Financial Instruments are valued either at amortised cost or at fair value. Fair value valuation could be either by fair value through Profit and Loss or Fair value Through Other Comprehensive Income; the latter could be transferred on de-recognition either to Profit and Loss or to other equity depending on various Business Models.

In Indian dispensation, so long, we have adopted cost basis. Cost is a fact as against amortised cost which is real and realistic. Interest under Indian Diaspora is what is earned or incurred that is factual. But, in Ind.AS regime, it is calculated by Effective Rate of Interest that is not only real but also realistic. This approach is the kingpin of IFRS in substance and compliance.

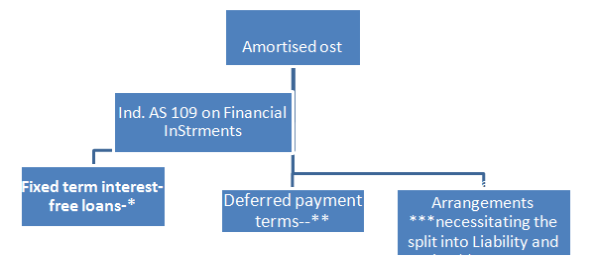

Amortised cost is profusely dealt with In Ind.AS 109 on “Financial Instruments” and in fact, it is the fulcrum and to be precise the live –wire and sheet- anchor to provide a lay out procedure to calculate amortised cost so as to converge with IFRS approach that has significant impact in various dispensations coming under the disciplines of relevant Ind. ASs, where certain instruments are coming within the ambit of amortised cost that is handled a little later in this article. The following diagram maps out the flow of amortised cost through three dimensions under the umbrella of Ind.AS 109 on ‘Financial instruments’.

*The fixed term loans at below market rate could be normally between holding and subsidiaries on either way; also covers interest free loans or at concessional rate by government; includes similarly interest free loans or at concessional rate by employers to their employees etc.,. Financial instruments at a discount or at premium, as the case may be with adjusted interest offered could be in the notch computing amortised cost

**Differed payment loans normally cover the sale/purchase of goods or services on differed payment terms.

***Arrangements necessitating the split into liability and equity under Ind.AS 32 on ‘Financial Instruments: Presentation’ where liability segment is coming under the slot of Ind. AS 109 on ‘Financial Instruments’. Since the same has been handled in another article under ‘Forum’ by the author, it is not handled for brevity.

What is amortized cost?

Amortised cost is the amount at which the carrying amount is measured after reckoning plus or minus cumulative amortisation Effective Interest Rate (EIR) takes care of bonds purchased or issued at discount/ premium; the applicable rate of interest as compared to market rate, bonds with market equity eligibility etc.,

Initial measurement: Cash received less transaction costs associated with issue .Subsequent measurement: Amortised cost using effective interest method= opening liability + finance cost (based on effective interest) – cash paid (based on coupon rate)

To which Financial Asset Amortised cost applicable?

Financial assets held: (a) to collect contractual cash flows and (b)they represent the financial asset of cash flows that are solely payments of principal and interest on the principal amount outstanding(SPPI) ---are measured initially at fair value and subsequently at amortised cost (4.1.2)(Refer 4.1.2 of Ind. AS 109).

Loans bearing a market rate of interest vis a vis with transaction costs have been incurred or premiums/discounts have been paid/received:

Loans bearing a market rate of interest will therefore be recognised at the initial value exchanged (i.e. the amount of the cash lent or received) including transaction costs.

Loans that meet the conditions of a basic debt instrument set out in paragraph 4.1.2 of Ind.AS.109 are measured at amortised cost after initial recognition.

In an unambiguous language, if no transaction costs have been incurred or premiums/discounts have been paid or received, for loans bearing a market rate of interest, the effective interest rate is equal to the market rate of interest at the date of initial recognition. In other words, it is not expected that accounting differences will arise in respect of loans bearing a market rate of interest when transitioning to Ind.AS regime.

For borrowers, the loan is recognised initially at the amount of the net proceeds, which in most cases would be the amount borrowed .Finance costs are defined as the difference between the net proceeds and the total payments. The difference between the cash received and the present value of the loan is recognised as interest expense over the period of the loan using the effective interest method.

