Menu

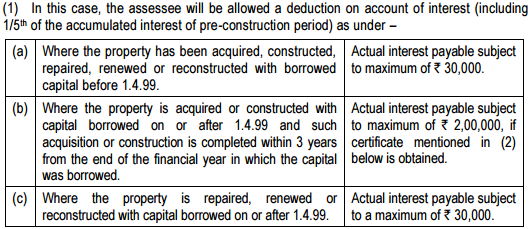

Home loan prepayment deuctions

Can I claim a deduction on home loan prepayment (for an under-construction poperty)?

Replies (2)

Recent Threads

- Houston Sign Company For Custom Signs, Banners &am

- Refund due to change in GST Rate Tobacco Products

- Lease related query can we rent out lease ?

- Planning of Ceased a Business i.e Closure of Compa

- Property value in 26QB

- Form 26QB Multiple Buyer/Multiple seller

- Company Formation for clothing business

- TDS on purchase 194Q

- Compensation for urban land acquisition

- Understanding section 269st

Related Threads

CAclubindia

CAclubindia