(A Quick Compliance Commitment)

(Short summary of GST forms, returns, due date with extension, late filling with interest & penalty, recent updates of GST council meetings and a quick guidance for filling returns)

Introduction-

France was the first country to implement GST in the year 1954 within 62 years of its invent about 160 countries across the world adopted GST.

Goods and service tax is a single indirect tax levied on the supply of goods and services from the manufacturer to the consumer. Input tax credits paid at each stage will be made available in the following stage of value addition. GST is basically a tax levied on value addition at each stage. Therefore, the consumer has to pay only the GST charged by the last dealer or supplier in the supply chain.

All individuals registered under the GST Act have to furnish the details of the sales and purchases of goods and services along with the tax collected and paid. This can be done by filing online returns. GST Returns are the Goods and Services Tax Return forms that taxpayers of all types have to file with the income tax authorities of India under the new GST rules.

Implementation of a comprehensive Indirect Tax system like GST in India will ensure that taxpayer services such as registration, returns, and compliance are transparent and straightforward. Individual taxpayers are using forms for filing their returns such as the return for supplies, return for purchases, monthly returns, and annual return. Small taxpayers who have opted for composition scheme have to file quarterly returns. All filing of returns are online.

Goods and Services Tax (GST) Forms for Registration & Cancellation

|

Sr. No |

Form Number |

Description |

|

1. |

REG-1 |

Registration Application u/s 19(1) GST Act, 20 |

|

2. |

REG-2 |

Acknowledgement |

|

3. |

REG-3 |

Information regarding Registration / Amendments / Cancellation Notice |

|

4. |

REG-4 |

Filing application for clarification Registration / Amendment / Cancellation / Revocation of Cancellation |

|

5. |

REG-5 |

Order application for rejection for Registration / Amendment / Cancellation / Revocation of Cancellation |

|

6. |

REG-6 |

Issued registration certificate u/s 19(8A) of the GST Act, 20 |

|

7. |

REG-7 |

Application for Registration as TDS or TCS u/s 19(1) of the GST Act, 20 |

|

8. |

REG-8 |

Order of Cancellation of Application for Registration as TDS /TCS u/s 21 of the GST Act |

|

9. |

REG-9 |

Non-Resident Taxable Person Application for Registration |

|

10. |

REG-10 |

Person supplying online information and database access or retrieval services from a place outside India to a person in India, other than a registered person Application for registration |

|

11. |

REG-11 |

Amendment in Particulars subsequent to Registration Application |

|

12. |

REG-12 |

Temporary Registration/ Suo Moto Registration Order of Grant |

|

13. |

REG-13 |

Grant of Unique Identity Number (UIN) to UN Bodies/ Embassies /others Application/Form |

|

14. |

REG-14 |

Application for Cancellation of Registration under GST 20 |

|

15. |

REG-15 |

Amendment Order |

|

16. |

REG-16 |

Cancellation of Registration Application |

|

17. |

REG-17 |

Cancellation of Registration Show Cause Notice |

|

18. |

REG-18 |

Show Cause Notice issued for Cancellation Reply |

|

19. |

REG-19 |

Cancellation of Registration Order |

|

20. |

REG-20 |

Dropping the proceedings for cancellation of registration Order |

|

21. |

REG-21 |

Revocation of Cancellation of Registration Application |

|

22. |

REG-22 |

Order for revocation of cancellation of registration |

|

23. |

REG-23 |

Show Cause Notice for rejection of application for revocation of cancellation of registration |

|

24. |

REG-24 |

Reply to the notice for rejection of application for revocation of cancellation of registration |

|

25. |

REG-25 |

Provisional Registration Certificate |

|

26. |

REG-26 |

Existing Taxpayer Application Enrolment |

|

27 |

REG-27 |

|

|

28 |

REG-28 |

Provisional registration Order Cancellation |

|

29. |

REG-29 |

Provisional registration Application cancellation |

|

30 |

REG-30 |

Field Visit Report Form |

Due dates for All GST Returns

These returns are as per the GST Act:-

|

Return Form |

By Whom |

Particulars |

Frequency |

Due Date |

|

GSTR-1 |

Regular Dealer |

Details of outward supplies of taxable goods and/or services effected |

Monthly |

10th of the next month |

|

GSTR-2 |

Regular Dealer |

Details of inward supplies of taxable goods and/or services effected claiming input tax credit. |

