Question Paper Analysis and Feedback of Candidates on CA Final November 2019 Exams:

1st November 2019 marked the beginning of the CA Final November 2019 attempt. After every exam, we collected question papers of both old and new courses and sent them for expert analysis. We have also curated feedback of candidates who appeared in November 2019 Exams. In this article, you will find subject wise question papers, expert analysis, and students' feedbackfor CA Final(Old and New) November 2019 Exam.

|

Date |

CA Final New |

CA Final Old |

|

1/11/2019 |

Financial Reporting |

Financial Reporting |

|

3/11/2019 |

SFM |

SFM |

|

5/11/2019 |

Advanced Auditing and Professional Ethics |

Advanced Auditing and Professional Ethics |

|

7/11/2019 |

Corporate and Economic Laws |

Corporate and Allied Laws |

|

9/11/2019 |

Strategic Cost Management and Performance Evaluation |

Advanced Management Accounting |

|

13/11/2019 |

Elective Paper Download |

Information Systems Control and Audit |

|

15/11/2019 |

Direct Tax Laws and International Taxation Download |

Direct Tax Laws |

|

17/11/2019 |

Indirect Tax Laws Download |

Indirect Tax Laws |

Paper 1- Financial Reporting (Old Course):

Paper Analysis by CA Sumit Sarda:

To give you a brief overview: the difficulty level of the question paper was moderate. It was neither very easy nor very difficult. However, all the questions that were asked in the exam were from ICAIs module. You can easily find all these questions in Study Material, Practice Manuals, RTPs or MTPs issued by the institute. This attempt paper was certainly easier than the one that was framed in the previous attempt i.e. May 2019.

View the detailed analysis here:

Financial Reporting (New Course)

Paper Analysis by CA Rahul Malkan:

Chapter wise break-up of Marks:

1. IND AS 102 - Share based payment: 8 marks

2. IND AS 103 - Business combination: 16 marks

3. IND AS 105 - Non current Assets held for sale & discontinued operations: 10 marks

4. IND AS 113 - Fair Value measurement: 8 marks

5. IND AS 115 - Revenue from contract with customer: 12 marks

6. IND AS 10 - Events after reporting period: 8 marks

7. IND AS 16 - Property, Plant and Equipment: 8 marks

8. IND AS 20 - Government Grants: 4 marks

9. IND AS 21 - Effects of changes in Foreign Exchange transactions: 4 marks

10. IND AS 23 - Borrowing Cost: 8 marks

11. IND AS 32/107/109 - Financial Instruments: 14 marks

12. IND AS 38 - Intangible Assets: 8 marks

13. Analysis of Financial Statements: 12 marks

2. Question wise marks and comments:

1-A: IND AS 103 Lovely question. Worthy of being at Question 1. All major provision of the standard are covered up- 16 marks

1-B: IND AS 20 Basic knowledge of IND AS 20 would be enough to solve this question.- 4 marks

2-A: IND AS 32 Highly expected question. The concept is repeated in past papers. Students would have been looking forward to this question- 10 marks

2-C: IND AS 105 Right from study Material. 10 Marks are too much for this question- 10 marks

3-A: IND AS 102 Again a basic question. An sure no student might have missed this one- 8 marks

3-B: IND AS 23 IPCC level question - ICAI should have avoided this. Rather they have tested other standard- 8 marks

3-C: IND AS 21 Hahaha ! Lovely googly - Basic fundamental Question. Love surprises. Am happy- 4 marks

4-A: IND AS 115 Lovely question. Knowledge of Previous standard on construction contract is needed. Great level. More questions like this please- 4 marks

4-B: IND AS 38 Basic question. Similar to once covered in study material- 8 marks

5-A: Analysis of Financial Statement Really expected. Should have been avoided. Rather a 12 marker on IND AS 110 was needed. - 12 marks

5-B: IND AS 16 Basic - Just knowledge of basic provision of IND AS 16 is needed- 8 marks

6-A: IND AS 10 Good question that covers all aspects of Standard. After Question 1 on IND AS 103 - I like this question - 8 marks

6-B: IND AS 113 Surprised to see IND AS 113 for 8 marks. Loot LO - 8 marks

6-C: IND AS 109 Again basic concept of 109 is needed.- 4 marks

To watch detailed analysis here.- By CA Sumit Sarda

Feedback of Candidates:

To participate in discussions related to exam click here.

