Real Estate is an ever green investment option in India and it has always given good returns. It can be a residential or commercial property.

Real Estate gives recurring income in form of rent and appreciation in value in case of re-sale.

As it gives good return, so taxability of income earned from real estate too arise. Taxability of income from real estate can be explained as below.

Taxability under Income Tax

House Property –

Rental income from property is taxable under this head. The following three conditions must be satisfied before income from a property can be taxed under this head

1. The property should consist of any building or lands appurtenant thereto.

2. Assessee should be owner of property

3. The property should not be used by owner for purpose of any business or profession carried on by him, profit of which is chargeable to tax.

Notes-

(i) Income from subletting of property and vacant land is not taxable here.

(ii) Ownership includes both free-hold and lease-hold right as well as deemed ownership.

(iii) House property in foreign country is taxable to Assessee as per his residential status u/s 6.

When property income is not chargeable to tax

(a) Income from Farm House,

(b) One place of an ex- ruler of India,

(c) Property income of a local authority or trade Union,

(d) Property held for charitable purpose,

(e) Property used for own business or profession,

(f) One self occupied property of an individual / HUF

Computing income from house property

|

Gross Annual Value |

**** |

|

Less: Municipal Taxes (if paid by owner) |

**** |

|

Net Annual Value |

**** |

|

Less: Deduction under Sec.24

|

**** |

|

Income from house property |

**** |

Expected rent: Municipal value or fair rent whichever is higher but higher value cannot exceed Standard Rent, if SR is not applicable than M.V or FRV which is higher.

Actual Rent: Rent received or receivable from let out property during previous years.

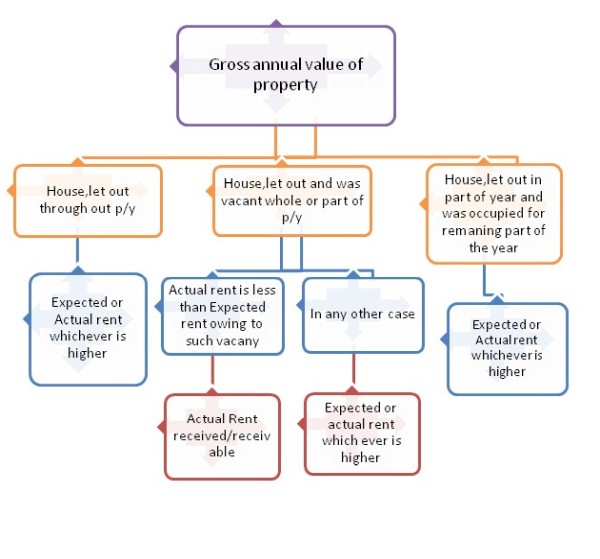

Determination of Gross Annual Value

A. House property which is let out throughout previous year- Gross Annual Value would be higher of Expected Rent and Actual Rent.

B. House property which is let out and was vacant during the whole or part of the previous year- There may be two situation in this type of house property

1. Actual rent received/receivable is more than Expected rent in spite of vacant period- in this situation Gross Annual Value would be actual rent received/ receivable.

2. Actual rent received/receivable is less than Expected rent owing to such vacancy- in this situation Gross Annual Value would be Actual rent received/ receivable.

C. House property which is part of year let and part of the year occupied for own residence- Gross Annual Value would be higher of Expected rent and Actual rent.

Deduction from income from house property (Sec. 24)

Deduction from income from house property (Sec. 24)

a) Statutory Deduction Sec 24 (a) - 30 % of Net Annual Value (NAV). No deduction is provided if Net Annual Value is NIL or having negative balance.

b) Deduction of Interest on borrowed capital. (Based on following conditions)

a. Borrowed money must be utilized for purchase, construction, repair or renovation of HP.

b. The borrowed must be interest bearing. Although it is immaterial whether interest has been actually paid or not paid during the previous year.

c. Brokerage or commission paid for arrangement of loan is not deductable.

Notes-

1. Interest payable on borrowed capital for the period prior to the previous year in which the property has been acquired or constructed, can be claimed as deduction over a period of 5 year in equal annual installment coming from the year of acquisition, completion of construction.

Example - loan was taken on 1-5-07 and construction was completed on 7-8-11, then A/Y is 2011-12 and P/Y is 2010-11. Accumulated interest would be from 1-5-07 to 31-3-11 means till last day of P/Y 2010-11. 1/5 of such accumulated interest would be allowed for 5 successive F/Y starting from the year in which acquisition/construction was completed.

2. Interest on unpaid interest is not deductable.

Example – Assessee had not paid loan EMI on time and interest was charged for late payment. Such interest will not be allowed as deduction u/s 24 of Income Tax Act 1961

Capital Gain –

Capital Gain –

When one sold his Real Estate Property and earned profit, it will be taxable under Capital Gain.

Any profits arising on the Transfer of any Capital Asset shall be chargeable to tax under the head Capital Gains in the year of transfer.

