Medical or Health Insurance is gaining popularity in India these days. After the spread of COVID-19 pandemic, having a health insurance policy has become inevitable!

Medical emergencies always take us by surprise. It is always better to be safe than sorry, and it is no different when it comes to medical insurance.

It's is a must in your "investment portfolio".

The government encourages everyone to buy medical insurance and also allows tax deductions on the premium so paid under Section 80D of the Income Tax Act.

In this article we will be discussing about the applicability and deductions that are available under the income tax act in relation to medical insurance premium and medical expenditure.

Moreover, we will also be highlighting the important points that are to be kept in mind before one invests in a health insurance policy.

Let us first discuss the provisions of Section 80D in detail as per the Income Tax Act.

I. SECTION 80D

In computing the total income of an assessee, being an individual or a Hindu Undivided Family (HUF), there shall be deducted a "sum" paid towards medical insurance premia or medical expenditure out of the assessee's income chargeable to tax.

In order to understand the provisions in a better way, let's divide our discussion in two parts:

|

PART A |

Deduction in respect of health insurance premia or medical expenditure available to an Individual |

|

PART B |

Deduction in respect of health insurance premia or medical expenditure available to a Hindu Undivided Family (HUFs) |

A. Deduction in respect of health insurance premia or medical expenditure available to an Individual:

• Where the assessee is an individual, the "sum" as referred above shall be the aggregate of the following:

|

Description |

Senior Citizen* |

Others |

|

i. CGHS/Insurance Premia/Preventive health check-up of assessee or his family: • Total amount (incl. GST/taxes) paid on - • a fresh/new health insurance policy or • renewal of an existing health insurance policy for the assessee or his/her spouse and his/her dependent children OR • Contribution made to the Central Government Health Scheme (CGHS) OR • Payment made on account of preventive health check-up** of the assessee or his/her spouse and his/her dependent children. |

Upto Rs. 50,000 |

Upto Rs. 25,000 |

|

ii. Insurance Premia/Preventive health check-up of the parents of the assessee: • Total amount (incl. GST/taxes) paid on - • a fresh/new health insurance policy or • renewal of an existing health insurance policy for the parents of the assessee OR • Payment made on account of preventive health check-up** of the parents of the assessee. |

Upto Rs. 50,000 |

Upto Rs. 25,000 |

|

iii. Medical Expenditure incurred on the assessee or any member of his/her family*** - not covered by any health insurance: • Total amount (incl. taxes, if any) paid on account of medical expenditure incurred on the health of the assessee or any member of his/her family***; • provided they are not covered by any health insurance |

Upto Rs. 50,000 |

NIL |

|

iv. Medical Expenditure incurred on the parents of the assessee - not covered by any health insurance: • Total amount (incl. taxes, if any) paid on account of medical expenditure incurred on the health of any parent of the assessee; • provided they are not covered by any health insurance |

Upto Rs. 50,000 |

NIL |

*Senior Citizen means an individual resident in India who is of the age of 60 years or more at any time during the relevant year.

(Any individual, who is aged 60 years or more, being a non-resident, shall be considered in the Others category and the deduction shall be available to him likewise).

**Where the amounts (as referred to in clauses i. and ii. above) are paid on account of preventive health check-up, the maximum deduction for such amounts, in aggregate, shall be allowed only upto Rs. 5,000. Thus, the amounts paid on account of preventive health check-up of the assessee, his/her spouse, his/her dependent children and his/her parents shall be allowed deduction, in aggregate of an amount upto Rs. 5,000 only.

***Author's Interpretation on the meaning of word "family" as specified in clause iii. above:

Any member of assessee's Family can also be a person other than his/her spouse or his/her dependent children. The term "family" has been defined in this section only in relation to clause i. that means - the spouse and dependent children of the assessee. However, the same has not been made effective/applicable for clause iii.

Thus, clause iii. has a wider scope and can cover the assessee's brother, sister, etc. being the members of his/her family on whom, if the assessee incurs medical expenditure, he/she can claim deduction under section 80D.

