Menu

Journal Entry of credit note

in sales invoice

Taxable amount 12000

CGST. 1080

SGST. 1080

Bill amount. 14160

Less CN 500

net amount. 13660

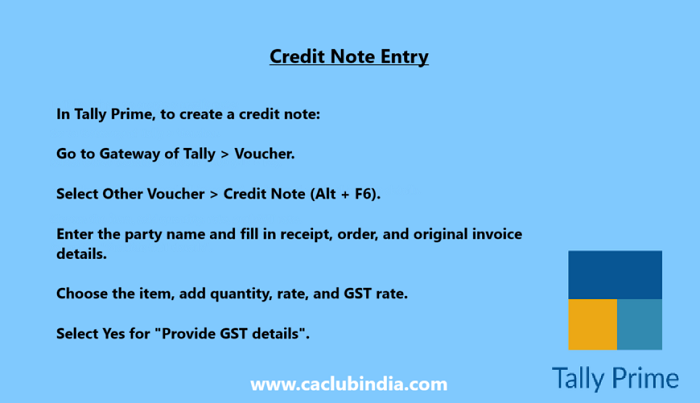

how to show this transaction in tally prime

Taxable amount 12000

CGST. 1080

SGST. 1080

Bill amount. 14160

Less CN 500

net amount. 13660

how to show this transaction in tally prime

Replies (7)

Recent Threads

- International Tax clarification UK.

- E way bill expired penalty

- Best SME Focused AIF Funds in India for High Growt

- How does employee management software help in stat

- Clarification Required – Section 18 of Wage

- How to split freelance project income with a frien

- 194a for A y 2024-25

- Compensation & Benefits

- SAC code and GST rate transport services for anima

- Section 44AB is Gone — How Different is Tax

Related Threads

CAclubindia

CAclubindia