1. Clarification to deal with difference in Input Tax Credit (ITC) availed in FORM GSTR-3B as compared to that detailed in FORM GSTR-2A for the period 01.04.2019 to 31.12.2021 through Circular No. 193/05/2023-GST dated 17-7-2023

As you must be aware, a new concept of GSTR-2A matching was introduced on 9-10-2019. The government introduced Rule 36(4) of the CGST Rules, 2017, through which it notified that ITC that can be claimed by a taxpayer in GSTR-3B is limited to 20% over and above of what is appearing in GSTR-2A of the said taxpayer.

This limit of 20% was gradually reduced to

- 10% from 1-1-2020

- 5% from 1-1-2021

And from 1-1-2022, a new form GSTR-2B was introduced and the government changed Sec 16(2) of the CGST Act, 2017 and Rule 36(4) of CGST Rules, 2017, and stated that ITC that can be claimed by a taxpayer in GSTR-3B shall be restricted to the amount of credit available in GSTR-2B.

The problem was faced when the taxpayers started receiving many notices by the department in the FORM ASMT-10, asking the taxpayer to explain the differences of GSTR-2A vs GSTR-3B.

The government then issued a circular i.e. circular no. 183/15/2022-GST dated 27th December, 2022. This circular was valid for the FY 2017-18 and 2018-19. However, through a ruling of Hon'ble Karnataka High Court in the case of Wipro Limited, the circular's applicability was extended to FY 2019-20.

The department was obliged to do the following as per circular no. 183 -

a) If the difference is less than Rs. 500,000 per supplier per financial year, the proper officer shall ask the claimant to produce a certificate fromthe concerned supplier to the effect that said supplies have actually been made by him to the said registered person and the tax on said supplies has been paid by the said supplier in his return in FORM GSTR 3B.

b) If the difference is more than Rs. 500,000 per supplier per financial year, accept a CA certificate brought by a claimant to the same aforesaid effect.

Now the CBIC has issued a circular no. 193/05/2023-GST dated 17-7-2023, through which the CBIC has reinforced the % limit as specified in Rule 36(4), which was applicable till 31-12-2021.

It has clarified that Self-declaration/CA Certificate as per Circular No. 183 shall not be accepted for differences appearing over and above the percentage specified in Rule 36(4).

It illustrates that

Consider a case where the total amount of ITC available as per FORM GSTR-2A of the registered person was Rs. 3,00,000, whereas, the amount of ITC availed in FORM GSTR-3B by the said registered person during the corresponding tax period was Rs. 5,00,000. However, as per rule 36(4) of CGST Rules as applicable during the said period, the said registered person was not allowed to avail ITC in excess of an amount of Rs 3,00,000*1.2 = Rs.3,60,000. In the above case, the ITC of Rs 1,40,000 which has been availed in excess of Rs. 3,60,000 shall not be admissible as per rule 36(4) of CGST Rules as applicable during the said period even if the requisite certificate as prescribed in Circular No. 183/15/2022-GST dated 27.12.2022 is submitted by the registered person. Therefore, ITC availed in FORM GSTR-3Bin excess of that available in FORM GSTR-2A up to an amount of Rs 60,000 only (i.e. 3,60,000-3,00,000) can be allowed subject to production of the requisite certificates as per Circular No. 183/15/2022-GST dated 27.12.2022.

The taxpayers need to consider the clarification issued through Circular No. 193 when presenting the representation before the authorities in case of mis-match of ITC.

2. Clarification on refund-related issues through Circular No. 197/09/2023-GST dated 17-7-2023

a) Refund claims from the period of January, 2022 will be restricted to amount of ITC appearing in GSTR-2B. ITC can relate to January, 2022 period or any period prior to it. This restriction has been imposed on ITC relating to period prior to Jan'22 although matching of GSTR-2B with GSTR-3B started from 1-1-2022.

b) Sec 41 of the CGST Act, 2017 which talked about provisional acceptance of credit has been amended to give finality to input stated in GSTR-3B. Sec 42 of the CGST Act, 2017 which talked about matching, reversal and reclaim of such ITC has since been omitted w.e.f. 1st October, 2022 vide Notification No. 18/2022-CT dated 28.09.2022.