For lenders, when a transaction constitutes, in effect, a financing transaction, the financial asset shall be measured at the present value of the future payments discounted at a market rate of interest for a similar debt instrument. The difference between the cash loaned and the present value of the loan is recognised as interest income using the effective interest method.

Example:

PRS Ltd buys 100 bonds of RS 1000 each at RS 900 per bond at 5% interest. PRS derives an effective interest rate of 8.95%. Using this ERI,PRS creates the following amortization table for the bond discount:

|

|

|

(B) |

|

(D) |

|

|

1 |

90000 |

5000 |

8100 |

3100 |

93100 |

|

2 |

93100 |

5000 |

8300 |

3300 |

96400 |

|

3 |

96400 |

1,05,000 |

8600 |

3600 |

1,00000 |

Journal Entries to be passed

|

Year |

Journal entries |

First year RS |

Second year |

Third Year |

|

1 |

Cash Held To Maturity investment Interest income |

DR 5000 DR 3100 CR 8100 |

DR 5000 DR 3300 CR 8300 |

DR 5000 DR 3600 CR 8600 |

Fixed term interest-free loans between a parent and its subsidiary&vies- versa:

Loans between parents and their subsidiaries are more often than not extended on interest-free terms for reason presumably that the parent owns and controls its subsidiary. As a result, fixed term interest free-loan between holding and subsidiary company consists, in substance, of two components:

-- One -a loan at a market rate of interest and the other a benefit or contribution to the borrower. In such a situation the first component, that is, the loan made at a market rate of interest, is determined by calculating the present value of the future payments discounted at a market rate of interest of a similar loan.

-- Second component, that is, the gift or contribution to the borrower, is the measurement difference which is accounted for as a capital contribution or distribution. The accounting is demonstrated in the numerical examples below.

A parent provides a fixed term interest-free loan of RS.1, 000 to its subsidiary. The present value of the loan using a market rate of interest for a similar loan is Rs.900. The difference of CU100 represents an additional investment by the parent in the subsidiary. The parent would record the following accounting entries in its individual financial statements:

|

Entries by holding Co., RS. |

Entries by subsidiary Co., RS |

|

Loan receivable from subsidiary Dr.900 Investment in subsidiary Dr. 100 CashCr.1,000 |

Cash Dr. 1000 Loan repayable to parent Cr. 900 Capital contribution (equity) Cr. 100 |

If the subsidiary extends loan to holding company on similar terms and circumstances, the following accounting entries will flow:

|

Entries by subsidiary Co., RS. |

Entries by holding Co., RS. |

|

Loan receivable from parent Dr.900 Distribution to parent (equity) Dr.100 Cash Cr. 1000 |

Cash Dr.1,000 Loan repayable to subsidiary Cr.900 Distribution received from subsidiary Cr.100 (profit or loss) |

Fixed term interest-free loans Ind. As. 20 on ‘Accounting of Government Grants and Disclosers of Govt. Assistance’:

Para 10A of the above Ind.AS under the sub head ‘Government Grant’ speaks the language of amortised cost The benefit of a government loan at a below-market rate of interest is treated as a government grant. The loan shall be recognised and measured in accordance with Ind. AS 109, Financial Instruments. The benefit of the below market rate of interest shall be measured as the difference between the initial carrying value of the loan determined in accordance with Ind. AS 109, and the proceeds received. The benefit is accounted for in accordance with this Standard. The entity shall consider the conditions and obligations that have been, or must be, met when identifying the costs for which the benefit of the loan is intended to compensate.

In other words, as per Ind.AS 20 on ‘Accounting of Government Grants and Disclosers of Govt. Assistance’, the benefit derived below market rate is to be accounted as government grant--- measured between initial carrying amount of the loan determined as per Ind. AS and the actual amount received. Very often interest Free Sale Tax payment concessions are extended on specific situations and payable after appointed dates as prescribed—may come under amortised cost.

The difference between the initial fair value of the loan and the proceeds received is Government grant to be recognized in accordance with Ind. AS 20. Going forward, the loan is measured at amortized cost using EROI.