Monthly |

15th of the next month |

|

GSTR-3 |

Regular Dealer |

Monthly return on the basis of finalization of details of outward supplies and inward supplies along with the payment of amount of tax. |

Monthly |

20th of the next month |

|

GSTR-3B |

Regular Dealer |

Simple return for Jul 2017- Mar 2018 |

Monthly |

20th of the next month |

|

GSTR-4 |

Composite Tax Payer |

Return for compounding taxable person |

Quarterly |

18th of the month succeeding quarter |

|

GSTR-5 |

Foreign Non-Resident Taxpayer |

Furnish details of imports, outward supplies, ITC availed, tax paid, and closing stock |

Monthly |

20th of the next month |

|

GSTR-6 |

Input Service Distributor |

Furnish the details of input credit distributed |

Monthly |

13th of the next month |

|

GSTR-7 |

Return for authorities deducting tax at source. |

Furnish the details of TDS deducted |

Monthly |

10th of the next month |

|

GSTR-8 |

E-commerce |

Details of supplies effected through e-commerce operator and the amount of tax collected on supplies |

Monthly |

10th of the next month |

|

GSTR-9 |

Regular Dealer |

Annual Return |

Annually |

31st December of next financial year |

|

GSTR-9A |

Composite Tax Payer |

Annual Return |

Monthly |

31st December of next financial year |

|

GSTR-10 |

For taxable person whose registration has been surrendered or cancelled |

Final Return |

Once. When registration is cancelled or surrendered |

Within three months of the date of cancellation or date of cancellation order, whichever is later |

|

GSTR-11 |

Specialized agency of the United Nations Organisation or any multilateral Financial Institution and notified United Nations Bodies, Consulate or Embassy of foreign countries |

Details of inward supplies to be furnished by a person having UIN and claiming refund |

Monthly |

28th of the month following the month for which statement is filed |

Late filing

Return filing is mandatory under GST. Even if there is no transaction, you must file a nil return.

- You cannot file a return if you don’t file previous month/quarter’s return.

- Hence, late filing of GST return will have a cascading effect leading to heavy fines and penalty.

Late fee & Interest

- Interest is 18% per annum. It has to be calculated by the tax payer on the amount of outstanding tax to be paid. Time period will be from the next day of filing to the date of payment.

- Late fee is Rs. 100 per day per Act. So it is 100 under CGST & 100 under SGST. Total will be Rs. 200/day. Maximum is Rs. 5,000. There is no late fee on IGST.

- For delayed filing of NIL returns, late fee reduced from Rs 200 per day to Rs 20 per day.

- Late fees for GSTR-3B of July, Aug and Sept waived. Any late fees paid for these months will be credited back in Electronic Cash Ledger under ‘Tax’ and can be utilized to make GST payments.

Some other important forms:

|

Sr. No |

Form Number |

Description |

|

1. |

TRP-1 |

Application for enrolment as Tax return preparer |

|

2. |

TRP-2 |

Enrolment certificate as Tax return preparer |

|

3. |

TRP-3 |

Show cause to as Tax return preparer |

|

4. |

TRP-4 |

Order of cancelling enrolment as Tax return preparer |

|

5. |

TRP-5 |

List of Tax return preparers |

|

6. |

TRP-6 |

Consent of taxable person to Tax return preparer |

|

7. |

TRP-7 |

Withdrawal of authorization to tax return preparer |

|

8. |

9A |

Audit Report |

|

9. |

ITC-1A |

ITC Mismatch Report |

Goods and Services Tax (GST) Forms for Composition

|

Sr. No |

Form Number |

Description |

|

1. |

CMP-01 |

Notification for the payment of taxes under section 10 (composition scheme)

|

|

2. |

CMP-02 |

Notification for the payment of taxes under section 10 (composition scheme)

|

|

3. |

CMP-03 |

Notification of stock details from the date of opting composition scheme |

|

4. |

CMP-04 |

Notification/ Application to opt out from the composition scheme |

|

5. |

CMP-04 |

Notification of denial option for the payment of tax under composition scheme |

|

6. |

CMP-06 |

Responding to the notification to show cause |

|

7. |

CMP-07 |

Reply order to accept or reject concerning show cause notice |

Goods and Services Tax (GST) Forms for Challan

|

Sr. No |

Form Number |

Description |

|

1. |

PMT-1 |

Electronic Liability Register of registered person (Part–I: Return related liabilities)

