1. TDS on payment of interest on listed debentures to a resident

Section 193 of the Act provides for TDS on payment of any income to a resident by way of interest on securities.

2. Interest on housing Loan not treated As cost of improvement

Interest on housing loan claimed as deduction while computing taxable income shall not be included in cost of acquisition/improvement for purposes of capital gains.

3. Capital gains deduction on residential property

The maximum deduction that can be claimed by the assessee under Section 54 and 54F to rupees ten crore in place of all available long-term gain.

4. Foreign remittances for overseas tour packages

TCS increased from 5% to 20% for the purchase of overseas tour programmes without any threshold.

5. Taxation of capital gains in case of market-linked debenture

Long-term capital gains arising from market-linked debentures are currently taxed at a concessional rate of 10%. It is proposed to tax such gains as short-term capital gains at normal rates.

6. Leave encashment

The exemption limit for leave encashment received on retirement by non-government salaried employees increased to INR 25 lakh from the current INR 3 lakh.

7. Deemed Gift

Now if NR Received money exceeding INR 50,000 received without consideration by a person resident in India is deemed to be income accruing or arising in India.

8. Life insurance Policies

Now, it is proposed to tax income received from life insurance policies issued on or after 1 April 2023 if the aggregate annual premium exceeds INR 5 lakh, except if received on death of the assured.

9. Change in new Tax Regime

- Standard Deduction Rs 50000, Family pension and Agniveer corpus Fund is now allowable for Computation of income under New Tax regime.

- Section 115BAC applicable Now applicable also on association of persons [other than a co- operative society], or body of individuals, whether incorporated or not, or an artificial juridical person referred to in sub-clause (vii) of clause (31) of section 2.

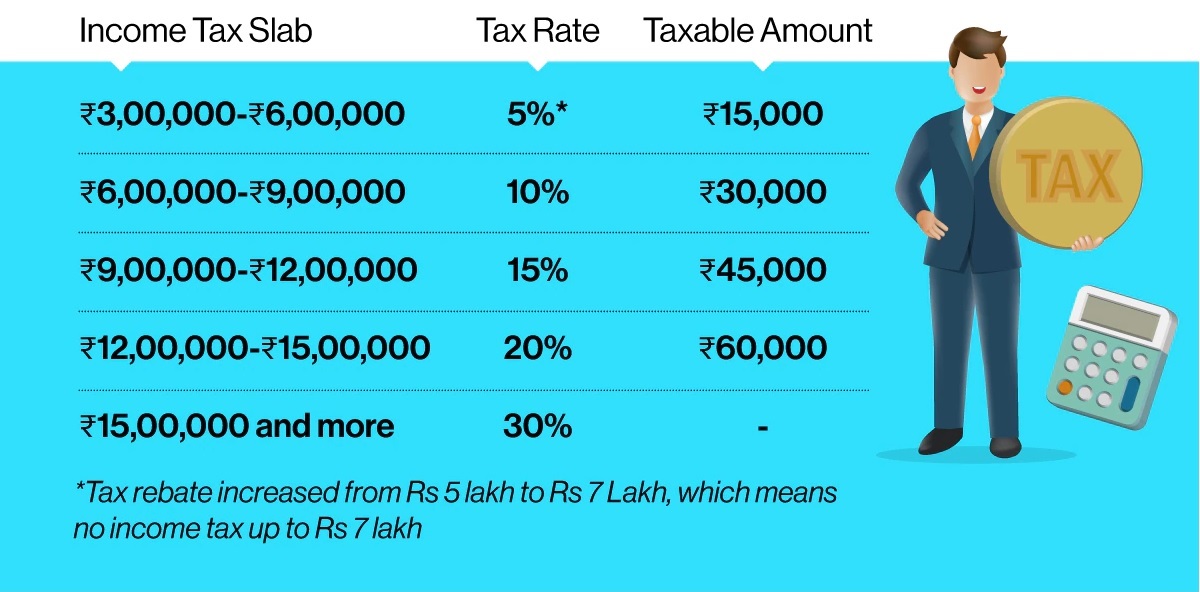

- Slab Rate for new tax regime.

10. New income tax regime to be default regime

On the portal new tax regime will be the default tax regime

Important for Company: If the employee did not opt for any option then as default deduct TDS as per the new tax regime only.

CAclubindia

CAclubindia