Why GST demand arise for taxpayers?

A GST demand arises when a taxpayer fails to pay their due taxes. It may happen due to:

- Non-payment of GST dues,

- Errors in tax filing,

- Incorrect Input Tax Credit (ITC) claims, or

- Suppression of taxable turnover.

What happens if the taxpayer fails to pay the GST demand?

If the taxpayer fails to pay the due amount within the specified timeline, recovery proceedings under Chapter XV of the GST Act are initiated.

How GST department can recover the unpaid dues?

Department uses multiple recovery methods u/s 79 of the GST Act to recover the unpaid dues.

Section 79 of the GST Act empowers tax authorities to recover the unpaid GST dues using methods by:

- Directly deducting unpaid amounts from refunds payable to the taxpayer.

- Attaching and selling movable or immovable properties.

- Recovering dues directly from third parties who owe money to the defaulter.

- Approaching a magistrate to recover dues as fines.

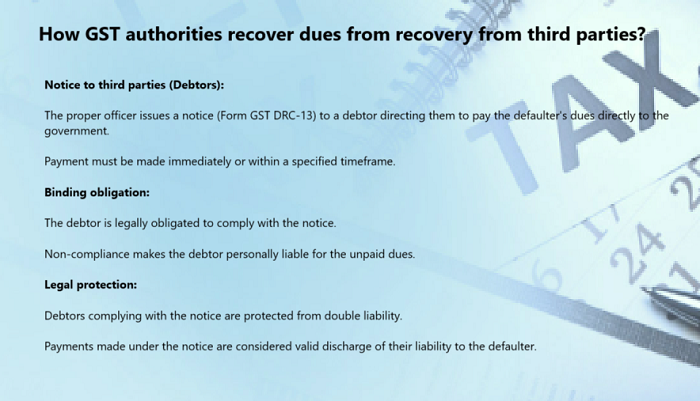

How do GST authorities recover dues from recovery from third parties?

Can the notice to the third party be revoked or amended?

Yes, the proper officer can amend, revoke, or extend the deadline for payment under the notice, based on changing circumstances.

What happens if the debtor pays the defaulter after receiving a notice?

If the debtor pays the defaulter instead of the government after receiving a notice:

- They become personally liable to the government.

- Their liability is limited to the lesser of the amount paid to the defaulter or the dues owed to the government.

Are there exemptions for third parties from liability?

Yes, a third party can claim exemption.

If the third party proves that no money was due or likely to become due to the defaulter, they are exempt from complying with the notice.

What are the relevant forms used for recovery from third parties?

Here, Rule 145 outlines the procedure for recovery from third parties:

Sub-rule (1):

Form GST DRC-13: Notice issued to the debtor for payment.

Sub-rule (2):

Form GST DRC-14: Certificate acknowledging the liability discharged by the debtor.

CAclubindia

CAclubindia