Form 3CD is a key document used in tax audits that provides information on various aspects of the assessee's financials and compliance with tax laws.

This Form requires the assessee/auditor to specify the details related to TDS and TCS compliance.

How to Report TDS/TCS Details in the tax audit?

The TDS/TCS details are required to be given in the tax audit report in below 4 sub-clause:

- Clause 21(b): Reporting of disallowance for non deduction of TDS.

- Clause 34(a): Reporting of TDS/TCS deduction or collection details.

- Clause 34(b): Reporting of TDS/TCS returns related details.

- Caluse 34(c) Reporting of TDS or TCS interest related details.

These sub-clauses aim to ensure that the TDS compliance is properly reported in the tax audit.

Clause 21(b): Reporting of disallowance for non deduction of TDS

The auditor to report any disallowance of expenses under Section 40(a)(i) or 40(a)(ia) for non-deduction or non-payment of TDS. The following points to be considered while reporting in Clause 21(b):

- For non-resident payees

- Reporting of expenses other than salary must be made in 21(b)(i)

- Reporting of salary needs to be made in clause 21(b)(vi) since no payment basis allowance is available in respect of the salary to non-resident.

- Unlike Clause 26(43B Reporting), Clause 21(b) focuses solely requires reporting of non-compliance. The subsequent payments and allowances (on payment basis) are directly reportable in ITR.

- The reporting is to be made for 100% of the expenses both in case of Residents and Non Residents.

- If the payee provides a Certificate in Form 26A from a Chartered Accountant that the income received by him on which TDS was not deducted, has been appropriately shown in the ITR and Tax has been paid accordingly, then the auditor does not need to report any adverse reporting of such payee in Form 3CD.

- Reporting made in Clause 21(b) shall be in consonance with Clause 34(a).

Clause 34(a): Reporting of TDS/TCS deduction or collection details

Under Clause 34(a), the auditor needs to confirm whether the assessee has deducted and deposited TDS on amounts liable for tax deduction. The following points to be considered while reporting in Clause 34(a):

- If no such payment has been made by the assessee which is TDS deductible, then selecr 'No' and the clause do not require any reporting.

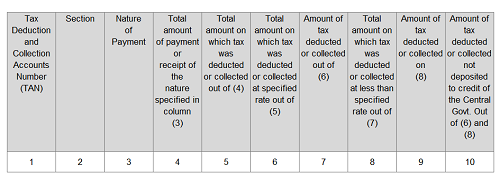

- If assessee has made such TDS deductible payments and deducted/not deducted or deposited/ not deposited TDS on the same, the reporting is required to be made in Clause 34(a) as under:

- Column (1), (2), (3) are general columns related to TAN, Section and Nature of Payment.

- Column (4) requires reporting of total amounts of nature of payment reported in column (3).

- Column (5) requires reporting of expenses which are subject to TDS or TCS.

- Column (6) requires reporting of amounts on which TDS/TCS was actually deducted/allowed by the assessee.

- Column (7) requires reporting of TDS/TCS deducted/collected in Column (6) amounts. The correct TDS/TCS compliance needs to be reported in Column (7)

- Column (8) requires reporting of expenses on which TDS/TCS deducted /collected at less than specified rate i.e., Non Compliance.

- Column (9) requires reporting of its TDS/TCS part.

- Column (10) requires reporting of taxes on which TDS/TCS deducted/collected but not deposited to the Government from Column (7) and Column (9).

Demands coming at TRACES portal shall be checked and incorporated in Clause 34(a).

Clause 34(b): Reporting of TDS/TCS returns related details

Clause 34(b) focuses on TDS return filing, where the auditor must report the due dates of returns filed by the assessee and confirm their accuracy.

The reporting under Clause 34(b) shall be in consonance with Clause 21(b) and Clause34(a).

The actual dates of filling of TDS/TCS returns can be taken from Traces/IT portal.

Clause 34(c) Reporting of TDS or TCS interest related details

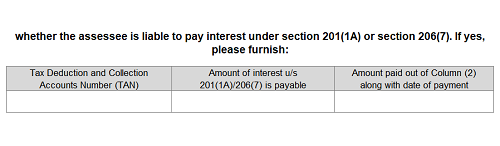

Clause 34(c) of Form 3CD requires reporting of interest related to TDS (Tax Deducted at Source) or TCS (Tax Collected at Source).

The reporting in column (2) needs to be made for ‘interest payable’ due to non/late deduction or non-payment of TDS/TCS. The same shall be calculated on the amounts reported in Clause 21(b) and Clause 34(a).

The amount of interest paid out of Column (2) must be reported in Column (3).

CAclubindia

CAclubindia