House Property is a Capital Asset if before transfer, it was owned by assessee except as Stock in Trade. Capital Gain can be Long Term or Short Term. If holding period of property before transfer was more than 36 months, then it is long term otherwise it will be short term.

WHAT IS A TRANSFER?

It includes:

a. Sale, Exchange (Must be of two capital assets). Relinquishment of Asset.

b. Extinguishment of an Asset.

c. Compulsory acquisition by Government.

d. Conversion of an asset into Stock-in-trade.

e. Any transfer covered by Sec.53 A of the transfer of Property Act.

Calculation of Long Term Capital Gain

|

Particulars |

Amount |

|

Sale Consideration |

**** |

|

Less: Expenses on Transfer |

**** |

|

Less: Index Cost of Acquisition |

**** |

|

Less: Index Cost of Improvement |

**** |

|

Long Term Capital Gain |

**** |

Note: In computing Short term Capital Gain, indexation is not allowed.

Exemption of Capital Gain from Real estate

An assessee can claim exemption from Capital Gain under Section 54 and 54 EC but it must be noted that exemption is available only for Long term Capital Gain. A brief of these exemptions is given below in a tabular form which is easy to understand.

|

Particulars |

Section 54 |

Section 54 EC |

|

Assets Transferred |

Residential House (Self -Occupied or Let out) |

Any asset |

|

Entitled |

Individual or HUF |

All Assessee |

|

Type of Capital Asset |

Long Term Capital Asset |

Long Term Capital Asset |

|

Investment in New Assets |

Residential House |

Long term specified assets. Ex. NHAI, REC Bond |

|

Prescribed Period for Investment |

Purchased within one year before or two years after date of transfer, OR completed construction within 3 years, after the date of transfer |

Six months from date of transfer |

|

Exemption |

Amount invested or Capital gain whichever is lower |

Amount invested or Capital gain whichever is lower. But maximum amount is Rs. 50 Lakhs |

|

Treatment of Unutilized Amount |

Deposit in Capital Gains A/c Scheme upto due date of return u/s 139 (1) and must be fully utilized for investment with in stipulated period otherwise unutilized amount will be treated as LTCG |

Not Applicable |

|

Holding Period of investment |

3 years from the date of investment |

3 years from the date of investment |

|

Sale of investment before end of holding period |

If sold within 3 years from the date of investment then capital gains claimed as exempt under this section, shall be reduced from cost of acquisition of investment while calculating STCG on it. |

If sold within 3 years from the date of investment then capital gains claimed as exempt under this section, shall be reduced from cost of acquisition of investment while calculating STCG on it. |

Taxability under Wealth Tax

Wealth tax is charged for every assessment year in respect of the net wealth on the corresponding valuation date of every Individual; Hindu Undivided Family and Company at the rate of 1% of the amount by which the net wealth exceeds Rs.30 Lakhs.

COMPUTATION OF NET WEALTH

|

Particulars |

Rs. |

|

Assets specified in Sec. 2(ea) chargeable in the hands of assessee |

xxxx |

|

Add: Deemed asset in the assessee's hands u/s 4 |

xxxx |

|

Less: Aggregate value of all the debts owed by the assessee on the valuation date incurred in relation to the above said assets |

(xxxx) |

|

Less: Assets exempt u/s 5 |

(xxxx) |

|

Net wealth as per Wealth Tax Act |

xxxx |

ASSET - SECTION 2 (ea)

Discussion is limited only to Real Estate Assets

"Asset” means Building and Urban Land.

Building - Any building or land appurtenant thereto, whether used for Residential purpose or Commercial purposes or For the purpose of maintaining a guest house. Including a farm house situated within 25 kilometers from the local limits of any municipality

But does not include –

a) Residential house is allotted by a company to an employee or an officer or a director who is in whole-time employment, having a gross annual salary of less than Rs 5,00,000;

b) Any house for residential or commercial purposes which forms part of stock-in-trade:

c) Any house which is occupied by assessee for purposes of any business or profession carried on by him;

d) Residential property which is let out for a minimum period of 300 days in previous year;

e) Any property in the nature of commercial establishments or complexes.

Urban Land - Urban land situated in 'specified area'. This means:

a. Situated within municipality, etc. which has a population of not less than 10,000 as per latest census on the first day of previous year,

b. Situated within 8 kilometers from the notified local limits.

Urban land does not include -

a. land on which construction of a building is not permissible under any law for the time being in force in the area in which such land is situated; or

b. land occupied by any building which has been constructed with the approval of the appropriate authority; or

c. any unused land held by the assessee for industrial purposes for a period of two years from the date of its acquisition by him; or

d. Any land held by the assessee as stock-in-trade for a period of ten years from the date of its acquisition by him.

REAL ESTATE ASSETS EXEMPT FROM TAX – SECTION 5

In case of an Individual or a HUF assessee, following assets are exempt u/s 5-

a) A house or a part of house; or

b) A plot of land not exceeding 500 sq. meters in area.

CMA Arif Farooqui

Practicing Cost Accountant

Email - arif_cwa@yahoo.co.in

CAclubindia

CAclubindia