In practical terms, when the loan is received, if no terms are prescribed as to how the loan is to be utilised, then the following entry will be passed:

|

RS |

|

Bank A/c — Dr. 1, 00,000 Interest-free tax loan (discounted to the present value) —Cr. 90,000; Grant from the government (taken to equity) — Cr. 10,000 |

Fixed term interest-free loans to Employees:

Ind. AS 19 is conspicuous by silence on this. Staff is stuff and to retain the stuff, one of the strategies of the management is to extend soft loan to employees with concessional below market rate of interest. If the benefit is extended, how to handle the loan is matter of practical approach? - Amortised cost may step in. The entries for the loan may depend on the recovery pattern of the loan -whether the concessional loan will continue even after parting or cease at that point of time. The amortisation approach varies from the difference between amortised cost and loan paid may be written off and to the difference will sit on Prepaid until is written off over the period with amortised cost arrived for each reporting period. There could be a better option depending on the nature and extent of loan. A lot of study may be required to decide the accounting treatment. Somebody can throw some light.

How entries flow on Concessional/interest free loans and subsequent Entries for the above said Loans?

The accounting entries are not suggested in black and white in the said Ind. ASs but these are financial instruments- assets/ liabilities coming under the discipline of Ind. AS 109 on ‘Financial Instrument’. But, the flows of entries are taken the roots of the intention and substance of the relevant Ind. ASs so as to move in the correct route appropriate to the relevant Ind.AS. Therefore, correct understanding of the concerned Ind. ASs and proper judgment thereon will stitch the entries that suit the occasion and purpose.

Subsequently, every year the imputed interest cost will be provided in the profit and loss (P&L) account for the year as an expense with the corresponding credit, over the years finally winding back the loan amount to what would be the repayable amount (the amount that was received originally).

Simultaneously, an appropriate amount will be transferred from equity to the P&L account depending upon the relevant Ind. AS which will have the effect of negating the interest cost in the P&L account.

Other Ind. ASs having ramification of Amortised Cost and Effective Rate of Interest:

Adverting back to the third paragraph on other Ind. ASs where there are references of amortised cost and effective rate of interestwhen the inflow of cash or cash equivalents is deferred; let us handle with the relevant Ind. ASs one by one as follows:

Ind.AS.11, on ‘Construction Contracts’ (Exposure Draft);

Para 24 of Appendix A on Service Concession Arrangements of the above Ind.AS reads as follows:

The amount due from or at the direction of the grantor is accounted for in accordance with Ind. AS 109 at: (a) amortised cost; (b) fair value through other comprehensive income; or (c) fair value through profit or loss.

Para 25: If the amount due from the grantor is measured at amortised cost or fair value through other comprehensive income, Ind. AS 109 requires interest calculated using the effective interest method to be recognised in profit or loss.

Ind. AS.18 on ‘Revenue’(Exposure Draft):

What about the sale of goods or services on differed payment terms?

When goods or services are sold on credit, the arrangement has in substance two components, firstly the sale of the goods or services and secondly a financing element. The two components are accounted for separately. When the arrangement is a financing transaction, that is, when the payment for goods or services is deferred beyond normal business terms or the sale is financed at a below market rate of interest, the trade debtor and trade creditor are measured at the present value of the cash flows receivable or payable discounted at the market rate of interest for a similar receivable orpayable. In practice, an entity may use the current cash selling price for the goods or services sold on an arm’s length basis as an estimate for the present value of the future payments. However, if there is no cash sale alternative or the cash selling price is the same as the price when buying on credit, the entity must calculate the present value of the future cash flows. For the purchaser (borrower), the difference between the fair value and the amount to be paid is the finance cost, to be allocated to periods over the term of the debt at a constant rate on the carrying amount. For seller of the goods/services on extended credit terms (lender),the difference between the invoiced amount and the present value of the future payments is recognised as interest expense over the credit term using the effective rate

Refer Para IA and Par 11, Para 29 of the Ind. AS 18 on ‘Revenue’.

