Section 90 of the Income Tax Act, 1961, "Agreement with foreign countries or specified territories" states that-

(1) The Central Government may enter into an agreement with the Government of any country outside India or specified territory outside India-

(a) for the granting of relief in respect of-

(i) income on which have been paid both income tax under this Act and income tax in that country or specified territory, as the case may be, or

(ii) income-tax chargeable under this Act and under the corresponding law in force in that country or specified territory, as the case may be, to promote mutual economic relations, trade and investment, or

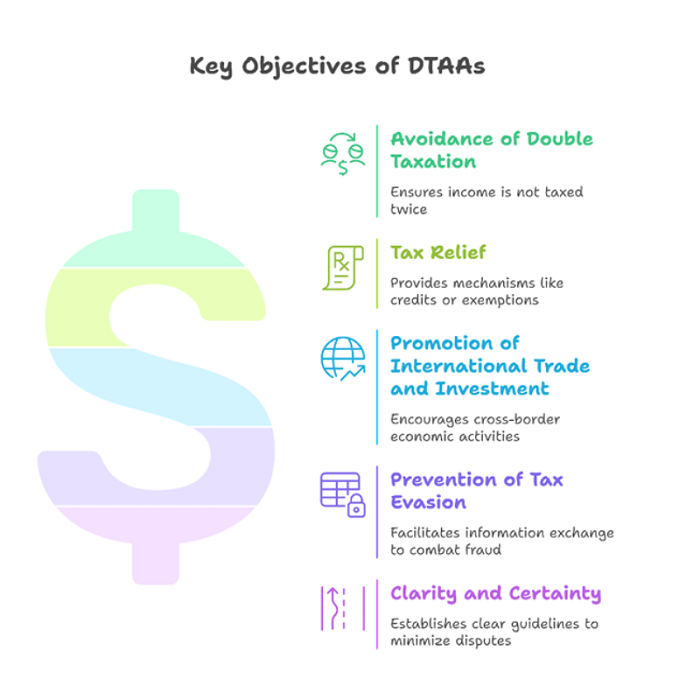

(b) for the avoidance of double taxation of income under this Act and under the corresponding law in force in that country or specified territory, as the case may be, or

(c) for exchange of information for the prevention of evasion or avoidance of income-tax chargeable under this Act or under the corresponding law in force in that country or specified territory, as the case may be, or investigation of cases of such evasion or avoidance, or

(d) for recovery of income tax under this Act and under the corresponding law in force in that country or specified territory, as the case may be, and may, by notification in the Official Gazette, make such provisions as may be necessary for implementing the agreement.

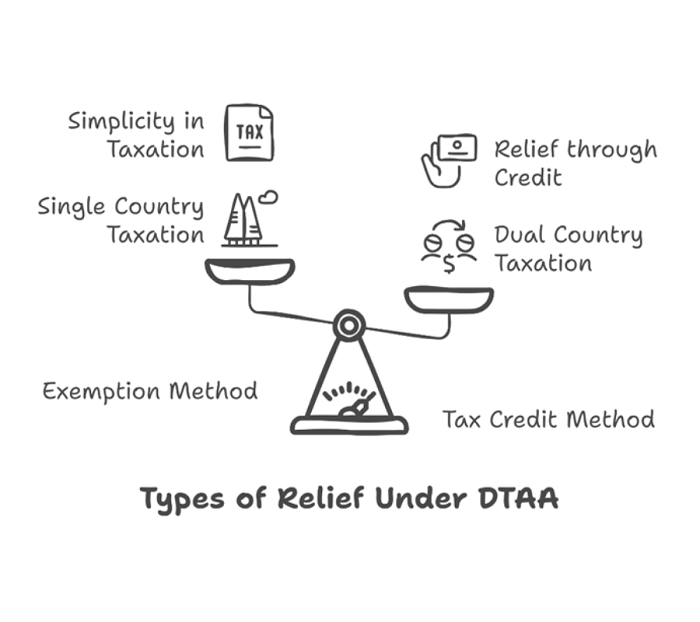

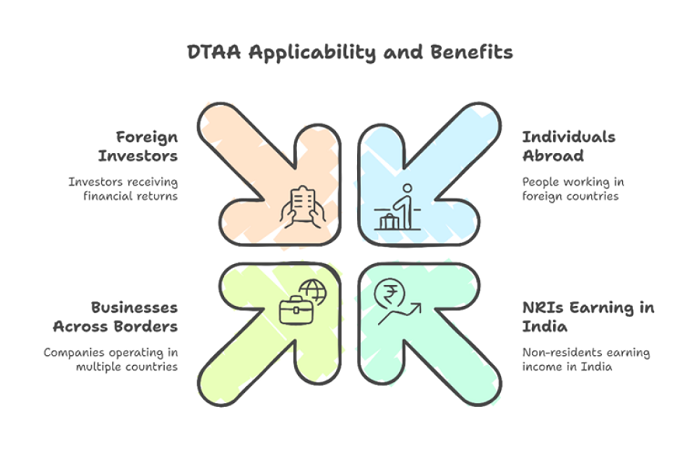

Simply put, a Double Taxation Avoidance Agreement (DTAA) is a treaty established between two or more countries to prevent the same income from being taxed in both places. This agreement protects taxpayers, whether individuals or businesses, from facing double taxation, which can happen when income is taxed in the country of origin (source country) as well as in the taxpayer's home country (residence country). DTAAs outline the rules and procedures for distributing taxing rights and provide benefits for tax relief.

