

Total Tax for AUG: 1000

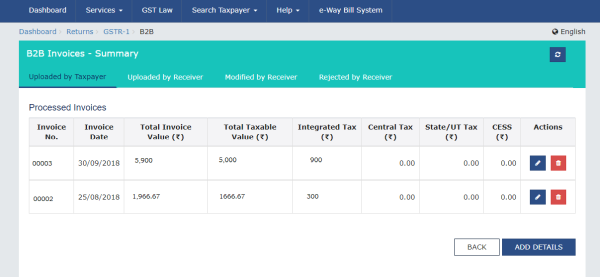

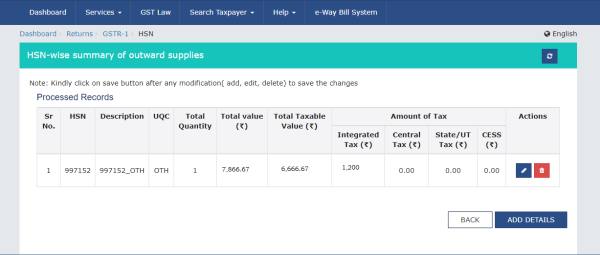

issued 2 B2B invoices in AUG. (IGST)

B2B invoice no 1 : 700 ( GST amount)

B2B invoice no 2 : 300 (GST Amount)

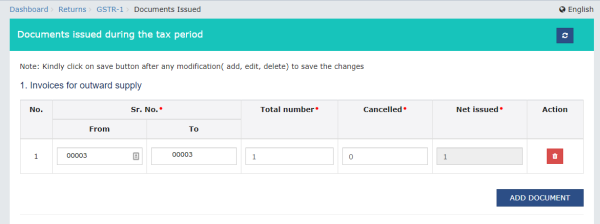

filed 700( invoice 1) in AUG GST but missed to file 300.

Total Tax for Sept : 900

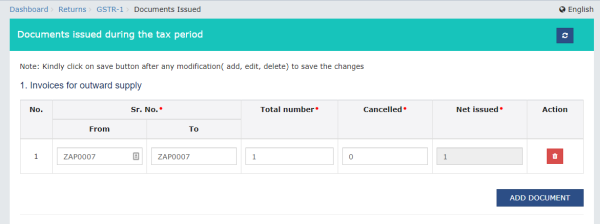

invoice no 3 : 900 ( GST )

I will pay 900+300 in GSTR3B of Sept 2018 .

But what to change in GSTR 1 ?

in which table should I add the missing invoice in GSTR1 of Sept 2018 ?

please guide .

issued 2 B2B invoices in AUG. (IGST)

B2B invoice no 1 : 700 ( GST amount)

B2B invoice no 2 : 300 (GST Amount)

filed 700( invoice 1) in AUG GST but missed to file 300.

Total Tax for Sept : 900

invoice no 3 : 900 ( GST )

I will pay 900+300 in GSTR3B of Sept 2018 .

But what to change in GSTR 1 ?

in which table should I add the missing invoice in GSTR1 of Sept 2018 ?

please guide .

Replies (11)

Recent Threads

- Login credentials and payment acknowledgement not

- Export sales not realised payment not received fro

- Capital gain account amount utilisation

- Form 26QB – Section 194-IA: TDS on Full Cons

- Indexation Benefit available or not on Calculation

- Documents for return exhibition material

- Can I set off equity losses(both short term loss a

- Input tax credit on rent to rent

- Family Pension Army

- Waste Management services

Related Threads

CAclubindia

CAclubindia