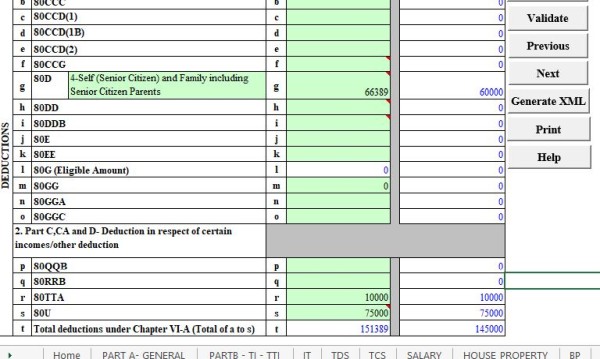

hi karthick, I think shirish explanation seems to help understand this issue closely.This is what i also did in my returns. I added my savings interest correctly in "Other sources" but in deductions VIA infront of "80TTA" i put 10,000 instead of putting the actual savings interest. I presumed this to be put as 80TTA exemption value. Although this will not result in any tax implications but seems CPC took this as error which is also not right from CPC end.As it comes under deductions so understanding was to put the expemption that tax payer is seeking in this coulmn. It was not very clear in previous AY forms although in AY18-19 they have corrected this by asking savings information separately.

Now for reponse part to CPC demand, if we select rectication with reprocess i think we may still get same error unless CPC correct it in their systems. Pls suggest as i am still confused with selection between option 2 or 3

CAclubindia

CAclubindia