Menu

Delay of more than 300 days - roc filing

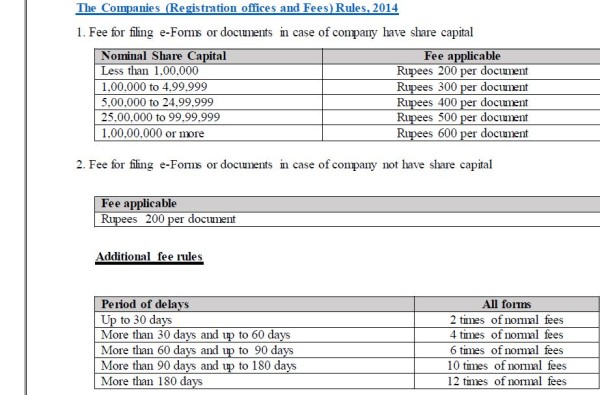

Dear Sirs, can an ROC form (ADT-1) be filed online after a delay of 300 days? Kindly clarify. Thanks in advance.

Replies (3)

Recent Threads

- Input tax credit on rent to rent

- Family Pension Army

- Waste Management services

- Seeking Clarity: New Transport Allowance Limits (D

- Query regarding Consolidated Gift Deed for Bank Tr

- TDS u/s194IB - Joint Ownership

- Free GST Reconciliation Tool in Google Sheets R

- NRI return after due date refund case

- TDS u/s 194J - training honorarium

- WHERE TO REGISTER UNDER PTRC AND PTEC ACTS ?

Related Threads

CAclubindia

CAclubindia