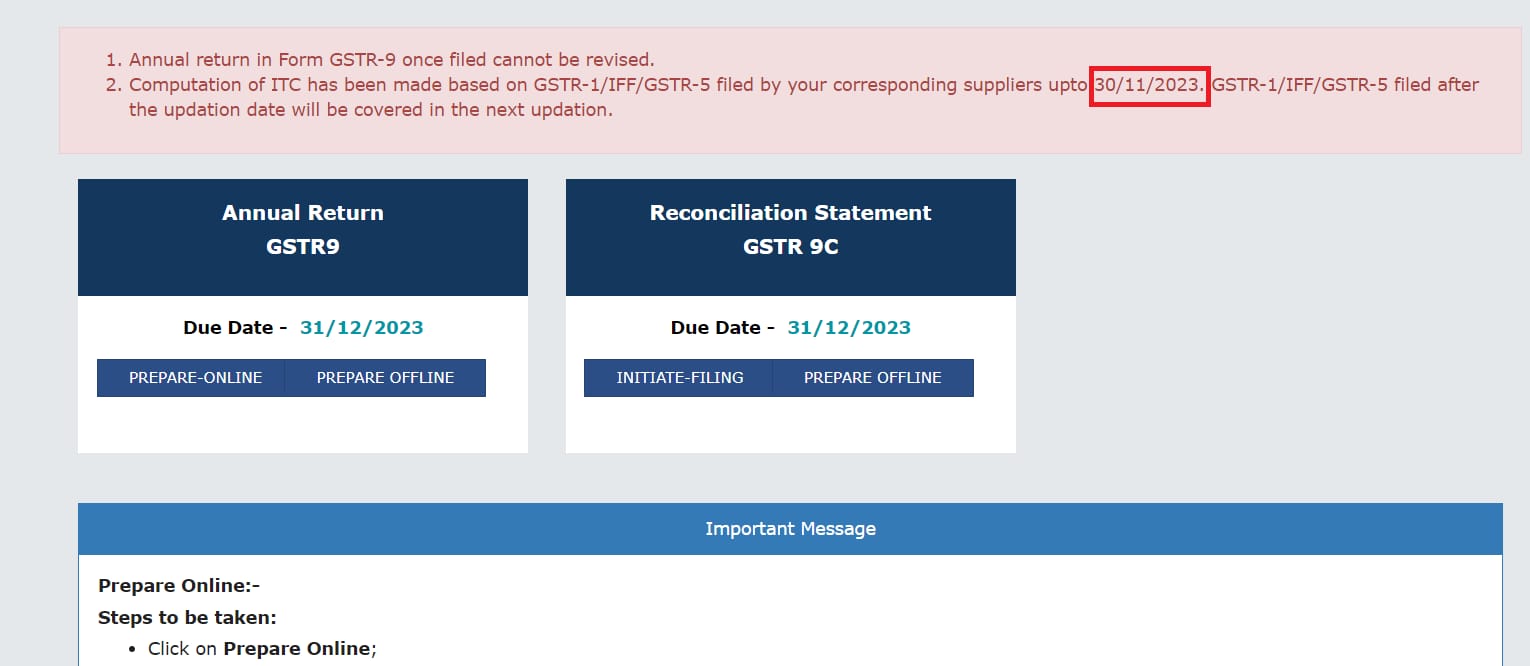

GSTR-9 Annual Return Table 8A ITC Computation Updated with Supplier Filings Until November 30, 2023

In a recent development, the Annual Return GSTR-9's Table 8A, responsible for Input Tax Credit (ITC) computation, has undergone a significant update. The revision incorporates crucial data extracted from suppliers' GSTR-1, IFF (Invoice Furnishing Facility), and GSTR-5 filings, providing a comprehensive overview of transactions up to November 30, 2023.

This update brings a heightened level of accuracy and completeness to the ITC computation process, as it reflects the latest information available from suppliers. The Annual Return GSTR-9 serves as a comprehensive document summarizing the financial activities and tax liabilities of a taxpayer for a given financial year.

The incorporation of data until November 30, 2023, ensures that businesses can rely on the most up-to-date information for their ITC calculations. This is particularly crucial for organizations seeking precision in their tax reporting and compliance efforts.

It is noteworthy that the refreshed information in Table 8A is now finalized, indicating that no further changes are expected in this specific section. Taxpayers and professionals can proceed with confidence in utilizing the updated figures for their annual return filing.

However, it's essential to be aware that any filings made by suppliers after the mentioned update date will not be reflected in the current update of Table 8A. Instead, these subsequent filings will be considered in the next update cycle, ensuring that the annual return captures the most recent and accurate data available.

This announcement underlines the commitment to maintaining transparency and accuracy in the GST filing process, providing stakeholders with reliable and current information for their compliance activities. Taxpayers are advised to stay informed about such updates and adhere to the guidelines to ensure seamless and compliant filing of their Annual Return GSTR-9. As the tax landscape continues to evolve, timely and accurate reporting remains a key aspect of efficient business operations in the GST regime.

CAclubindia

CAclubindia