Event Industry being the small industry are equally affected by the introduction of GST a new indirect tax regime. GST has opened the new credit areas to the event industry leading to the reduction in the event cost, on the other hand, it has brought some challenges to the industry in the form of additional compliances burden in terms of additional record maintenance and return filing and so on.

Flawless input tax credit is the basic mantra of GST. However, after going through the input tax credit related provisions in the act and the ground realities, it seems we are missing from the basic mantra of the GST.

For claiming the input tax credit following are the basic criteria and documentation requirement:

- Invoice in accordance with the provisions of section 31

- Debit Note in accordance with the provision of section 34

- Bill of Entry as per the Customs Act, 1962

- Invoice as per the rules 7(1)

Conditions for claiming the input tax credit:

- Tax Invoice or debit note.

- Goods and services must have been received

- Tax Must be paid to the government

- Filing of GST return

GST Credit shall not be allowed in respect of the following:

- motor vehicles and other conveyances

- food and beverages, outdoor catering, beauty treatment, health services, cosmetic and plastic surgery

- Works contract services when supplied for construction of an immovable property

- goods or services or both received by a taxable person for construction of an immovable property

- GST Paid on invoices where service provider opting for composition levy.

- Goods or services or both received by a non-resident

- Goods or services or both used for personal consumption

- Goods lost, stolen, destroyed, written off or disposed of by way of gift or free samples

- Any tax paid in accordance with the provisions of sections 74 (Determination of tax not paid or short paid or erroneously refunded or input tax credit wrongly availed or utilised by reason of fraud or any wilful misstatement or suppression of facts.), 129 (Detention, seizure and release of goods and conveyances in transit) and 130 (Confiscation of goods or conveyances and levy of penalty.)

All the above limitation are very common in the event industry and the situation remains same as it was in the earlier indirect tax regime. However, the challenge of segregating and disallowing the inadmissible input tax credit brings the additional compliance burden on the event management companies.

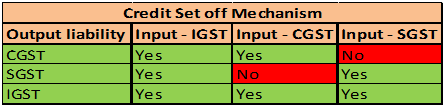

Following are the credit setoff mechanism:

As we have three types of taxes in the GST regime, payment of each type of tax involves taking the input credit of some other tax component. Following are the GST input credit setoff mechanism:

Above table clearly shows that the output CGST cannot be paid by utilizing the input SGST or vice versa, even within the state.

GST Credit vis-à-vis place of registration vis-à-vis palace of service

GST being the consumption-based taxation, the state where goods are consumed or service is provided is going to get the tax and place of supply are of vital importance in this regard. For the whole event industry, this becomes tough nuts to crack in terms of availing the input tax credit or absorbing the tax component as cost. The following table shows the credit admissibility of tax as credit and cost:

The above table clearly shows that the event companies are at a disadvantages position if they are not registered in the state of an event as they may be losing the business to the local event management companies due to increased cost on account non-availability of input tax credit.

In order to avail the credit event company need to register itself in the state of the event. However additional registration brings additional compliance burden on account of separate record maintenance return filing etc.

Conclusion:

From the above it is clear that the GST has widened the input tax credit umbrella to the event management companies,on the other hand it has also brings new challenges in the form of additional compliance and return filing and other areas.

In order to avail the maximum GST benefit, the companies must analyses each and every event carefully and take the decision. Like each event is new the decision considering the GST impact can also be different for each event.

CAclubindia

CAclubindia