IMP. NOTE:

The aggregate of the sum specified under clause i. and clause iii. above [i.e. the total amounts paid on the health of the assessee or his family] OR

The aggregate of the sum specified under clause ii. and clause iv. above [i.e. the total amounts paid on the health of the parents of the assessee]

"shall not exceed Rs. 50,000"

• MODE OF MAKING PAYMENT:

For the purposes of claiming deduction, the payment shall be made by —

• any mode, including cash, in respect of any sum paid on account of preventive health check-up

• any mode other than cash (i.e. by cheque, NEFT/RTGS, credit/debit card, UPI, etc.) in all other cases.

"THE MAXIMUM DEDUCTION UNDER THIS SECTION CANNOT EXCEED RS. 1,00,000 FOR AN INDIVIDUAL"

B. Deduction in respect of health insurance premia or medical expenditure available to a Hindu Undivided Family (HUF):

• Where the assessee is a HUF, the "sum" referred above shall be the aggregate of the following:

|

Description |

Senior Citizen^ |

Others |

|

1. Insurance Premia of any member of HUF: • Total amount (incl. GST/taxes) paid on - • a fresh/new health insurance policy or • renewal of an existing health insurance policy for any member of HUF. |

Upto Rs. 50,000 |

Upto Rs. 25,000 |

|

2. Medical Expenditure incurred on any member of HUF - not covered by any health insurance: • Total amount (incl. taxes, if any) paid on account of medical expenditure incurred on the health of any member of HUF; • provided they are not covered by any health insurance |

Upto Rs. 50,000 |

NIL |

^Senior Citizen means an individual resident in India who is of the age of 60 years or more at any time during the relevant year.

(Any individual, member of an HUF, who is aged 60 years or more, being a non-resident, shall be considered in the Others category and the deduction shall be available to him likewise)

IMP. NOTE:

The aggregate of the sum specified under clause 1. and clause 2. above [i.e. the total amounts paid on the health of any member of HUF]

"shall not exceed Rs. 50,000"

• MODE OF MAKING PAYMENT:

For the purposes of claiming deduction, the payment shall be made by —

• any mode other than cash (i.e. by cheque, NEFT/RTGS, credit/debit card, UPI, etc.) in all cases.

"THE MAXIMUM DEDUCTION UNDER THIS SECTION CANNOT EXCEED RS. 1,00,000 FOR AN HUF"

Let us now understand the provisions more effectively with the help of five (5) unique illustrations.

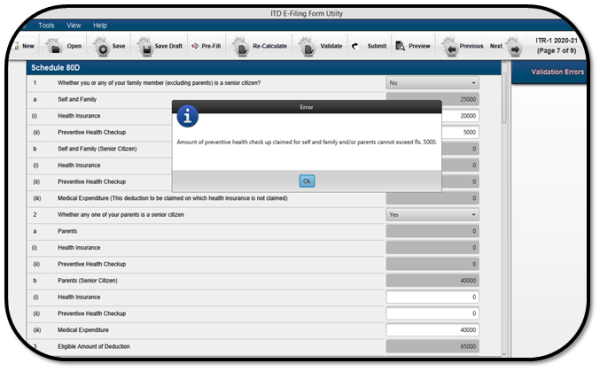

To make our readers understand the things in a better way, we have presented the solutions to these illustrations by using the LATEST INCOME TAX RETURN PREPARATION SOFTWARE/UTILITY that has been made available for the FY 2019-20.

The snapshot of the same is as under:

Illustration 1:

Mr. Raju, aged about 45 years, resident in India, paid Health Insurance Premium by cheque of Rs. 20,000 on 04.04.2019 towards a floater health policy offered by XR Insurance Company Ltd. covering him and his spouse. He also paid an amount of Rs. 5,000 in cash towards preventive health-tests.

During the FY 2019-20, Mr. Raju's father, resident in India, aged about 67 years, was hospitalized for a period of 7 days due to seasonal infection. Mr. Raju paid Rs. 40,000 by his Debit Card towards this expenditure as Mr. Raju's father was not covered by any health insurance. An amount was Rs. 4,000 was also paid in cash by Mr. Raju towards preventive health tests of his mother, resident in India, aged about 63 years.

