The Central Board of Direct Taxes (CBDT) has launched an electronic campaign to resolve mismatches between income and transactions reported in:

- Annual Information Statement (AIS) and

- Income Tax Returns (ITRs) for FY 2023-24 and FY 2021-22.

It also targets individuals with taxable income or high-value transactions in AIS who have not filed ITRs for these years.

Objective of the Campaign

- To resolve mismatches in income/transactions.

- To encourage non-filers and under-reporters to comply.

- To implement the e-Verification Scheme, 2021 effectively.

Communication with Taxpayers

Who is going to receive messages?

Taxpayers with mismatches between AIS and ITR.

Non-filers with high-value transactions.

How?

Messages are sent via SMS and email.

Purpose of these messages

To remind and guide individuals who may not have fully disclosed their income in their ITRs to take this opportunity to file revised or belated ITRs for FY 2023-24.

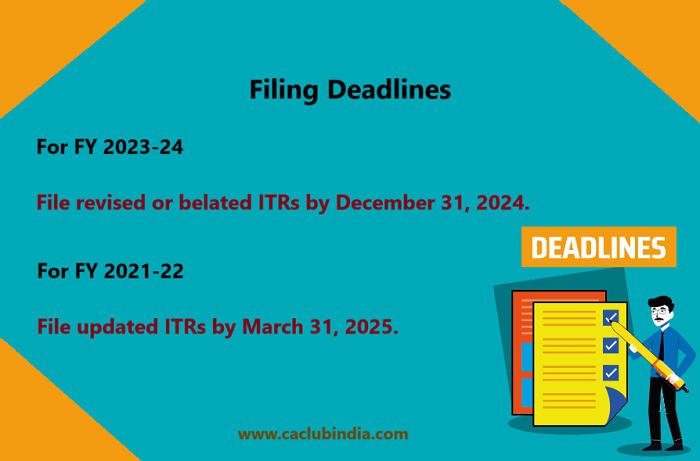

Filing Deadlines

Taxpayer Actions

Taxpayers can submit feedback, including disagreements with AIS information, through the AIS portal on the e-filing website.

Benefits of the Initiative

Encouragement to Taxpayers

- Take this opportunity to fulfil tax obligations.

- Support the government's vision of Viksit Bharat.

- Foster a culture of transparency, accountability, and compliance.

- This campaign highlights the government's use of technology to make tax filing easier and more efficient.

CAclubindia

CAclubindia