Menu

Due date of advance tax

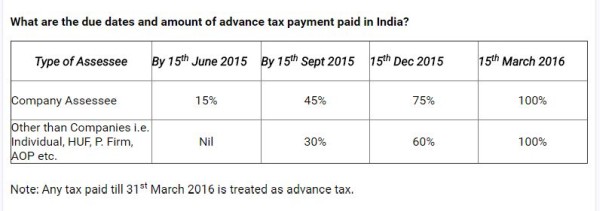

Due date of Advance Tax

Replies (3)

Recent Threads

- TDS u/s 194J - training honorarium

- WHERE TO REGISTER UNDER PTRC AND PTEC ACTS ?

- Key Corporate Compliance Requirements for Private

- Gst Non Filling Return Notice

- GSTR 2B ( MULTIPLE MONTHS )

- Eway bill generation for export material.

- International Tax clarification UK.

- E way bill expired penalty

- Best SME Focused AIF Funds in India for High Growt

- How does employee management software help in stat

Related Threads

CAclubindia

CAclubindia