I am also facing the same issue.

MY Income as follows :

(1) income from saving bank a/c : 17121

(2) income from FDs : 3,55,074

(3) dividend income : 4805

(4) STCG on shares : 30,078

(5) LTCG shares : 64,654

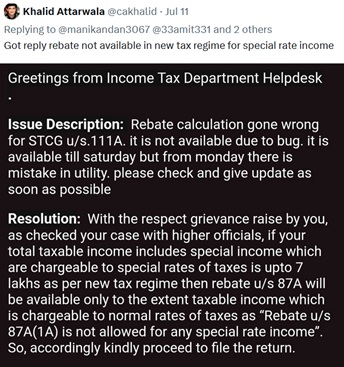

My tax is coming around 4500 despite 87 A rebate. in fact it should be zero.

CAclubindia

CAclubindia