Hope you already know that Dividend received from company is taxable from financial year 2020-21. Hence exemption u/s 10(34) is not applicable from FY 2020-21 as Dividend Distribution Tax u/s 115O. But there are fewer clarifications regarding Mutual Fund Dividend Exemption under section 10(35). Is it still available or not? Let's read and understand with official links:

What is Dividend?

Dividend means the distribution of rewards from a portion of the company's earning and is paid to its shareholders. Dividend is a part of the profit that a company shares with its shareholders. Dividends can be issued as cash payments or as shares of stock or any other kind, though cash dividends are most common.

According to Sec 10(22) of Income Tax Act, Dividend Includes

- Distribution of accumulated profits to shareholders entailing release of the company's assets;

- Distribution of debentures or deposit certificates to shareholders out of the accumulated profits of the company and issue of bonus shares to preference shareholders out of accumulated profits;

- Distribution made to shareholders of the company on its liquidation out of accumulated profits;

- Distribution to shareholders out of accumulated profits on the reduction of capital by the company ; and

- Loan or advance made by a closely held company to its shareholder out of accumulated profits.

Taxation on Dividend received from Indian Companies (Domestic Companies)

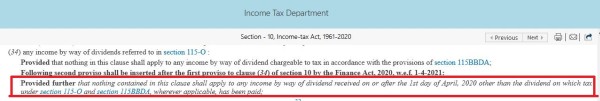

From Financial Year 2020-21, Dividend received from companies is taxable in the hand of receiver (shareholder). There is no exemption available u/s 10(34) of I.T. Act.

Taxation on Dividend received from Mutual Funds

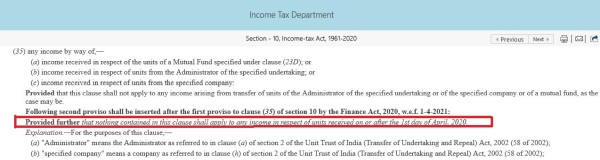

From Financial Year 2020-21, Dividend received from Mutual Funds is also Taxable in the hand of receiver. There is no exemption available u/s 10(35) of I.T. Act.

Consequently, Sec 115BBDA which provides for Taxability of Dividend in excess of Rs. 10 lakh has no relevance as the entire amount of dividend shall be taxable in the hand of shareholder.

CAclubindia

CAclubindia