Salary Income - 5,53,501

STCG 111A - 11,371

LTCG 112A - 2,076

Other Sources - 79,753

New Regime

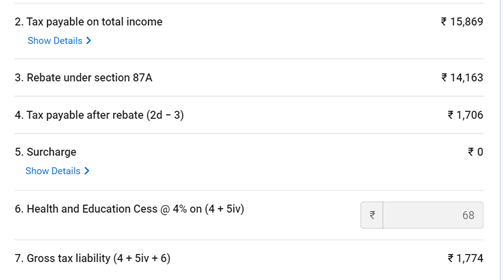

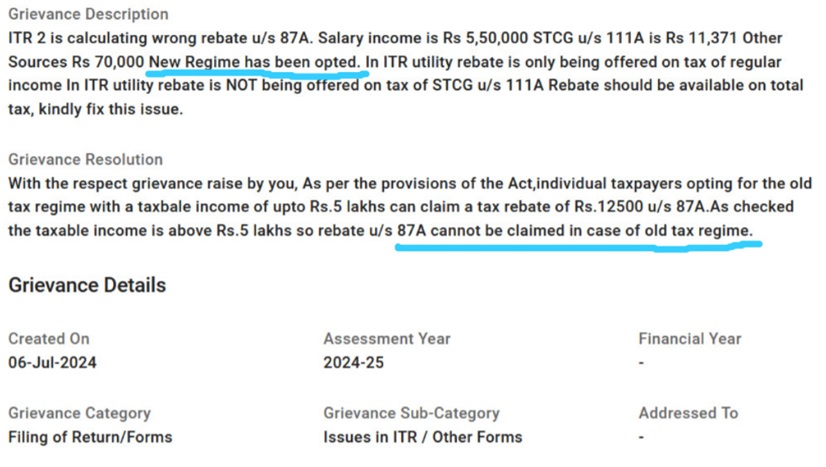

Rebate u/s 87A should be available on whole tax of Rs 15,869 but ITR 2 is only allowing it for tax on regular income.

I even checked income tax calculator on ITD website and same is calculating rebate correctly and showing 0 tax.

Am I missing something or is this an error in ITR Form?

The rebate can be claimed against tax liabilities on:

-

Normal income is taxed at the slab rate.

-

Long-term capital gains under Section 112 of the Income Tax Act (excluding listed equity shares and equity-oriented schemes of mutual funds).

-

Short-term capital gains on listed equity shares and equity-oriented schemes of mutual funds under Section 111A, taxed at a flat rate of 15%.

CAclubindia

CAclubindia