Previously, taxpayers had to check their income tax refund status on the TIN-NSDL website. However, the Income Tax Department has now launched a new functionality called "Know Your Refund Status" on the e-filing portal that allows users to check their refund status directly from the portal itself. This functionality allows taxpayers to check the status of their income tax refund online.

If you have paid more tax than your actual tax liability, you can claim a tax refund from the Income Tax Department.

A Step-By-Step Guide To Check Income Tax Refund Status

Step 1: Visit the E-filing portal.

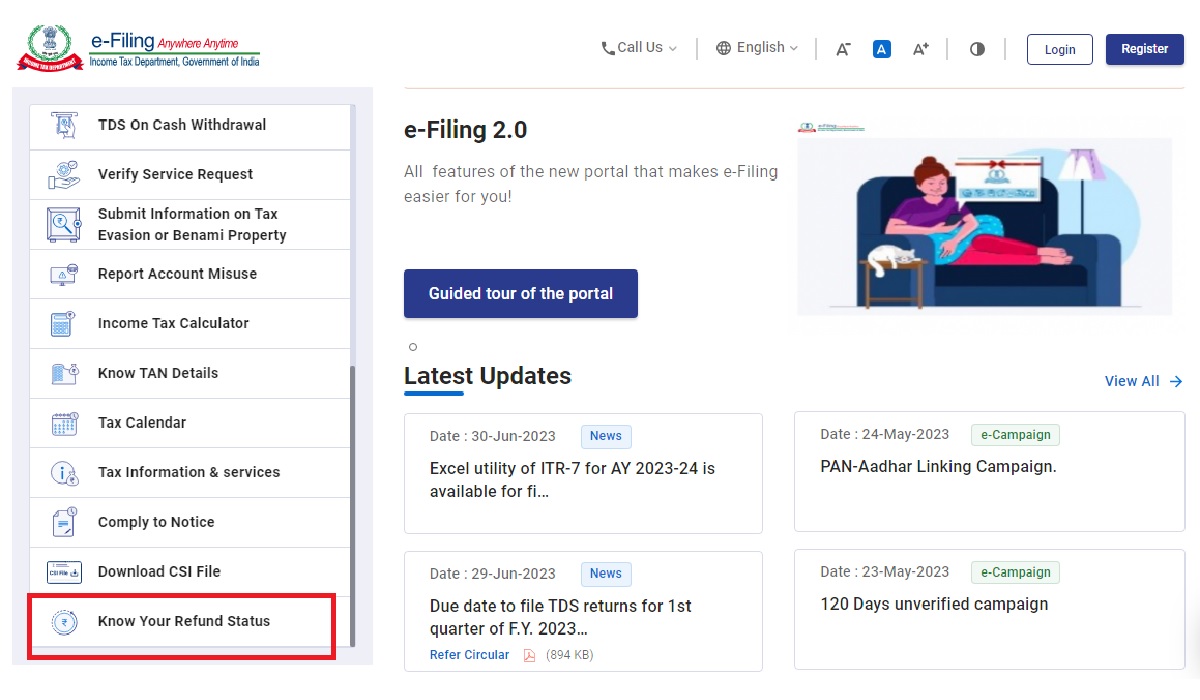

Step 2: Scroll down the 'Quick Links' section till you see 'Know Your Refund Status'. Click on it.

Step 3: Fill in your PAN number, AY (2023-24 for the current year), and mobile number.

Step 4: You will get an OTP. Fill in the OTP in the given place.

Now, it will show the income tax refund status. If there is some issue with your ITR bank details, the income tax refund status will show as "No Records Found". In this case, you will need to check your e-filing processing status to see if your return has been processed successfully. You can do this by navigating to the "e-File" tab on the income tax portal and selecting "Income Tax Returns" and then "View Filed Returns". If your return has been processed successfully, you will see a status of "Processed". If your return has not been processed successfully, you will see a status of "Pending" or "Rejected".

CAclubindia

CAclubindia