|

|

2. |

PMT-2 |

Electronic Credit Ledger |

|

3. |

PMT-3 |

Order for re-credit of the amount to cash or credit ledger on rejection of refund claim |

|

4. |

PMT-4 |

Application for intimation of discrepancy in Electronic Credit Ledger/Cash Ledger/Liability Register |

|

5. |

PMT-5 |

Electronic Cash Ledger |

|

6. |

PMT-6 |

Challan For Deposit of Goods and Services Tax |

|

7. |

PMT-7 |

Application for intimating discrepancy in making payment |

Goods and Services Tax (GST) Refund Forms (Centre)

|

Sr. No |

Form Number |

Description |

|

1. |

RFD-1 |

Refund Application form |

|

2. |

RFD-2 |

Acknowledgement |

|

3. |

RFD-3 |

Notice of Deficiency on Application for Refund |

|

4. |

RFD-4 |

Provisional Refund Sanction Order |

|

5. |

RFD-5 |

Refund Sanction/Rejection Order |

|

6. |

RFD-6 |

Order for Complete adjustment of claimed Refund |

|

7. |

RFD-7 |

Show cause notice for reject of refund application |

|

8. |

RFD-8 |

Payment Advice |

|

9. |

RFD-9 |

Order for Interest on delayed refunds |

|

10. |

RFD-10 |

Refund application form for Embassy/International Organizations |

Goods and Services Tax (GST) Refund Forms (State)

|

Sr. No |

Form Number |

Description |

|

1. |

RFD-04 |

Provisional Refund Order |

|

2. |

RFD-05 |

Refund Sanction/Rejection Order |

|

3. |

RFD-06 |

Order for Complete adjustment of claimed Refund |

|

4. |

RFD-08 |

Payment Advice |

|

5. |

RFD-09 |

Order for Interest on delayed Refunds |

Changes Made in GST Council Meeting 6th Oct 2017

1-Registration Limit in GST is 20 lacs for Both Local and Interstate Sales

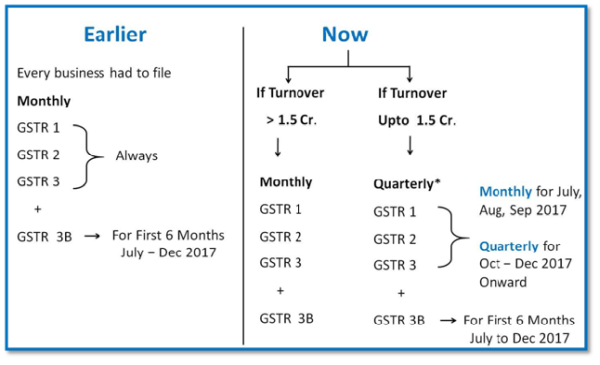

2- File Quarterly GST Returns 1, 2, 3

3- Composition Dealer Turnover Limit Raised

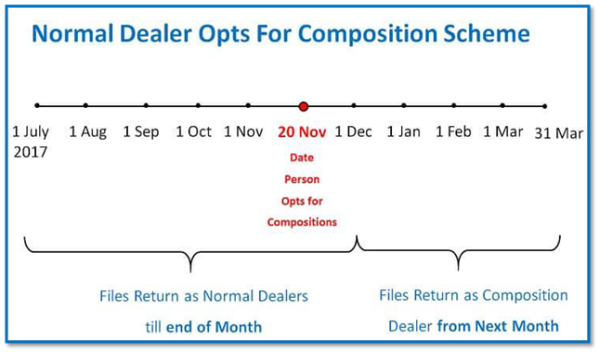

4-Option to Avail Composition Scheme

Example-Normal Dealer opts for Composition Scheme by 20 Nov 2017 He will file Composition Dealer Return and Tax starting from 1 Dec 2017.

5- Reverse Charge to Unregistered Dealer suspended till 31.3.2018

6- No GST on Advance Received for Small Business

7- Other Changes

1. E-WAY BILL Concept of E-Way Bill to be Introduced in Staggered Manner starting from 1 Jan 2018 There will be different dates for its launch in different states In Whole of India, it will be launched by 1 April 2018

2. TDS TCS IN GST TDS TCS in GST will also be differed to 1 April 2018

Latest Update:-

23rd GST Council Meet on 10th November 2017

- GSTR-3B has been extended to March 2018

- All businesses to file GSTR-3B by 20th of next month till March 2018.