What shall be the total deduction available under section 80D for the FY 2019-20 to Mr. Raju?

Solution:

Thus, Mr. Raju shall be eligible to claim a deduction of Rs. 65,000 for the FY 2019-20 under Section 80D.

Note: The maximum amount of expenditure on preventive health check-up of self, family and parents is restricted to Rs. 5,000.

Any amount exceeding Rs. 5,000 shall not be accepted by the software/utility.

If you will try to input the amount in excess of Rs. 5,000 in aggregate, you will get a pop-up error as displayed below:

Illustration 2:

Mr. Vinod, aged about 61 years, resident in India, paid Health Insurance Premium by cheque of Rs. 51,000 on 05.08.2019 towards a floater health policy offered by BHJ Insurance Company Ltd. covering him and his spouse. He also paid an amount of Rs. 4,000 in cash towards preventive health-tests.

During the FY 2019-20, Mr. Vinod also paid a premium of Rs. 30,000 towards renewal of Health Insurance of his father, resident in India, aged about 80 years. Also, his mother, resident in India, aged about 77 years, was hospitalized for a period of 4 days due to seasonal flu. Mr. Vinod paid Rs. 30,000 by his Credit Card towards this expenditure as Mr. Vinod's mother was not covered by any health insurance. An amount was Rs. 1,000 was also paid in cash by Mr. Raju towards preventive health tests of his mother.

What shall be the total deduction available under section 80D for the FY 2019-20 to Mr. Vinod?

Solution:

Thus, Mr. Vinod shall be eligible to claim a deduction of Rs. 1,00,000 for the FY 2019-20 under Section 80D.

Illustration 3:

Mr. Akshay, aged about 31 years, resident in India, paid Health Insurance Premium by cheque of Rs. 18,000 on 06.07.2019 towards a health policy offered by XR Insurance Company Ltd. for himself. He also paid an amount of Rs. 3,000 in cash towards preventive health-tests.

During the FY 2019-20, Mr. Akshay also paid a premium of Rs. 41,000 towards renewal of Health Insurance of his father and mother, both resident in India and aged about 57 years. An amount was Rs. 3,000 was also paid in cash towards preventive health tests of his mother and father.

What shall be the total deduction available under section 80D for the FY 2019-20 to Mr. Akshay?

Solution:

Note: The maximum amount of expenditure on preventive health check-up of self, family and parents is restricted to Rs. 5,000. Any amount exceeding Rs. 5,000 shall not be accepted by the software.

Thus, Mr. Akshay shall be eligible to claim a deduction of Rs. 46,000 for the FY 2019-20 under Section 80D.

Illustration 4:

Mr. Sumit, aged about 29 years is working in a finance company at Delhi. The company has a group health insurance policy which covers all its employees. The company pays the premium for this policy from its own pocket.

During the FY 2019-20, Mr. Sumit paid a premium of Rs. 26,000 towards renewal of Health Insurance of his mother, resident in India, aged about 60 years. Also, his father, resident in India, aged about 64 years, was hospitalized for a period of 2 days due to severe diarrhea. Mr. Sumit paid Rs. 30,000 by UPI towards this expenditure as Mr. Sumit's father was not covered by any health insurance. An amount was Rs. 4,000 was also paid in cash by him towards preventive health tests of his father and mother.

What shall be the total deduction available under section 80D for the FY 2019-20 to Mr. Sumit?

Thus, Mr. Sumit shall be eligible to claim a deduction of Rs. 50,000 for the FY 2019-20 under Section 80D.

Illustration 5:

Mrs. Sarita, aged about 63 years, resident in India, incurred an expenditure of Rs. 44,000 on 24.05.2019 as she was hospitalized due to Dengue fever. She also paid an amount of Rs. 5,000 in cash towards preventive health-tests during the FY 2019-20.

What shall be the total deduction available under section 80D for the FY 2019-20 to Mrs. Sarita?

