Calendar of the Events :

- MCA on 15th February 2018, came out with draft of Companies (Beneficial Interest and Significant Beneficial Interest) Rules 2018.

- On June 14, 2018, MCA issued the Companies (Beneficial Interest and Significant Beneficial Interest) Rules 2018 and enforced section 90 of the Amendment Act.

- On Feb 8, 2019, MCA has notified the revised rules on SBO.

Who is the Significant Beneficial Owner?

In relation to a reporting company means an individual referred to in sub-section (1) of section 90, who acting alone or together, or through one or more persons or trust, possesses one or more of the following rights or entitlements in such reporting company, namely:

- Holds more than 10% of shares or

- Holds more than 10% of the voting rights in shares or

- Participate in more than 10% of total distributive dividend

- Exercise significant influence or control, other than direct holdings

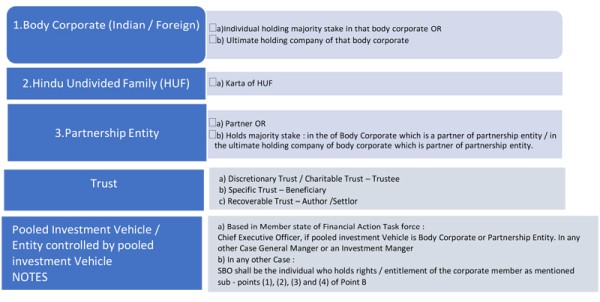

When an individual shall be considered to hold a right or entitlement indirectly in the reporting company :

Meaning of the specific terms :

1. Majority Stake :

- holding more than 50% of the equity share capital in the body corporate or

- holding more than 50% of the voting rights in the body corporate or

- having the right to receive or participant in more than 50% of the distributable dividend or any other distributions by the body corporate

2. Together i.e. Person Acting in Concert :

- If any individual or individual acting through any person or trust, act with common intent or significant influence or exercising control or purpose of exercising any rights or entitlement.

- Over Reporting Company, pursuant to an agreement or understanding, than such individual or individuals, acting through any person or trust, shall be deemed to be 'acting person'

3. Shares :

- Shares include : Equity shares, GDR, ADR, CCP, CCD

Rules not applicable to the extent the shares of the reporting company is held by :

- IEPF Authority

- It's holding reporting company (however the details of such holding company shall be reported in BEN-2 by subsidiary or wholly owned subsidiary.

- The central government, state government, or any other local authority

- a reporting company, or a body corporate, or an entity, controlled by the Central Government or by any State Government or Governments, or partly by the Central Government and partly by one or more State Governments;

- SEBI registered Investment Vehicles such as mutual funds, alternative investment funds (AIF), Real Estate Investment Trusts (REITs), Infrastructure Investment Trust regulated by the Securities and Exchange Board of India,

- Investment Vehicles regulated by Reserve Bank of India, or Insurance Regulatory and Development Authority of India, or Pension Fund Regulatory and Development Authority

Declaration of SBO

- SBO is required to file a declaration in Form No. BEN-1 to the reporting company, within 90 days from 08th February 2019.

- Every individual, who subsequently becomes a SBO or where his SBO undergoes any change shall file a declaration in Form No. BEN-1to the reporting company, within thirty days of acquiring such significant beneficial ownership or any change therein.

- Clarification regarding the individual becoming SBO or any change therein during the 90 days from 08th February 2019. It shall be deemed that such individual became the significant beneficial owner or any change therein happened on the date of expiry of ninety days from the date of commencement of said rules, and the period of thirty days for filing will be reckoned accordingly.

STEPS TO BE COMPLIED BY THE REPORTING COMPANY

STEP-1 : The Company should check whether any member is Non-Individual and holding more than 10% of shares, voting rights, right to receive or participate in the dividend or any other distribution payable in a financial year in the company.

STEP -2 : Sending notices to the Non-Individual members in Form No. BEN-4 seeking information to furnish the Significant Beneficial Owner of the shares.

STEP-3 : Receiving the duly filled FORM No. BEN-4 from the Non-Individual members who is holding more than 10% of the shares in the company . [Timeline - Within 30 days of date of notice in Form No. BEN-4]

STEP-4 : Receiving Form No. BEN-1 from the Significant Beneficial Owner : [Timeline - Within 90 days from the commencement of these rules (i.e. 09.05.2019)]

STEP-5 : Filing of E-form No. BEN-2 with ROC by the Company. [Timeline - Within 30 days from the date of receipt of declaration in Form No. BEN-1 from the SBO]

STEP-6 : Maintaining Register in Form No. BEN-3

ILLUSTRATIONS

General Assumptions :

H1, H2, etc are the Holding Companies

R is the Reporting/Targer Companies

RH is the Reporting Holding companies

I1, I2,etc are the Individuals

F1, F2, etc are the foreign body corporate.