Paper 2- SFM (New Course)

Paper Analysis by CA Rahul Malkan:

1. Chapter-wise break up:

|

Sr no |

Chapter |

Marks |

|

1 |

Financial Strategy |

4 marks |

|

2 |

Security Analysis |

8 marks |

|

3 |

Security Valuation |

8 marks |

|

4 |

Mergers and Acquisition |

8 marks |

|

5 |

Mutual Funds |

10 marks |

|

6 |

Forex |

8 marks |

|

7 |

Futures |

22 marks |

|

8 |

Portfolio |

16 marks |

|

9 |

International Capital Budgeting |

12 marks |

|

10 |

Business Valuation |

8 marks |

|

11 |

Startup and Finance |

8 marks |

|

12 |

Securitization |

4 marks |

|

13 |

Value at Risk |

4 marks |

Given below is the question wise break up of marks:

1-A. 8 marks Mergers and Acquisition:

A very basic Question with basic calculations - Question to jump on and score full

1-B. 8 Marks Derivatives - FRA

A repeat question - Why should we repeat the past paper question - Students will love this one too.

1-C. 4 Marks Start up Finance - Theory

A question right from the text book - makes me feel like we are giving some college paper

2-A. 10 Marks Mutual Funds A repeat question

Why should we repeat the past paper question - Am sure students would have fallen in love with this paper by now.

2-B. 6 Marks Derivatives - Futures

A question based on Cost of carry model. For me 6 marks are a bit high for this question.

2-C. 4 Marks Securitization - Theory

A question right from the text book

3-A. 8 Marks Derivatives

Option A good Question - We need little bit of thinking on this question.

3-B. 8 Marks Security Analysis

Why!! to repeat ? Its CA final for god. Everyone would have by hearted this question an sure of that. Le LO 8 Mark.

3-C. 4 Marks Start up - Theory Last question on start up

Again from text book.

4-A. 8 Marks Security Valuation

Would say it's a good question - Students will have to work it out with some common sense.

4-B. 8 Marks Forex

Surprisingly forex was low on this paper and even this question is a repeat. Every class and prof would have done this in class

4-C. 4 Marks VAR

Very basic question. Anyways there is not much to do in VAR.

5-A. 8 Marks Portfolio

Have we not seen this question being repeated at least 5 times in past. Stop it NOW.

5-B. 8 Marks International Capital Budgeting

Happy to see the question where students will have to read it more than twice and will have to put thinking hat on. Every mark is worth. This should have been in Compulsory List.

5-C. 4 marks Financial Strategy - Theory

Right from study material. Even I can answer this.

6-A. 8 Marks Portfolio

Second question from this chapter. We could have avoided this and put another question from forex instead.

6-B. 8 Marks Business valuation

Good question. Knowledge of 2 stage model is needed and also some good reading for proper interpretation.

6-C. 4 Marks Securitization / International Capital Budgeting - Theory

Again from study Material

Feedback of Candidates:

To participate in discussions related to exam click here.

Advance Auditing Question Paper:

Expert Analysis of CA Final Audit New Course Paper (Nov 19) by CA Ravi Taori:

Hello everyone CA Ravi Taori here, as a professor its very important that to understand source of each and every question which was asked in exams. So we analyze it with lot of efforts and go to very base of each and every question, we take good time in analysing it. We can tell exactly how many times particular question was repeated in ICAI publications, what was page number of study material from where new questions were asked.

Nov 19 CA Final Audit exam paper was a cakewalk by all means; it was much much simpler than May 19 exams. Below are the highlights of the paper.

- 47 marks out of 84 (56%) marks in descriptive questions were from recent MTPs & RTPs (4 attempts)

- 39 marks out of 84 (46%) marks in descriptive questions were from OLD course practice manual

- 14 marks out of 84 (17%) marks in descriptive questions were from recent Past Papers (4 attempts)

- 14 marks out of 84 (17%) i.e is only 3 questions marks in descriptive questions were outside PM, Recent RTPs / MTPs / Past Papers out of these 1 was super easy, Question of Risk Assessment was from page 3.12 and Question of Tax Audit was from page 12.26 of module. So 70 marks i.e whooping 83% from PM + Recent ICAI publications.