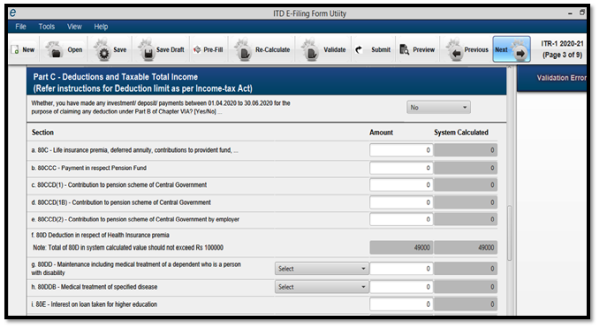

Solution:

This amount shall automatically reflect in the Part-C where all the deductions shall be listed in your ITR. The same has been shown below:

Let's now discuss the last provision as contained in Section 80D.

• SINGLE PREMIUM HEALTH INSURANCE POLICIES

A single premium insurance plan is an insurance product which offers complete coverage benefits in return of a one-time/lump sum payable premium. Therefore, in a single premium insurance plan, the calculated premium can be paid in one go for certain time period and there is no need for regular year after year payment of the premium.

A single premium insurance plan offers certain benefits over the regular premium plan like 10-15% discount (advance payment), protection against premium-hike in future, etc.

The Finance Act, 2018 introduced a new provision for claiming a deduction with regards to single premium health insurance policies.

Where the total amount (incl. GST/taxes) paid in lump sum in a relevant year on -

• a fresh/new health insurance policy or

• renewal of an existing health insurance policy

for any person for more than an year, then, there shall be allowed for each of the relevant years, a deduction in equal proportion of the amount so paid.

The total amount so paid in lump sum shall be apportioned equally between the relevant years to which the policy relates.

Let's understand this by way of an example.

Illustration:

Mr. Anil, aged about 58 years, resident in India, paid Health Insurance Premium in lump sum of Rs. 1,35,000 for 3 years on 02.06.2019 as he was getting a 5% discount on the premium and also premium-hike-protection against the increased future premiums.

Now, he can claim the deduction under section 80D for 3 years as under:

|

Eligible Years for claiming deduction |

2019-2020, 2020-2021 and 2021-2022 |

|

Total No. of Years |

3 |

|

Total Insurance Premium Paid |

Rs. 1,35,000 |

|

Deduction per Year |

1,35,000 ÷ 3 = 45,000 |

|

Maximum allowable Deduction for the financial year 2019-2020 and 2020-2021 |

Rs. 25,000 |

|

Maximum allowable Deduction for the financial year 2019-2020 and 2020-2021 |

Rs. 45,000 (as Mr. Anil now becomes senior citizen and can claim deduction of an amount up to Rs. 50,000) |

Note: If in the future financial years, the maximum allowable limit for claiming deduction under section 80D is increased by the government, then such increased limit shall be applicable in order to claim deduction for the relevant financial year.

Moving now towards the second section of our article, where we will enlist the important points that are to be kept in mind before investing in a health insurance policy.

II. IMPORTANT POINTS TO BE KEPT IN MIND BEFORE INVESTING IN A HEALTH INSURANCE POLICY

Before you invest in a health insurance policy, a few important things that you should always keep in mind include:

• The health insurance policy shall be in accordance with a scheme made by the General Insurance Corporation of India (GIC) and approved by the Central Government or made by any other insurer and approved by Insurance Regulatory and Development Authority (IRDA).

• The Sum Insured or SI is the maximum amount that your insurer shall pay. Mostly, your hospital room category is dependent on this SI. Higher the SI, higher is the room category i.e. a single private room, suite, etc. that you are eligible for. Before you buy the insurance policy this factor should be taken care of.

• Ensure that the claim settlement process of your health policy is cashless.

• The pre-hospitalization and post-hospitalization expenses are usually not covered in many insurance plans. This accounts for major expenses as you have to take medicines and treatments before and after your visit to the hospital. This should be considered before you invest into a health policy.

