In our current online age, most financial transactions take place in a digital infrastructure, making data the lifeblood of the industry. The banking and finance sectors depend on systems for data processing and to deliver pivotal services to their clients. If any issue occurs online, it could spark negative outcomes, from data loss involving millions of customers to monetary losses, and so forth. Thus, having a solid fallback option becomes important as this gives assurance that the company can continue their usual operations.

In their quest to maintain uninterrupted service, fiscal organizations allocate resources to disaster recovery (DR) plans and mechanisms. DR consists of a set of policies, instruments, and methods designed for quick system reboot and restoration after a disruption-causing scenario. This strategy includes duplicating data, software applications, and settings at an alternate venue - often a reserve data hub or cloud storage - which then facilitates prompt system recovery should any mishap occur.

While having a comprehensive DR plan in place can be helpful, it is equally crucial to regularly test and validate the effectiveness of the plan through DR drills. DR drills, also known as disaster recovery exercises or simulations, are controlled exercises that simulate various disaster scenarios to evaluate the readiness and effectiveness of the DR plan.

Vaishali Bhaurao Nagpure, a seasoned IT professional with extensive experience in the financial sector, shares her insights and experiences into how DR drills play an important role in testing high availability in financial systems. She has successfully conducted an impressive number of DR drills for major finance organisations, marking her contribution to their resilience against unfavourable circumstances.

The primary objective of DR drills is to act as checks and balances, assessing the effectiveness of backup systems and recovery methods. In doing so, Vaishali has stretched her expertise across 1500+ remote branches, managing to maintain the flow of critical monetary operations without a glitch. Furthermore, she also conducted broad DR drills to establish data security and availability of services, along with effective VLAN segmentation. Her efforts have ensured constant access to 2 million+ records and smooth data transitions during system switches.

In a field like finance where time is money, any downtime equates to losses. Real-time transactions must be constantly catered to and customer service should minimally falter. Vaishali shares her experience of conducting DR drills for over 1500 branches of a leading financial institution. "Our objective was to achieve 99.9% uptime during both planned and unplanned outages," she recalls.

While conducting these exercises, she pinpointed and rectified potential system weaknesses thus lessening threats during actual crises. Also, she trained IT teams by training them to respond efficiently in various disaster scenarios which boosted team productivity by 30%. Apart from this, she also ensured compliance with all necessary regulatory standards, through comprehensive DR drill reports and readiness metrics.

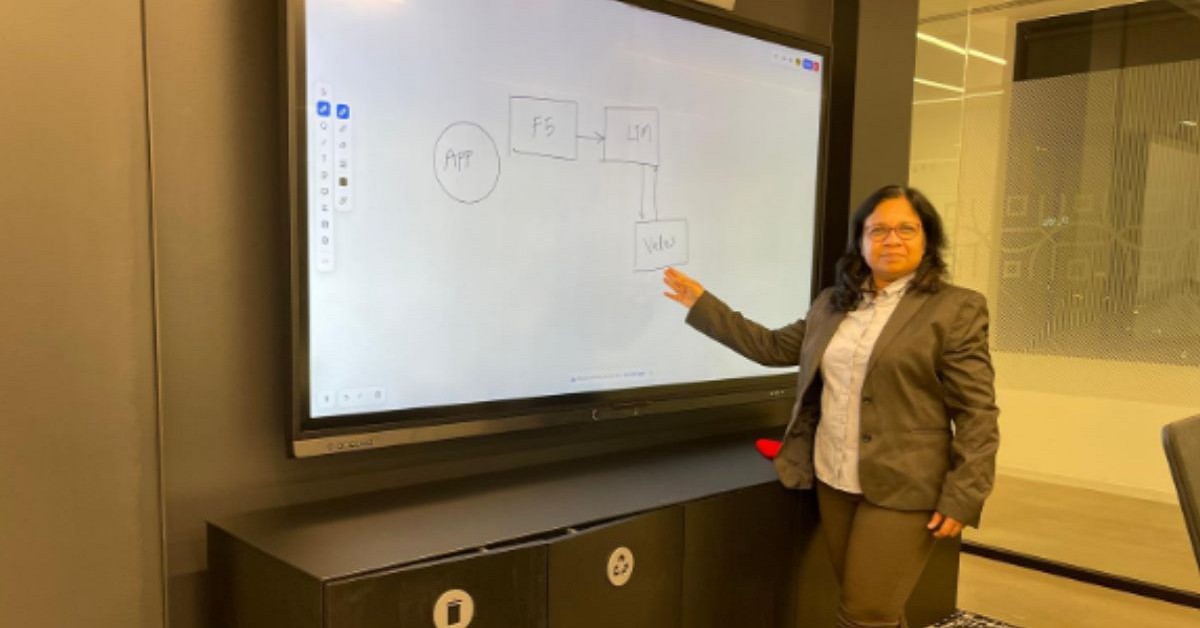

A crucial consideration while executing DR drills in finance is maintaining uninterrupted links between branch locations and the main data center. Vaishali also reflects on how they meticulously validated the routing configurations and redundancy setups to maintain uninterrupted branch-to-data center connectivity.

A significant success of Vaishali lay in the administration of DR drills for a Leading Public Sector Bank's data center. Such a task involved confirming failover across an expansive network of 500+ branches. By leveraging her skilful use of OSPF (Open Shortest Path First) settings and previously checked backup strategies, Vaishali managed to achieve smooth operations without stoppages while fully validating the robustness of the system structure. Similarly, her collaborations with government-authorised data centres reflect her ability and determination to oversee thorough failover simulations for more than 2 million clients, sustaining the preservation of data and continuity in workflow for services linked to the National Identity Services of India.

However, engaging in these activities, also meant that she had to stumble on certain considerations. One challenge was minimizing downtime during DR Drills, for which they implemented phased drills during off-peak hours with pre-tested configurations and rollback plans, which resulted in ensuring zero operational impact while achieving comprehensive failover validation. Another challenge was ensuring data integrity during failovers. To tackle the problem, she configured real-time data replication mechanisms and tested synchronization protocols during drills, which maintained 100% data accuracy throughout DR exercises. Testing failover across distributed systems was logistically challenging. She and her team coordinated multi-site drills with detailed workflows and automated failover configurations. The actions resulted in validating failover across 1500+ locations, ensuring system-wide continuity.

Furthermore, Vaishali's expertise in network configuration perfectly lines with supporting high availability. Her experience in implementing VLANs, OSPF, BGP, and MPLS setups has ensured seamless failover and continuous branch-to-data center connectivity.

When asked about the trends in the field, she lets us know that automated recovery testing and failover simulations will become essential for faster and more accurate validations, while AI tools will predict failure scenarios optimizing recovery processes. She also highlights the importance of incorporating zero-trust principles to ensure system security during failovers and the growth of Hybrid DR solutions that integrate on-premise systems with cloud platforms.

For organizations navigating the environment of drills, she suggests conducting regular DR drills to be prepared for unexpected failures, using automated tools to streamline failover testing and reduce manual errors and involving all stakeholders, including business teams, to ensure holistic preparedness. Further, she tells us that, "DR drills are not just technical exercises but also organizational preparedness tools. They ensure not only system resilience but also team readiness and stakeholder confidence."

Her work demonstrates the potential of DR drills in the financial sector as she concludes by saying, "Proactive DR drills help identify vulnerabilities that may not be apparent during routine operations, making the system more resilient during real disasters." More testing and simulations often result in a more resilient testing system.

CAclubindia

CAclubindia