- 37 marks out of 84 (44%) marks in descriptive questions were from chapters other than SAs / Professional Ethics / Company Audit & CARO

- 14 marks out of 84 (17%) marks in descriptive questions were from Company Audit

- 10 marks out of 84 (12%) marks in descriptive questions were from Professional Ethics

- 84 marks out of 84 (100%) were from our Question Bank PARAM &Regular Notes

- Not a single question can be termed as difficult 50% paper was easy and 50% of medium level

- 24 marks out of 85 (28%) were from 2019 MTPs & RTPs

So overall conclusion, ICAI said lets give good pitch for scoring marks. Students following our strategy would have cracked exams extremely well. We focused on understanding and memory techniques and our question bank covered all questions from PM / RTPs / MTPs / Past Papers of 7 attempts, each and every question had a shortcut. Follow us on social media handles to know more about audit and how to crack it. All the best for upcoming exams.

Feedback of Candidates:

To participate in discussions related to exam click here.

Paper 4- Corporate and Allied laws:

Expert Analysis:

Will be updated Soon

Candidates Feedback:

To participate in discussions related to exam click here.

Paper 5- AMA:

Expert Analysis:

Will be updated Soon

Candidates Feedback:

Will be updated Soon

Paper 6- Information System Control and Audit:

Expert Analysis by Prof. Jignesh Chheda:

Level of the examination was not very difficult. Can be referred to as of moderate difficulty. My general analysis of the examination is as follows:

• ONLY total 3 mark question were asked from very important chapter like chap 5(SDLC)

• Same only 1 question were asked from chap 7

• By looking at paper pattern if any one have omitted chap8 than also he/she could have been survived as 3 questions were asked from chap 8 and all 3 questions were in Q-6.

• All the questions were covered in the classes thoroughly.

• Some questions were repeated from recent past papers.

• Mostly known question were asked in exam.

Going question by question, following can be analyzed about the exam :

|

CHAP 1 |

CHAP 2 |

CHAP 3 |

CHAP 4 |

CHAP 5 |

CHAP 6 |

CHAP 7 |

CHAP 8 |

TOTAL |

|||

|

Q-1 |

6 |

5 |

3 |

14 |

|||||||

|

Q-2 |

6 |

5 |

3 |

14 |

|||||||

|

Q-3 |

6 |

3 |

5 |

14 |

|||||||

|

Q-4 |

6 |

5 |

3 |

14 |

|||||||

|

Q-5 |

3 |

5 |

6 |

14 |

|||||||

|

Q-6 |

6 |

8 |

14 |

||||||||

|

OR |

|||||||||||

|

3 |

|||||||||||

|

TOTAL |

15 |

15 |

15 |

9 |

3 |

16 |

3 |

8 |

84 |

||

|

PLUS OPTIONAL 3MARKS |

|||||||||||

Candidates Feedback:

Will be updated Soon

Paper 7- Direct Tax Laws:

Expert Analysis:

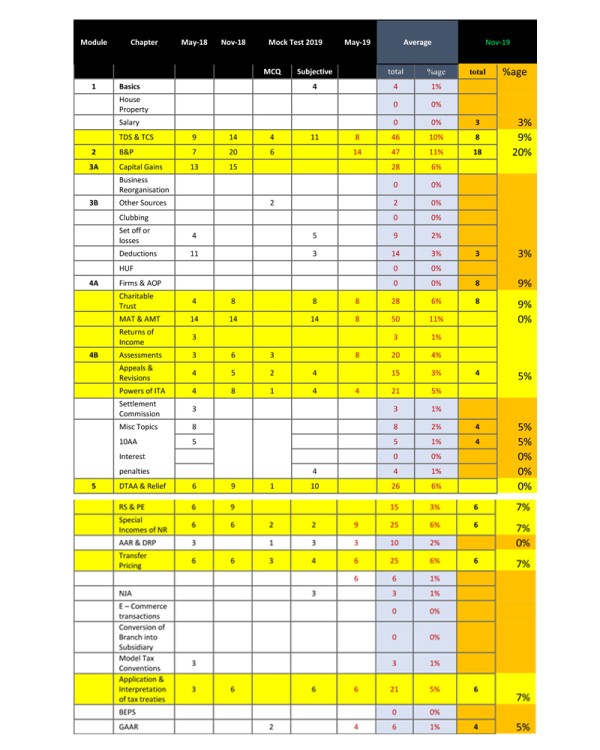

Nov 2019 DT paper (Old): An analysis and coverage by CA Arvind Tuli

The syllabus of DT is very vast and the trick to scoring well is the last day revision of all the course. Thus before the exams I always release the SET's [Special emphasis topics] for that attempt, which in my perspective will cover 80% of the paper. As I firmly believe in smart study to score maximum marks along with conceptual clarity.

