Tax reforms play a critical role in economic policy and can greatly influence the financial stability of individuals and families. The middle class is often regarded as the backbone of society and is especially sensitive to changes in tax policy. This article examines the intricate relationship between tax reforms and the middle class, focusing on how recent policy changes have affected their financial situations.

Some of the points have been listed below:

1. Direct Tax Vivad Se Vishwas Scheme 2024

The Union Government announced the second edition of the Vivad Se Vishwas Scheme (VSV 2.0 or DTVSV, 2024) which will become operational from 1st October 2024. The rules and forms for the scheme have been notified in Notification No. 104/2024 in G.S.R 584(E) dated 20.09.2024.

Vivad Se Vishwas Scheme 1.0 which was launched in 2020, gained a massive response from taxpayers at resolving tax disputes. This scheme would allow to settle tax related disputes for cases which are pending before appellate authorities, High Court, Supreme Court, Dispute Resolution Panel and revised applications filed before Income Tax Commissioner.

This new edition will also help taxpayers to settle their tax disputes and appeals efficiently within the limited time window.

Rules for –

- New Appellants: Lower settlement amounts for those filing after July 22, 2024

- Old Appellants: Standard settlement amounts for those with pending appeals as of July 22, 2024

The last date to avail of the scheme is December 31, 2024.

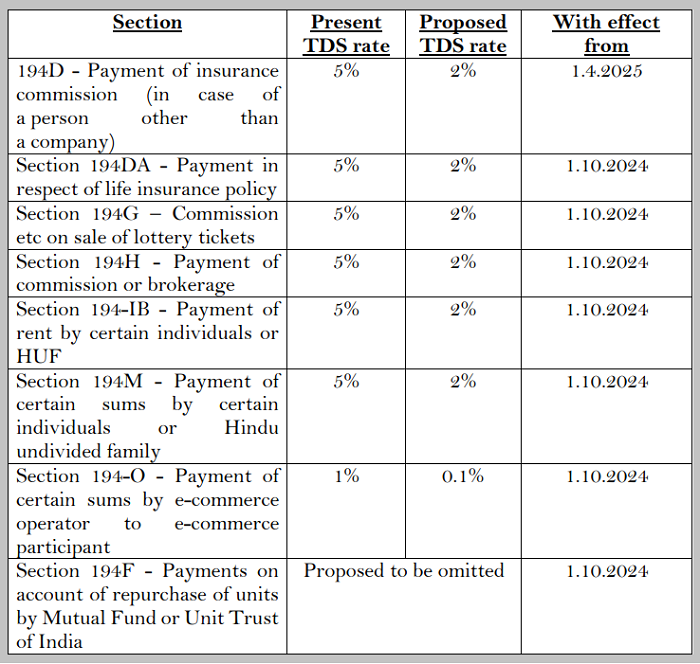

2. Revised TDS Rates

TDS rates have been reduced for certain sections –

3. Abolition of Angel Tax

The Union Budget for 2024-25 provided substantial relief to the Indian startup ecosystem by abolishing the "angel tax." This tax, previously outlined in Section 56(2)(viib) of the Income Tax Act of 1961, imposed a 30% tax on the share premium that unlisted companies received above their fair market value.

The Impact of Abolishing Angel Tax:

- Boost Startup Funding

- Enhanced Global Competitiveness

- Fostering Innovation

- Valuation Challenges

- Regulatory Oversight

4. Higher Securities Transaction Tax (STT)

As per the Budget 2024, the Securities Transaction Tax (STT) has been increased on futures and options (F&O) trading.

Currently, STT on delivery trades in equity shares is at 0.1% on both purchase and sale transactions and STT on the sale of an option in securities where the option is exercised is at 0.125% of the intrinsic price.

STT rates for -

The sale of an option in securities will be increased from 0.0625% of the option premium to 0.1% of the option premium.

The sale of a future in securities will be increased from 0.0125% of the price at which such futures are traded to 0.02% of the price at which such futures are traded.

5. TDS on Floating Rate Bonds

Section 193 of the Income Tax Act, 1961 – Deduction of tax at source on payment of any income to a resident by way of interest on securities

Applicable TDS rate – 10% on the income earned on Floating Rate Bonds

Exemptions – No TDS will be deducted if the total income earned from these bonds in a financial year is less than ₹10,000.

Applicable on – Floating Rate Savings Bonds (FRSB) 2020 (Taxable) & Any security of Central & State Government

Impact - Assessees earning over ₹10,000 from these bonds will face increased tax liability, leading to a reduction in net return.

6. RCM on Commercial Rent

According to the 54th GST Council Meeting, GST will be applied to renting commercial properties owned by unregistered individuals to registered persons through the Reverse Charge Mechanism (RCM).

Previously, renting commercial property by a registered person to a registered/unregistered person was liable to GST under the forward charge mechanism and renting commercial property by an unregistered person to a registered/unregistered person was not liable to GST.

As per Notification No. 09/2024-Integrated Tax (Rate) dated 8th October 2024, RCM shall be applicable to services by way of renting any property other than a residential dwelling provided by any unregistered person to any registered person.

GST is calculated at 18% (9% CGST & 9% SGST) in case of intra-state supply and 18% IGST in case of inter-state supply of services. GST shall be calculated on the taxable value.

This notification shall come into force from October 10, 2024.

7. GST on food delivery charges

The Directorate General of GST Intelligence (DGGI) has issued notices to the major aggregators in the food delivery industry, Zomato and Swiggy, seeking GST of Rs. 750 crore (Rs 400 crore from Zomato and Rs 350 crore from Swiggy) for the period between July 2017 and March 2023 questioning the classification of delivery charges along with their food delivery and their applicable GST rate.

The government official also stated that food delivery services are subject to an 18% tax. Since platforms like Swiggy and Zomato are collecting a service fee, they are required to pay this tax.

If the government imposes 18% GST on delivery charges from these platform operators, it will lead to an excessive tax burden on customers and the delivery platforms. This will also affect other delivery operators and mid-range hotels that use these food delivery platforms.

8. New Tax Regime

The Indian government has recently introduced a new tax regime that allows taxpayers to choose between the old and the new systems. The new tax regime is designed to simplify the tax structure and offer lower tax rates for many individuals.

The new tax regime in India provides various benefits, especially for individuals with lower to moderate incomes and fewer investments or deductions to claim.

The advantages are given below:

- Flexibility to Choose

- Increased Standard Deduction

- Lower Tax Rates

- Simplified Tax Structure

The tax reforms have both positive and negative effects on the middle class,such as reduced compliance burden, effective tax rates, impact of GST, reduced exemptions, lower tax rates etc.

The overall impact of tax reforms on middle class families varies based on several factors, including their income level, investment habits, and the specific deductions and exemptions they claim.

While some reforms have offered direct benefits, others have had mixed outcomes or could even have negative effects

CAclubindia

CAclubindia