1. Case -1 : Direct holding need not be declared.

a) I1 ----holding 20% in ----- R

As per the Explanation I of Rule 2 (1) (h), unless there is any indirect holdings, there is no need to declare SBO. Further, as per Explanation II, point - 1, the shares held by I1 in his own name in the R is to be considered as Direct holding.

[SBO declaration not required].

b) I1 ---- holding 10% in ------ H1 --- holding 15% in ------ R

I1 has already made declaration under sub section 2 of section 89.

As per the Explanation I of Rule 2 (1) (h), unless there is any indirect holdings, there is no need to declare SBO. Further, as per Explanation II, point - 2, if the I1 declares his holding or beneficial interest in the R under section 89 (2) then such holding or interest shall be considered as Direct holding.

[SBO declaration not required].

c) I1 ---- holding 5% in -----R

I2 --- holding 7% in -----R

As per the Explanation I of Rule 2 (1) (h), unless there is any indirect holdings, there is no need to declare SBO. I1 and I2 are the Person Acting together, and their holding is more than 10%. However, in the interpretation of Explanation I, no need disclosure required.

[SBO declaration not required].

2. Case-2 : Indirect holding declaration

I1 ---- holding 60% in ------ H1 --- holding 15% in ------ R

As per the Explanation I of Rule 2 (1) (h), unless there is any indirect holdings, there is no need to declare SBO. The Indirect holding of I1 is greater than 10% in R. (i.e. the entire 15% holding of H1 in R shall be considered as significant influence of I1 in the R).

[SBO declaration required].

a) I1 ----- holding 20% in ----- R

I1 ----- holding 60% in ------ H1 ----- holding 2% in ----- R

As per the Explanation I of Rule 2 (1) (h), unless there is any indirect holdings, there is no need to declare SBO. Here, the indirect holding of I1 along with the direct and indirect holding is greater than 10% (i.e. 20 % + 2% = 22%)

[SBO declaration required].

b) I1 ---- holding 10% in ------ H1 --- holding 15% in ------ R

I1 ---- holding 20% in ------H2 ----holding 5 % in ------R

I1 has already made his declaration of his holdings / interest in H1 under sub section 2 of section 89. - Considered as Direct Holding

However, he has not declared his holdings / interest in H2 - Considered as Indirect Holding

As per the Explanation I of Rule 2 (1) (h), unless there is any indirect holdings, there is no need to declare SBO. Further, as per Explanation II, point - 2, if the I1 declares his holding or beneficial interest in the R under section 89 (2) then such holding or interest shall be considered as Direct holding.

Here, the indirect holding of I1 along with the direct and indirect holding is greater than 10% (i.e. 15 % + 5% = 20%)

[SBO declaration required].

c) I1 ----- holding 7% in ---- R

HUF (I1 is the Karta) ---- holding 8% in ----- R

As per Explanation III (ii) of Rule 2 (1) ( h),the shares held by HUF are considered as indirect holding of the Karta. Here, the Indirect holding of I1 along with the direct holding is greater than 10 % (i.e. 7% + 8% = 15).

[SBO declaration is required].

d) I1 (Minor) ----- holding 8% in ---- R

HUF (I2 is the Karta ) ---- holding 3% in ----- R

(Note: I1 is the minor member and I2 is the karta of HUF)

I1 and I2 being the members of same HUF, deemed to be considered as person acting together.

I2 is the Karta of HUF, therefore he is having indirect holding in R. The indirect of I2 along with the direct holding of I1 is greater than 10%. Therefore the direct holding of I1 and indirect holding of I2 need to be declared.

[SBO declaration is required].

e) I1 ----holding 2% in R

I1 ---- holding 55% in ------ H3 ----- holding 70% in ------H2 ----- holding 70% in ----- H1 ------ holding 9% in R.

I1 is having direct holding of 2% in R.

Further, I1 is holding the majority stake in the ultimate holding Company (i.e. H3), hence the entire holding of H1 in the R shall be attributed to I1.

The indirect holding of I1 along with the direct holding is greater than 10% (i.e. 9% + 2% = 11%)

[SBO declaration is required].

f) H1 ---- holding 30% in ------ R (I1 ---- holding 55% in ------ H1)

H2 ----- holding 30% in ----- R

H3 ----- holding 30% in ----- R

1 is having the majority stake H1. The entire holding of H1 will be considered of I1. And that holding is more than 10%.