Various declarations have been suitably amended to exclude mention of Sec 42 while filing refund form.

c) Following explanation which was added in R-89(4) of CGST Rules, 2017 is to be required to be considered for determining the value of goods exported out of India for computation of GST Refund amount in case of export without payment of payment of tax under bond/LUT -

Explanation to Rule 89(4)- For the purposes of this sub-rule, the value of goods exported out of India shall be taken as - (i) the Free on Board (FOB) value declared in the Shipping Bill or Bill of Export form, as the case may be, as per the Shipping Bill and Bill of Export (Forms) Regulations, 2017; or (ii) the value declared in tax invoice or bill of supply, whichever is less.

Through this explanation, the government has restricted the computation of Refund amount to FOB value of export goods, even if the export goods are valued on CIF basis on invoice.

d) Refund applications required to be filed under "Excess payment of tax" the refund application needs to be filed under "Any other" on the portal,till the time facility to is unavailable.

One example is also sighted in the circular i.e. where goods are shipped in case of goods export, beyond the period of 3 months from the date of invoice or payment of services in case of service export is realised beyond 1 year from the date of issue of invoice, then refund which is due needs to be filed under "Any other" in the portal.

Taxpayers filing refund claim need to be mindful of the above restrictions and changes.

3. Clarification on issue pertaining to e-invoice through Circular No. 198/10/2023-GST dated 17-7-2023

The government has from 1st August, 2023 amended the e-invoice provisions and made all registered persons, other than specified exceptions, whose aggregate turnover in any of the preceding year starting from FY 2017-18 exceed Rs. 5 crores are required to issue E-Invoice, in respect of B2B Supplies (i.e. supplies made to registered persons) and in respect of Export supplies.

Some suppliers were also making invoices to government entities, who are registered just for the purpose of deducting TDS on GST. Doubts were raised whether E-invoice was to be issued by a registered person when they are making supplies to such entities.

If we read the provisions of GST law strictly and go through the definition of Registered person as specified in Sec 2(94), it states that "registered person" means a person who is registered under section 25 but does not include a person having a Unique Identity Number. Thus, the government entities registered solely for deducting TDS will be covered under the ambit of "Registered person" and supplier supplying to such entities will be required to issue E-Invoice.

Suppliers of goods or services to Government entities need to ensure that E-invoice provisions are adequately complied with in such cases.

4. Clarification on TCS liability under Sec 52 of the CGST Act, 2017 in case of multiple E-commerce Operators in one transaction through Circular No. 194/06/2023-GST dated 17-7-2023

Nowadays, there are multiple E-commerce Operators (ECOs) in one transaction, in the context of Open Network for Digital Commerce (ONDC).

In the case of the ONDC Network or similar other arrangements, there can be multiple ECOs in a single transaction - one providing an interface to the buyer and the other providing an interface to the seller. In this setup, the question arises as to which ECO will collect TCS u/s 52 of the CGST Act and deposit the same to the government.

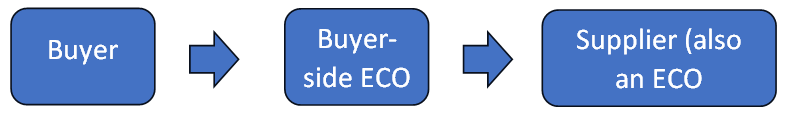

Take for example, multiple ECO's linked in the following manner -

As you can see there are two E-commerce websites connecting the buyer to the supplier. Now, if we recall the provisions of TCS, it talks about GST collected while making payment by the ECO. If one looks at the above diagram, one can see that payment to the supplier will be made by Supplier-side ECO.

Thus, CBIC has also clarified that supplier-side ECO is liable to collect TCS in such situations.

CBIC has also clarified in the following scenario

Since the Supplier is also an ECO but is not receiving payment directly from the buyer, thus due to there being one ECO in between buyer and supplier, TCS needs to be collected and buyer-side ECO will collect TCS and deposit the same to the Government.

Care needs to be given by the consultants dealing with ECOs to advise accordingly.

CAclubindia

CAclubindia