Measurement of Common Debt instruments:

- Overdraft is generally repayable on demand.I n Cash Flow Statement, Bank Overdraft to be netted against cash and cash equivalents if it forms an integral part of the entities cash management. In fact, it is a loan arrangement under which the bank extend credit up to a maximum amount (overdraft limit) against which the customer can write cheques or make withdrawals. B.O.D is a type of borrowing & interest charged on daily basis. It is sort of demand loan, any time can be demanded by the lender at his discretion. If a creditor has the right to demand repayment at any time, the borrower measures the liability at the undiscounted amount of cash repayable. So also, it is so, for the entity that avails of overdraft facility. Hence, a standard bank overdraft repayable on demand would be measured at the principal amount of the overdraft.

- So also, in the same logic, standard current accounts that can be drawn/ operated by issue of cheques are measured at the principal amount of the current accounts.

What about Fixed deposit with bankers?

Some entities are presenting fixed deposits with bankers under ‘cash and cash equivalents’ even when placed for more than one year for possible reason they can be broken at any point of time without loss of principal, though suffers loss of interest . Further these deposits are at market rates. Hence, may be bracketed liability at the undiscounted amount.

What about Current trade debtors (receivables) and trade creditors (payables)?

‘Trade receivables’ in accounting terminology branded as ‘debtors’. And trade payables, in accounting lingo is called as ‘creditors’—these are recognised at the transaction price, which in most cases is the invoiced amount-- Receivables and Payables due within one year and continue to be measured after their initial recognition at the undiscounted amount. Therefore in most situations short term receivables and payables are measured at their invoiced amount until they are settled or otherwise extinguished (unless the arrangement is a financing transaction as dealt with earlier).

Indian Accounting Standard (Ind. AS) 16 on Property, Plant and Equipment

According to Para.23, the cost of an item of property, plant and equipment is the cash price equivalent at the recognition date. If payment is deferred beyond normal credit terms, the difference between the cash price equivalent and the total payment is recognised as interest over the period of credit unless such interest is capitalised in accordance with Ind. AS 23.

Indian Accounting Standard (Ind.AS) 33 Earnings per Share

As per Par 6 of Ind. AS - 33, paragraph 15 has been amended by adding the phrase, ‘irrespective of whether such discount or premium is debited or credited to securities premium account in view of requirements of any law’ to further clarify that such discount or premium shall also be amortised to retained earnings.

Para 15 Preference shares that provide for a low initial dividend to compensate an entity for selling the preference shares at a discount, or an above-market dividend in later periods to compensate investors for purchasing preference shares at a premium, are sometimes referred to as increasing rate preference shares. Any original issue discount or premium on increasing rate preference shares is amortised to retained earnings using the effective interest method and treated as a preference dividend for the purposes of calculating earnings per share (irrespective of whether such discount or premium is debited or credited to securities premium account in view of requirements of any law).

Conclusion:

To be honest, the author has no real practical experience under IFRS Regime on the layout of Amortised Cost sewed on Effective rate of Interest that measures the carrying amount after reckoning plus or minus cumulative amortisation. Transition to Ind.AS regime is still in the horizon unleashing ‘pleasure and pressure’ to go through and experience. A deep study, search and re research culminating in a sort of research has emboldened me to attempt this article. The sum-up, Ind.AS 109 on ‘Financial Instrument’ is not only the route for amortised cost but also has spread its wings across various Ind. ASs spilling their nuances to frame the roots that facilitate flow of appropriate accounting entries to the relevant Ind. ASs as has been explained earlier. If anybody wants to throw some more light on the subject, it is highly welcome. “Let noble thoughts come from every side” to reach the goal with confidences.

Challenges at door step: The above treatments in accounts may create a haywire in facing Income tax department with respect to interest and related TDS since the treatment is dissimilar to the accounting of interest under amortised cost- Income tax is concerned with interest earned, paid or accrual basis as against the EROI that will rule the roost under amortised cost regime of Ind. AS. Preference shares and Convertible Debentures may also pose some problems from their side. Since sales and purchase on credit may alter the their book figures dancing to the tunes of amortised cost requirements, the companies may have to cope-up with proper and up to date reconciliations to deal with sales tax assessments. Trial period is waiting to face squarely. Let us arise, awake and stop not till our goal is reached.

CAclubindia

CAclubindia