Audit Articles

Importance of Audit for the Smallest of Enterprises - Response to Consultation Paper of NFRA

CA. (Dr.) Rajkumar Adukia 03 November 2021 at 09:33CONSULTATION PAPER DATED 29th SEPTEMBER 2021 OF NFRA IS OPPORTUNITY TO TELL THE WORLD ADVANTAGES OF AUDIT TO EVEN SMALLEST ENTERPRISE

Emerging Risk Areas In Internal Audit Due To COVID Pandemic

CA Amrita Chattopadhyay 02 November 2021 at 15:09The COVID 19 pandemic has bought unprecedented changes and uncertainties in the in the business environment. It had disrupted lives / labour force, business operations, insolvency risks, resulted in inflation and supply chain.

Comments on NFRAs Consultation Paper On Statutory Audit And Auditing Standards for MSMCs

Kotte Murali Krishna 09 October 2021 at 09:45In case, NFRA takes any drastic decision to exempt the need for statutory audit of MSME companies for any reason, the size of frauds would go up and the Indian economy will be in the doldrums.

Pros and Cons of NFRAs Consultation Paper on Statutory Audit

Poojitha Raam VinayRemoval of Statutory audits on MSMCs might facilitate frauds and misstatements since GST and Tax audits have been scaled down. Moreover, minority interest in companies will be affected.

Open Letter To NFRA Chairman Opposing Consultation Paper On Abolishing Statutory Audit

CA Rohit kapoor 04 October 2021 at 09:38If Statutory Audit is exempted then there will be no check on business transactions and such exemption will lead to an emergence of spurious companies within MSMCs.

What is audit and what are the different types of audits?

Taxblock 28 September 2021 at 09:35Audit is the activity of evolution and determine the financial, operational and strategic goals and exercise in an organizations to decide if the organization is in accordance with the rules and regulations.

Things to be checked before Balance Sheet Finalization

Varsha Nayyar 24 September 2021 at 09:45Balance Sheet finalization is the most important work that needs to be done for Statutory Audit. Discussing all the important points that need to be taken care of before finalization of the balance sheet.

Appointment of Auditor in Casual Vacancy in an OPC

CS Tanveer Singh Saluja 21 September 2021 at 15:45Let us discuss how to appoint an auditor in casual vacancy in an OPC

Concept & Meaning of Turnover in Tax Audit

CA.R.S.KALRA 15 September 2021 at 17:35'Turnover', 'Gross Receipts' and 'Sales' are the buzzwords during this Tax Audit season. Incidentally, they are the very starting point of a Tax Audit. They form the qualifying criteria, determine whether a taxpayer is liable to tax audit during a given year.

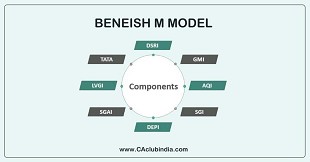

Beneish M Model - A Tool Detection Of Fraud in Financial Statements

Poojitha Raam VinayBeneish Model is a statistical model created by Professor Messod D. It is a model that studies the trend of the organisation through various ratios. This model is based on eight financial ratios.

Popular Articles

- No More Forced ITC Order: New Rules from Jan 2026

- Income Tax Return Filing Due Date For AY 26-27: Full Details With New Updates

- Revised Return Due Date Extension

- TDS Rate Chart For Tax Year 2026-27: With Revised Section Codes in Challans

- Holiday or Trading Day on 1st Feb 2026: Will the Stock Market Really Be Open on Sunday?

- Simplified GST Changes in Budget 2026: Finance Bill 2026 CGST and IGST Amendments

- Income Tax Amendments in Budget 2026: Topic-wise Summary of Key Proposals

- ICAI, ICSI & ICMAI to Launch Short-Term Courses to Develop 'Corporate Mitras' in Tier-II & III Towns

Trending Online Classes

-

DT & Audit (Exam Oriented Fastrack Batch) - For May 26 Exams and onwards Full English

CA Bhanwar Borana & CA Shubham Keswani

CA Bhanwar Borana & CA Shubham Keswani -

IDT LIVE Exam Oriented Batch | May 2026, Sept 2026 & Jan 2027

CA Arpita Tulsyan

CA Arpita Tulsyan

CAclubindia

CAclubindia