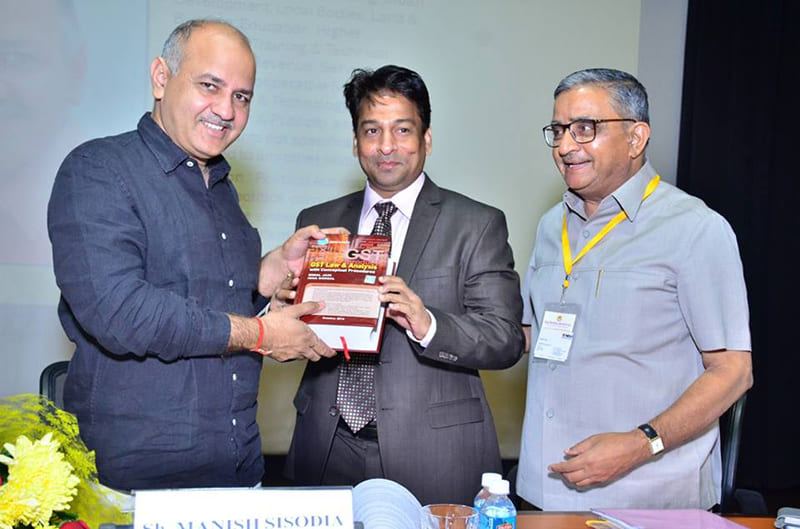

by CA Bimal Jain

By CA Bimal Jain

(Set of 3 Volumes) Edition November 2020

Published by - Bimal Jain and Isha Bansal

Rs. 5775 /-

Offer Price: Rs. 3176 /-

GST is historical indirect tax reform in India. There has been a paradigm shift in the Indirect

Tax structure with the GST rollout on 01st July 2017. It is really important to understand and

assimilate the new GST in India, new compliances and the changes in processes in

operating business.

To help professionals and aspirants with the ongoing changes and to make them GST

experts CAclubindia has introduced the Certification Course on GST. The objective

of this Course is to provide knowledge of practical aspects of GST to all.

At the end of the GST Certification course by CAclubindia, you will have a thorough

understanding of the GST regime and will be "GST Ready" for the coming future.

You will learn GST with Bimal Jain who is one of the most sought-after GST knowledge &

thought leader in the country with more than 19 years of experience in Indirect Taxation.

Through these GST Online Classes, you will be able to learn all the basic to advance

concepts and prepare yourself for the latest GST updates with this GST Online Course.

1: Levy & Supply under GST

2: Taxable Person & Registration, Threshold limits, etc.

3: Time and Value of Supply

4: Input Tax Credit

5: Place of Supply for Goods or Services

6: Zero-rated Supply (including Refund)

7: Tax Invoice, Introduction of E-Invoicing under GST, and Job Work

8: Existing Return and New GST Return System under GST & E- Way Bill

9: Clause by Clause filing of GST Annual Return (Form GSTR-9)

10: Clause by Clause filing of GST Audit Report (Form GSTR-9C)

11: Inspection, Search, Seizure, and Arrest under GST

12: Advance Ruling under GST

13: Appeal, Revision, Offence & Penalty in GST

14: Questions and Answers Questions related to the following Topics:

15: Questions and Answers

16.Intricacies in Supply, Deemed Supply, Cross Charge vs. ISD, Valuation, etc

17. Intricacies in Time of Supply and GST ITC with Q&A.

18. Overview & Intricacies of in Place of Supply for Goods and Services with Q&A.

19. Budget 2021.

This GST Certification Course will focus on practical aspects of GST with the support of the theoretical knowledge of the law and will build all the basics and advanced concepts in the mind of the students.

This GST Certification course is for everyone who wishes to learn and study GST and become an expert in GST or wants to become a certified GST practitioner with this GST Certification Course.

The new GST taxation system will be opening up an Ocean of Opportunities for all Tax/

Account Professionals, Manager Accounts, CFOs, Revenue Officials, CA and other Finance

Students.

Let's see what various reports in newspapers have to say about GST and Opportunities that will be unleashed with GST:

"GST opens job opportunities for finance, commerce graduates" - The Hindu Business Line

"GST rollout: Job market seeks over 100,000 employment opportunities. The job market is looking forward to a big boost from the new GST regime and expects over one lakh immediate new employment opportunities, including in specialized areas like taxation, accounting, and data analysis." - Business Standard

"Consultancy firm Ernst & Young India. In its Indirect Tax practice, the firm has seen over 60 percent increase in hiring. All the hiring were related to GST" - Sudhir Kapadia, National Tax Leader, EY India.

"GST will generate 10 lakh job opportunities" - Haryana Chief Minister Manohar Lal Khattar

GST is the latest amendments in the Indian taxation regime which has brought plethora of opportunities for finance professionals in the field of practice as well as jobs. Few of the benefits of learning GST are enumerated below:

Bimal Jain is a Member of Institute of Chartered Accountants of India since May 1994 and Member of Institute of Company Secretaries of India since December 2006 along with a Bachelor's degree in Law. Also, he is a Qualified SAP - FI/CO Consultant and has more than 21 years of experience in Indirect Taxation and specializes in all aspects of Service Tax, Value Added Tax (VAT)/ Central Sales Tax (CST), Central Excise, Customs, Foreign Trade Policy (FTP), Special Economic Zone (SEZ), Export Oriented Unit (EOU), Export-Import Laws and well acquainted with the concept and impact of way forward Goods and Services tax (GST).

CAclubindia has launched GST Certification Course with Bimal Jain which is available online on the website.

He has working experience of more than 18 years in renowned Companies viz. LG Electronics India Pvt. Ltd, Honda Motorcycle & Scooters India Pvt. Ltd, Hindustan Development Corporation Ltd, Khaitan & Company and presently he is the Executive Director of A2Z Taxcorp LLP - a boutique Indirect Tax firm.

He has hands on experience in providing opinion & advisory services, carrying out diagnostic review of business operations, process review, structuring of business model, undertaking litigation services at all appropriate forum including CESTAT, representation before the TRU/ CBEC/ DGFT, etc. for various matters concerning to trade, industry and commerce.

How much time will it take to complete this online course?

This GST Online Course will take up to one and half months to get complete understanding of the topics.

How does this GST Online Training will help in placements or promotions in career?

GST has now become the need of the hour and companies are hiring Individuals with understanding of GST regime and compliances. Also, it will become easy for professionals to get promotions when they acquire in-demand skills of GST.

Is there any requirement of prior knowledge / skills for this course?

Students are encouraged to have a basic understanding of Indirect Tax system in India.

Is there GST on training courses?

Yes there is GST on training courses at the rate of 18%

What is GST training?

GST training is a comprehensive workshop cum class based learning of Goods and Service Tax Act with practical application insights.

How do I become a GST professional?

One can be a GST professional by taking online courses on GST and then practice by serving the clients.

How do I become a GST practitioner?

One can take online classes to learn the concepts of GST and then appear for the Government certification exam. Once the exam is cleared you become a qualified GST Practitioner.