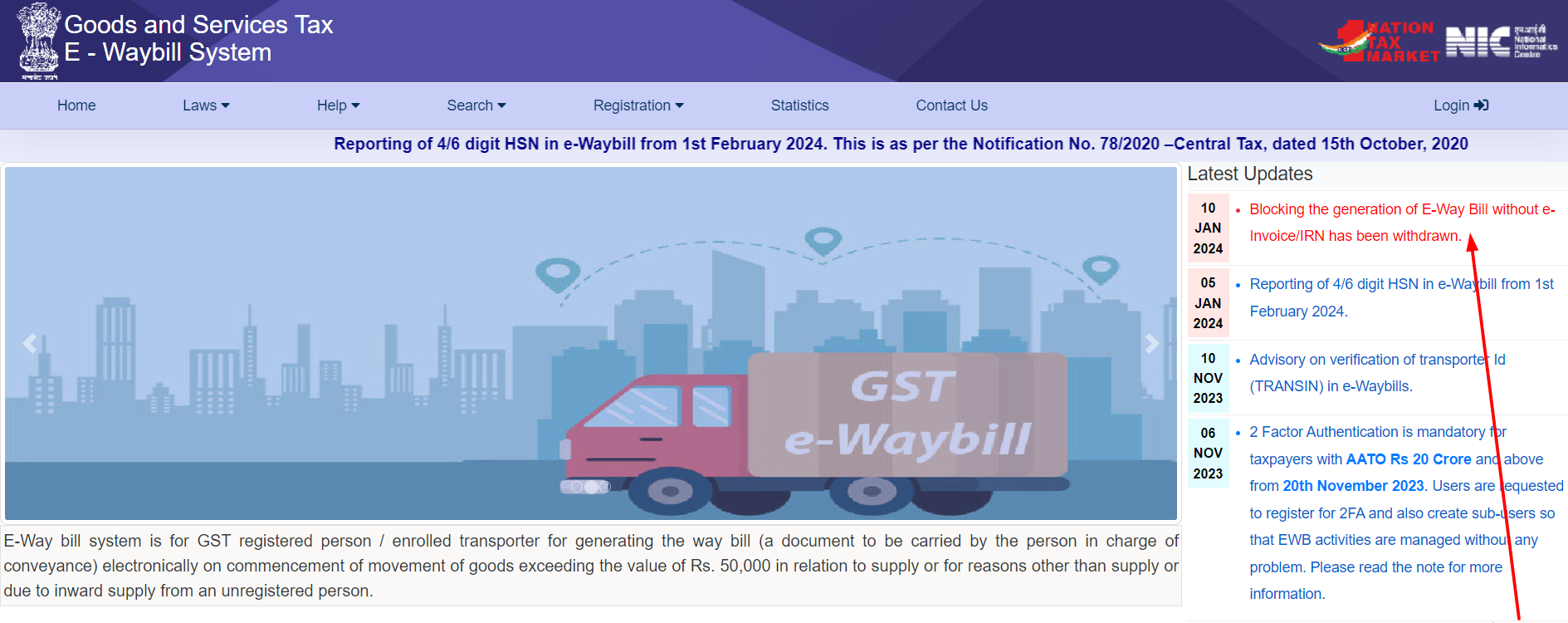

As of January 10, 2023, the earlier decision to restrict the creation of E-Way Bills exclusively to those accompanied by e-Invoice/IRN has been reversed, as per the recent update in the GST E-way bill system.

For additional details, kindly visit the "Latest Updates" section on the E-way bill portal.

The National Informatics Centre (NIC) had unveiled the pivotal update on January 5, 2024, reshaping the landscape of electronic documentation for businesses. The announcement outlined a mandatory integration set to be enforced starting March 1, 2024, where the generation of e-Waybills will be contingent upon the inclusion of e-Invoice details.

Click here for the announcement made initially by NIC

CAclubindia

CAclubindia