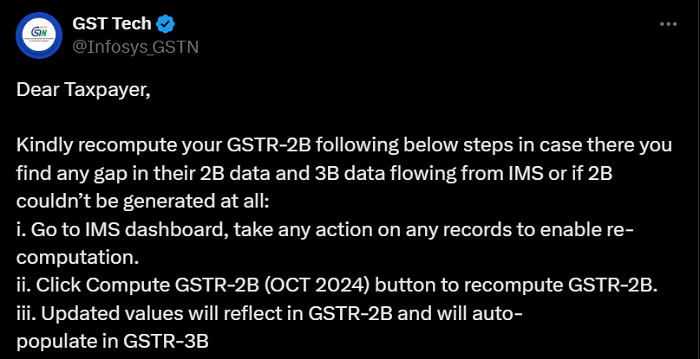

If you have observed that there are discrepancies between GSTR-2B and GSTR-3B or GSTR-2B is not generated, then you can re-compute it by following these steps:

Access the IMS Dashboard

- Login to the Input Management System (IMS) dashboard.

- Review the records that are displayed to identify the potential issues.

Take an Action on Records

- Select any record on the IMS dashboard and take action, such as Accepting, rejecting, or modifying the record.

- This action enables the system to initiate the re-computation process.

Click on the Compute GSTR-2B Button

- Locate the Compute GSTR-2B (OCT 2024) button on the dashboard.

- Click the button to recompute the GSTR-2B for the specified month.

Review Updated GSTR-2B

- After recomputation, check the updated GSTR-2B values.

- Ensure that the updated data reflects correctly in GSTR-2B and is auto-populated into GSTR-3B.

Cross-check the Final Data

- Compare the recomputed GSTR-2B and GSTR-3B to ensure there are no remaining discrepancies.

- Make the necessary corrections before filing the returns.

Purpose of Recomputing GSTR-2B

- To fix the missing details in GSTR-2B to ensure accurate ITC claims.

- To prevent errors in GSTR-3B by aligning it with updated GSTR-2B data.

- To ensure correct values auto-fill in GSTR-3B for ease of filing.

CAclubindia

CAclubindia