a) Past trend and comparative coverage in Nov 2019

The trick is in being able to target the paper smartly as well. We had given an analysis of the topics covered in the exams and mock tests from the previous 3 attempts before the exams

Nov 19: Point wise sections covered and related coverage from topic in the notes

My view on the paper:

• As can be seen there is a 65% paper from topics marked in yellow and this can help in scoring marks

• The paper was relatively straight forward without too many unexpected questions

The Paper is always going to be relatively the same level after all its the CA Final direct tax paper. I always say the Indian chartered accountant exams are the toughest in the world , more so because of the competition , we have with so many brilliant students appearing in one attempt. Having said that this, in my view, this was a relatively simpler paper with more or less standard points raised.

I have always advocated the mastering of the 3 - Presentation , Timing & Concepts [PTC] to ensure success in the course. Thus If you had an in depth understanding of the concepts and had presented the paper with working notes to maximise marks and had completed the paper then the chances are that you will pass.

I will share a story of two students which I always tell in class

Anuradha: who after the paper came to me telling me that she cannot pass as she had only attempted 74 marks of the paper. She had written in detail all the working notes and was sure that whatever she had attempted, she had attempted well

Ankit: one of the best students I have had and could understand and grasp the concepts of taxation better than most. He had attempted the entire paper and completed it before time (almost one hour to spare) and had written most answers in short (totally correct but without explaining the reasons),was sure he is going to get an exemption.

The result - Anuradha got 64 and Ankit scored 32.

Knowing the subject and scoring marks are totally different and one must understand the marking scheme and examination pattern to be able to score marks and that's what I lay stress on. We are enclosing the scanned images of the paper with comments for your appraisal.

To know detailed question by question analysis of the paper: Click Here

To enroll Direct Tax Laws (CA Final) subject of the author: Click Here

To view / download question paper on Direct Tax Laws (CA Final) subject: Click Here

Nov 2019 DT paper (new): An analysis and coverage by CA Arvind Tuli

The syllabus of DT is very vast and the trick to scoring well is the last day revision of all the course. Thus before the exams I always release the SET's [Special emphasis topics] for that attempt, which in my perspective will cover 80% of the paper. As I firmly believe in smart study to score maximum marks along with conceptual clarity.

a) Past trend and comparative coverage in Nov 2019

The trick is in being able to target the paper smartly as well. We had given an analysis of the topics covered in the exams and mock tests from the previous 3 attempts before the exams

Nov 19: Point wise sections covered and related coverage from topic in the notes

My view on the paper:

• As can be seen there is a 80% paper from topics marked in yellow and this can help in scoring marks as these are the topics we tell a student to lay stress on.

• The paper was a tricky paper with some unexpected questions mainly from smaller topics

• The framing of the questions was in a manner to simulate practical situations and thus checking the ability of a student to think and not just answer the questions from memory

The Paper is always going to be relatively difficult after all its the CA Final direct tax paper. I always say the Indian chartered accountant exams are the toughest in the world , more so because of the competition , we have with so many brilliant students appearing in one attempt. Having said that this, in my view, this was a relatively simpler paper with more or less standard points raised.

I have always advocated the mastering of the 3 - Presentation, Timing & Concepts [PTC] to ensure success in the course. Thus If you had an in depth understanding of the concepts and had presented the paper with working notes to maximize marks and had completed the paper then the chances are that you will pass.

I will share a story of two students which I always tell in class

Anuradha: who after the paper came to me telling me that she cannot pass as she had only attempted 74 marks of the paper. She had written in detail all the working notes and was sure that whatever she had attempted, she had attempted well

Ankit: one of the best students I have had and could understand and grasp the concepts of taxation better than most. He had attempted the entire paper and completed it before time (almost one hour to spare) and had written most answers in short (totally correct but without explaining the reasons),was sure he is going to get an exemption.

The result - Anuradha got 64 and Ankit scored 32.

Knowing the subject and scoring marks are totally different and one must understand the marking scheme and examination pattern to be able to score marks and that's what I lay stress on. We are enclosing the scanned images of the paper with comments for your appraisal

To know detailed question by question analysis of the paper: Click Here

To enroll CA Final DT New subject of the author: Click Here

To view / download question paper on CA Final DT New: Click Here

Candidates Feedback:

Paper 8- Indirect Tax:

Expert Analysis:

Will be updated Soon

Candidates Feedback:

To download all question papers of CA Final Nov'19 (Old / New) Syllabus - Click here

CAclubindia

CAclubindia