Ultimately, Double Taxation Avoidance Agreements (DTAAs) typically outline Special Tax Rates, commonly called withholding tax rates, applicable to specific income types such as dividends, interest, royalties, and technical service fees. These rates are generally lower than the regular domestic tax rates, effectively alleviating the tax burden at the source of income.

For instance, the DTAA between India and the USA establishes reduced withholding tax rates for various income categories, as detailed in the table below:

| Income Type | TDS Rate Under DTAA | TDS Rate Without DTAA |

| Interest on NRO Deposits | 15% | 30% + surcharge & cess |

| Dividends from Indian Companies | 25% (or 15% if the recipient owns >= 10% shares) | 20% + surcharge & cess |

| Royalty Income | 15% (or 10% or 20% based on conditions) | 10% |

| Fees for Technical Services | 15% (or 10% or 20% based on conditions) | 10% |

| Capital Gains on Property Sale | 20% (LTCG) / 30% (STCG) | 20% / 30% |

| Capital Gains on Shares/Mutual Funds | 10% (LTCG > ₹1 lakh) / 15% (STCG) | 10% / 15% |

How to Claim DTAA Benefits?

Tax Residency Certificate (TRC)

- Taxpayers must obtain a TRC from their country of residence to prove their eligibility for DTAA benefits.

Filing Requirements

- Taxpayers must disclose their foreign income and claim DTAA benefits in their tax returns.

- In some cases, they may need to submit additional documentation, such as proof of taxes paid in the source country.

Application of Treaty Provisions

- Taxpayers must ensure that the income qualifies for relief under the specific DTAA and follow the procedures outlined in the treaty.

DTAA Rates: Comprehensive Breakdown - Withholding Tax Rates

Dividend Taxation

- Typical DTAA Dividend Rates:

- 0-15% for corporate shareholders

- 10-20% for individual shareholders

- Reduced rates based on shareholding percentage

- Varies by specific bilateral agreement

Interest Income Rates

- Standard DTAA Interest Rates:

- 10-15% for bank/institutional interest

- 0-7.5% for government/infrastructure bonds

- Specific rates depend on investment type

- Negotiated between treaty countries

Section 89A in Budget 2021

- Section 89A was introduced in the Budget 2021 through the Finance Act, 2021, to offer tax relief to Indian residents earning income from specific foreign retirement accounts.

- This measure seeks to tackle the problem of double taxation that returning residents may encounter concerning their foreign retirement savings.

- The provision applies to retirement accounts in certain countries, including the USA, UK, and Canada (e.g., 401(k)s and RRSPs).

- The section became effective from April 1, 2022, for the assessment year 2022-23 and onwards.

- Taxpayers must file Form 10EE electronically and provide the necessary documentation to claim benefits under this section.

- Countries Covered Under Section 89A - United States (401(k), IRA accounts), United Kingdom (Pension schemes, SIPPs), Canada (RRSP, TFSA accounts) and Australia (Superannuation funds)

Conclusion

DTAA is essential for minimizing tax obligations for both individuals and businesses earning income globally. Being aware of the relevant DTAA regulations and advantages enables effective tax savings and adherence to international tax legislation.

Section 89A provides important relief for NRIs holding foreign retirement accounts, protecting them from double taxation. This provision harmonizes Indian tax regulations with international tax frameworks and benefits NRIs by permitting taxation only when funds are withdrawn.

FAQs

How do DTAAs reduce withholding taxes?

DTAAs often lower withholding tax rates on cross-border payments like dividends, interest, and royalties. For example, a DTAA may reduce the withholding tax on dividends from 20% to 10%.

Can one claim DTAA benefits if I am a freelancer or self-employed?

Yes, freelancers and self-employed individuals can claim DTAA benefits if they earn income from a country with which their home country has a DTAA.

What happens if there is no DTAA between two countries?

Without a DTAA, income may be taxed in both the source and residence countries, leading to double taxation.

What is the difference between a DTAA and a Tax Information Exchange Agreement (TIEA)?

A DTAA focuses on preventing double taxation and reducing tax rates.

A TIEA focuses on the exchange of tax-related information to combat tax evasion.

CAclubindia

CAclubindia