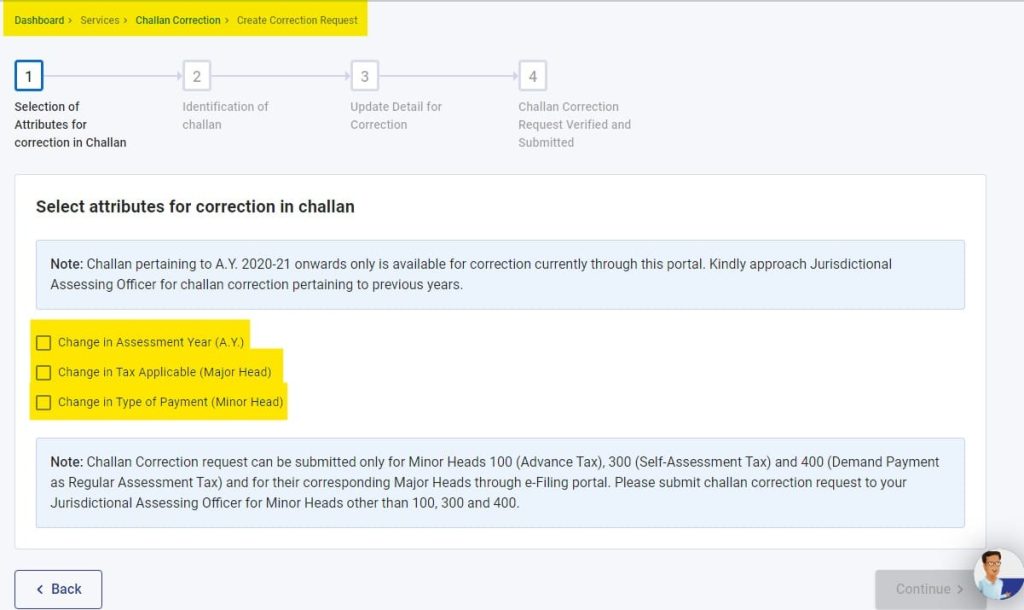

The Income Tax India portal has introduced a new feature called "Challan Correction," accessible through the path Dashboard > Services > Challan Correction.

This functionality empowers taxpayers to modify crucial details such as the Assessment Year, Major Head, and Minor Head for payments like Advance Tax, Self-Assessment Tax, and Regular Assessment Tax related to Challans for Assessment Year 2020-21 onwards. This enhancement provides taxpayers with the flexibility to make necessary adjustments to their tax payments, streamlining the process and ensuring accurate reporting.

The Challan Correction facility is a welcome addition to the Income Tax e-filing portal. It will help taxpayers to correct errors in their challans easily and quickly. This will help to ensure that their tax payments are accurate and up-to-date.

CAclubindia

CAclubindia