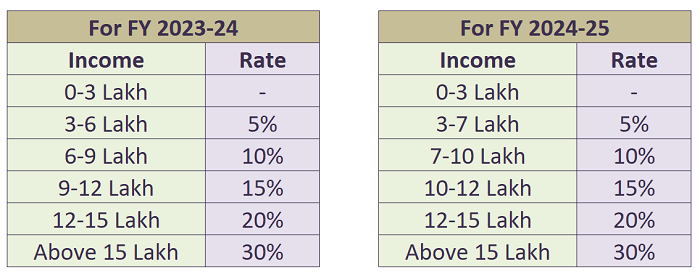

Change in Income Tax Slab under New Tax Regime

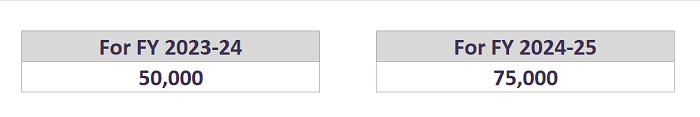

Standard Deduction

Standard deduction for a salaried employee under the new tax regime will increase:

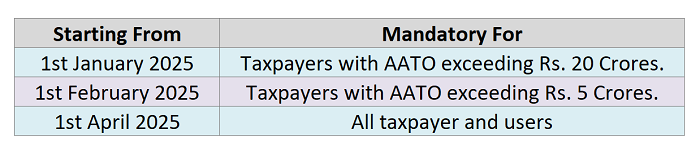

Mandatory Multi-Factor Authentication (MFA)

Taxpayers are required to activate MFA immediately and ensure that their registered mobile numbers are updated with GSTIN to avoid last-minute issues.

New Limit for E-Way Bill Generation

From 1st January 2025, E-way bills can only be generated for documents dated within 180 days of generation. For example, documents dated before 7th July 2024, will not be eligible for E-way bill generation after 3rd January 2025.

Extension of E-Way Bill

The extension will be limited to 360 days from their original date of generation.

Claiming Credit for TCS of Minor in the Hands of Parents

From 1st January 2025, parents can claim the TCS on funds remitted under the Liberalized Remittance Scheme (LRS) for minors.

Previously, TCS was collected under Section 206C(1G) but there was no provision for parents to claim it in their returns.

But now, parents will be eligible to adjust the TCS paid on their minor child's remittances against their tax liability when filing their Income Tax Return.

TCS on Luxury Goods Exceeding Rs.10 Lakh

To track luxury goods expenses and expand the tax base, a proposal has been made to amend Section 206C(1F) of the Income Tax Act.

This amendment would levy TCS on any goods valued over Rs. 10 lakh, as may be notified by the Central Government.

These goods will typically be categorized as luxury items.

The specific goods subject to TCS will be notified by the government in the future.

This change aims to target high net worth individuals' expenditure on luxury goods.

CAclubindia

CAclubindia