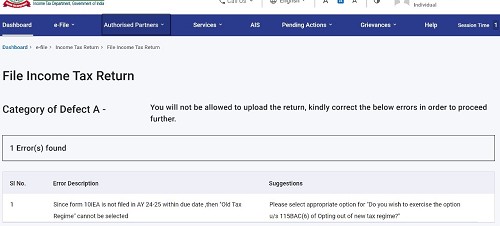

A partner in a firm who is subject to tax audit under section 44AB is suppose to file ITR on or before 31st Oct 2024, the firm has not filed the ITR still however, the accounts are finalised and hence, the profit was arrived and ITR is ready for filing hence, form 10IEA was filed on 31st August 2024 opting out of old tax regime and now when we upload the ITR u/s 139(1) it says "Since, Form 10IEA is not filed in AY 2024-25 within due date, then "Old Tax Regime" cannot be selected".

As per rule 21AGA due date for filing form 10IEA is that provided under section 139(1) and explanation 2 the due date applicable for filing ITR is 31st October 2024 so the form 10IEA is filed well within due date.

CAclubindia

CAclubindia