- All businesses to file GSTR-1 and GSTR-3B till March 2018.

- GSTR-2 and GSTR-3filing dates for July 2017 to March 2018 will be worked out later by a Committee of Officers

- Turnover under Rs 1.5 Cr to file quarterly GSTR-1

- Turnover above Rs 1.5 Cr to file monthly GSTR-1

GSTR-1 due dates

For turnover up to Rs 1.5 crore

|

Period (Quarterly) |

Due dates |

|

July- Sept |

31st Dec 2017 |

|

Oct- Dec |

15th Feb 2018 |

|

Jan- Mar |

30th April 2018 |

For turnover of more than Rs 1.5 crore

|

Period |

Dates |

|

July to Oct |

31st Dec 2017 |

|

Nov |

10th Jan 2018 |

|

Dec |

10th Feb 2018 |

|

Jan |

10th Mar 2018 |

|

Feb |

10th Apr 2018 |

|

March |

10th May 2018 |

Timelines for filing of GSTR-2 and GSTR-3 for July to March 2018 to be worked out by Committee of Officers. However, subsequent month filing of GSTR-1 will not be impacted.

Others GSTR filing extensions

|

Return |

Revised Due Date |

Old Due Date |

|

GSTR-5 (for Non Resident) |

15th Dec 2017 |

Earlier of 20th August 2017 or 7 days from date of registration |

|

GSTR-4 (for Composition Dealers) |

24th Dec 2017 |

18th October 2017 |

|

GSTR-6 (for Input Service Distributor) |

31st Dec 2017 |

13th August 2017 |

Due dates of filing GSTR-3B

|

Month |

Last Date for filing GSTR-3B |

|

August 2017 |

20th September 2017 |

|

September 2017 |

20th October 2017 |

|

October 2017 |

20th November 2017 |

|

November 2017 |

20th December 2017 |

|

December 2017 |

20th January 2018 |

|

January 2018 |

20th February 2018 |

|

February 2018 |

20th March 2018 |

|

March 2018 |

20th April 2018 |

Tax liability of GSTR-3B must be paid by the last date of filing for that month.

How to File GST Returns Online?

From manufacturers and suppliers to dealers and consumers, all taxpayers have to file their tax returns with the GST department every year. Under the new GST regime, filing tax returns has become automated. GST returns can be filed online using the software or apps provided by Goods and Service Tax Network (GSTN) which will auto-populate the details on each GSTR forms. Listed below are the steps for filing GST returns online:

- Visit the GST portal (www.gst.gov.in).

- A 15-digit GST identification number will be issued based on your state code and PAN number.

- Upload invoices on the GST portal or the software. An invoice reference number will be issued against each invoice.

- After uploading invoices, outward return, inward return, and cumulative monthly return have to be filed online. If there are any errors, you have the option to correct it and refill the returns.

- File the outward supply returns in GSTR-1 form through the information section at the GST Common Portal (GSTN) on or before 10th of the following month.

- Details of outward supplies furnished by the supplier will be made available in GSTR-2A to the recipient.

- Recipient has to verify, validate, and modify the details of outward supplies, and also file details of credit or debit notes.

- Recipient has to furnish the details of inward supplies of taxable goods and services in GSTR-2 form.

- The supplier can either accept or reject the modifications of the details of inward supplies made available by the recipient in GSTR-1A.

File GST return with GSTN

The Goods and Service Tax Network will store information of all GST registered sellers and buyers, combine the submitted details, and maintain registers for future reference. Companies have to file 3 monthly returns every 3 months and one annual return in a financial year (37 returns in total). GSTN has launched a simple excel based template to make filing of returns easier for businesses. This excel workbook can be downloaded from the GST common portal free of charge. Taxpayers can use this template to collate invoice data on a regular basis. The details of inward and outward supplies can be uploaded on the GST portal on or before the due date. The data preparation can be done offline. Only while uploading the prepared file on the GST portal will the taxpayer need Internet.

Source:Goods and service tax Act and GST council meeting reports

The author can also be reached at pawan.singh693@gmail.com

CAclubindia

CAclubindia