[SBO declaration is required].

g) H1 ---- holding 20% in ----- R

I1, I2, I3, holding 25%, 20%, 30%, respectively in ----- H1.

Here, I1, I2, I3, are deemed to be person acting together, hence their shareholding will be clubbed. They hold the majority shares in H1 (i.e. 75%). Hence, the declaration of SBO is required by I1, I2, I3 in H1.

FAQ on BEN-2

1. Purpose of filing the form : When to select the radio button 'for declaration of holding reporting company' ?

Ans: When the Subsidiary or the Wholly Owned Subsidiary company files the SBO.

The SBO for subsidiary or wholly owned subsidiary will be the same SBO which was declared by the ultimate holding / holding company.

2. What is the Number of Significant Beneficial Owners for whom the form is being filed ?

Ans : The individuals or person acting together, taking into consideration the indirect control along with the direct control in the reporting company, are to be considered as SBO.

Example : In case 2, (point d), there are 2 SBO. One is Minor holding directly, and second is Karta holding indirectly with the Minor.

3. Which is the date to be mentioned in the ' date of acquiring Significant Beneficial Interest' ?

Ans : The concept of SBO came on 8th February 2019, when the revised rules were notified. Hence the date shall be mentioned as '08th February 2019'.

4. Which is the date to be mentioned in the 'date of declaration under sub-section (1) of section 90.

Ans: The date when the individual declared as SBO in BEN-1 form.

5. When there are more than 2 SBO, do we need to take out ratio of each individual as per his holding in the member or reporting company?

Ans: No need to take out ratio. The entire stake of the member in the reporting company shall be considered as percentage which each SBO is holding.

Further, the additional attachment shall be give in BEN-2 clarifying that the entire holding of member in reporting company is attributed to all the SBO collectively and not divided among them.

6. Is Section -8 Company is a specific trust ?

Ans: Section -8 Companies are incorporated with the specific intent, but they are not trust as they are incorporated under the Companies Act 2013 or erstwhile.

7. What to do if there are more than 9 SBO ?

Ans: Either the Company can file the additional attachment in BEN-2 stating the additional SBO which a reporting company have or else can file another BEN-2 for the remaining SBOs'.

8. What does the share comprise of ?

Ans: The shares comprise of equity shares, CCD, CCP, GDR, ADR.

9. Is the Preference share part of share ?

Ans: No. The preference share is not part of the equity shares, as the preference shareholder does not have any voting right or does not influence the reporting company.

10. If there has been change in the holding of SBO, do we require to file to two BEN-2?

Ans: Yes. Initial BEN-2 shall be filed as on date of 08th Feb 2019, i.e. the holding of SBO as on 08thfeb 2019, shall be disclosed when filing initial BEN-2 form.

Further, if there was any change in the holding of SBO, then the new BEN-2 shall be filed for the SBO against the ID generated by initial BEN-2 form.

11. If the holding company or ultimate holding company is not filing BEN-2 return, then does the subsidiary or wholly owned subsidiary company requires to file BEN-2 return.

Ans: Subsidiary or Wholly owned subsidiary shall file the same SBO which is filed by the holding / ultimate holding company. In such case it would be because the holding reporting company had not identified any SBO; but simultaneously if the subsidiary company or Wholly owned subsidiary company identifies the SBO, then such company shall file the BEN-2, by selecting radio button second 'For declaration of Significant Beneficial Ownership under Section 90' of the Form.

12. If there are two individual (husband and wife) holding equal percentage of the stake (i.e. 50% is hold by each individual) in the member of reporting company, then do we need to consider such individuals as SBO?

Ans: In the Spirit of Law: Yes. They are person acting together and collectively their holding is 100%. Hence they are holding the majority stake as per the Explanation III (I) of Rule 2 (1) (h).

13. Is it mandatory to consider the relatives as 'person acting together ' to calculate the majority stake or significant influence.

Ans: The law talks about the actual control exercised by the individual acting alone or together indirectly.

The concept of deemed person acting together is provided under the SEBI (SAST) regulations. Here, the Law talks about actual control, hence mere on prima facie of blood relations, individuals can't be stated as person acting together. There may be the instances where though the individuals are connected through blood relationship, but their decisions and controls are not influenced by each other. And no one can challenge the same.But however, one has to always the interpret the provisions in the spirit of Law.

14. Are Subsidiary and Wholly Owned Subsidiary are exempted from filing BEN-2 ?

Ans: No. As per the rule 8 of SBO rules, the subsidiary or wholly owned subsidiary companies need to file BEN-2 by selecting the first radio button i.e. 'For declaration of holding reporting company'.

CAclubindia

CAclubindia