• Ambulances Expenses are not paid by the insurers in 90% cases. Select a policy that reimburses the charges you pay towards using hospital's emergency ambulance services.

• Ensure your policy has a Worldwide Emergency Cover which covers you against any health issues/emergency even outside India.

• Many people prefer alternative therapies to get cured. Ayurveda, Yoga & Naturopathy, Unani, Siddha and Homeopathy (abbreviated as AYUSH) are few such therapies. Health insurance policies also have AYUSH cover these days to reimburse the expenses you incur towards the treatment you take to get cured using these alternative therapies. This can be important to many and should be duly considered.

• Ensure the health policy you invest in provides health maintenance benefits upto a certain limit that reimburses the amount you pay towards health tests, OPD, medicine bills, etc. This can help you to pay for day-to-day medical expenses.

• Health Check-ups are provided each year in some health policies that includes various tests, evaluations, etc. which are very essential. Select the policy which has this added benefit.

• Ensure that your health policy provide you with a guaranteed cumulative bonus (usually 5% to 10%) every year i.e. a type of no-claim bonus, which is awarded even if you take a medi-claim in a policy term. The bonus percentage is added to your sum insured every year making you more secure.

• Lastly, make sure that the payment you make towards health insurance premium is by any mode other than cash. This would only make you eligible to claim the deduction under section 80D.

There are a number of other things that are noteworthy before investing, but due to brevity of space and time, mentioning all of them would be not be possible.

CONCLUSION

I. With regard to the deduction as specified under section 80D that we have discussed above, we have summarized the provisions in form of a table for ready reference:

|

Nature of Amount spent |

Deduction for Individuals |

Deduction for HUFs |

||||

|

Self and Family |

Parents |

Member |

||||

|

Below 60 years |

60 years or more* |

Below 60 years |

60 years or more* |

Below 60 years |

60 years or more* |

|

|

Insurance Premium |

25,000 |

50,000 |

25,000 |

50,000 |

25,000 |

50,000 |

|

CGHS Scheme |

25,000 |

25,000 |

- |

- |

- |

- |

|

Preventive Health Check-up |

5,000 |

5,000 |

5,000 |

5,000 |

- |

- |

|

Medical Expenditure |

- |

50,000 |

- |

50,000 |

- |

50,000 |

|

Maximum Deduction |

Rs. 25,000 |

Rs. 50,000 |

Rs. 25,000 |

Rs. 50,000 |

Rs. 25,000 |

Rs. 50,000 |

|

Maximum allowed in a FY |

Rs. 1,00,000 |

Rs. 1,00,000 |

||||

*Deduction only available for an individual resident who is of the age of 60 years or more (senior citizen) at any time during the relevant financial year.

For senior citizens being non-resident, the deduction shall be as allowed to individual below the age of 60 years.

It is pertinent to note that for the FY 2019-20, due to COVID-19 crisis, the government has extended the last date for the payment of health insurance premium/other expenses to 30th June, 2020 against the earlier 31st March, 2020. This has been done by passing a special Ordinance named "The Taxation And Other Laws (Relaxation Of Certain Provisions) Ordinance, 2020" on 31.03.2020.

Thus, in order to claim deduction under Section 80D for the financial year 2019-20, you can make the necessary payments by 30th June, 2020!

Moreover, we advise all the taxpayers to file their respective ITRs only after 30th June, 2020 (being the extended last date for making investments/payments/deposits in order to claim deductions under chapter VIA-B i.e. 80C, 80D, 80G, etc.) so that they do not miss out on claiming any deduction in a hurry to file for their ITRs.

II. Health insurance is very important and every Indian should take a policy on his health to remain protected in the odd times. Select the right insurance plan that costs you less and provides you with a bundle of benefits. Also, it is very important to read the policy document and the terms and conditions before you invest in a health insurance plan.

Choose wisely to gain the maximum advantage!

The author can also be reached at connect@ujlegal.com

Stay very-very cautious during UN-LOCK Phase-1.

Try to stay home/work from home in order to stay safe.

Stay home, stay well and stay safe!

CAclubindia

CAclubindia