Instruction No. 20/2021-Customs

F.No.450/179/2017-Cus- IV

Government of India

Ministry of Finance

Department of Revenue

(Central Board of Indirect Taxes & Customs)

*****

Room No.227B, North Block,

New Delhi, dated the 10th of September, 2021.

To,

All Principal Chief Commissioners/ Chief Commissioners of Customs/ Customs (Preventive),

All Principal Chief Commissioners/ Chief Commissioners of Customs & Central tax,

All Principal Commissioners/ Commissioners of Customs/ Customs (Preventive),

All Principal Commissioners/ Commissioners of Customs & Central tax,

All Principal Director Generals/Director Generals under CBIC.

Madam/Sir,

Subject: Easing availability of containers for exporters- reg.

The CBIC has taken various measures over last year related to the subject cited above including the Special drive for disposal of unclaimed/uncleared/ seized/ confiscated goods vide Instruction No.17/2020-Customs dated 10.08.2020 which has enabled disposal of over 1.6 lakh consignments and follow up on long standing containers which resulted in the release of nearly 14,000 TEUs. Recently on 07.09.2021, the Board has circulated an updated list of long standing 19,738 TEUs [13,104 containers] received from Container Shipping Lines Association (CSLA) to the field formations.

2. To continue the emphasis on enhanching the availability of containers, the Board has decided that the field formations also take the following measures:

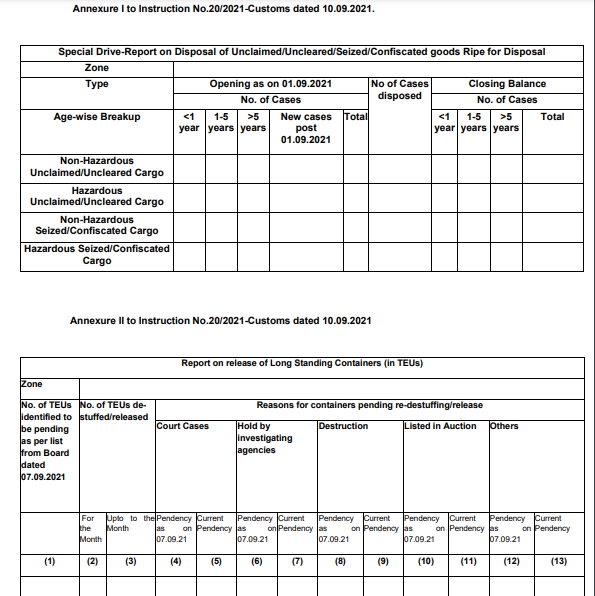

2.1. Dispose expeditiously the unclaimed/uncleared/seized/confiscated goods including that are holding up containers following the timelines and procedures prescribed in Board’s Circular 48/2018 dated 03.12.2018. The proforma for the monthly report is in Annexure-I. It should reach uscus4.dor@gov.in by 5th of the succeeding month.

2.2. Field formations follow the spirit of para 5 of Board Circular 83/98-Customs dated 5.11.1998 and para 3 of Board Circular No.84/95-Cus dated 25.07.1995 thereby taking proactive steps such that containers housing import cargo that is under enquiry are expeditiously released. For this, provision already exists that whenever it becomes necessary to detain the imported cargo, pending completion of enquiry/investigation, such cargo should be removed to a customs warehouse in terms of the provisions of Section 49 of the Customs Act, 1962. For this purpose, the cargo can also be removed from the container and the container can be released for further use. The field formations should encourage this activity by offering it to the importers.

2.3. Field formations had reported certain reasons such as court cases, hold by intelligence agencies etc., for non-release of containers. A monthly report proforma in Annexure-II is prescribed for this purpose. This proforma is designed in a manner to reflect the progress made by field formations in these sub-categories. This too should reach uscus4.dor@gov.in by 5th of the succeeding month. It is guided that proactive steps enabling release of such containers should also be adopted.

3. Hindi version follows.

Yours faithfully,

(Ananth Rathakrishnan)

Deputy Secretary (Customs)

CAclubindia

CAclubindia

Guest

Notification No : Instruction No. 20/2021-CustomsPublished in Custom

Source : https://www.cbic.gov.in/resources//htdocs-cbec/customs/cs-instructions/cs-instructions-2021/cs-ins-20-2021.pdf