GSTR-3B tab on the GST Portal will not open before the filing of GSTR-1. This is because GSTR-3B is a summary return that is based on the details filed in GSTR-1. If you have not filed GSTR-1, then the GST Portal will not have the necessary information to generate GSTR-3B.

The government has introduced this restriction in order to ensure that taxpayers file GSTR-1 on time. If taxpayers do not file GSTR-1, then they will not be able to file GSTR-3B, which will result in late fees and penalties.

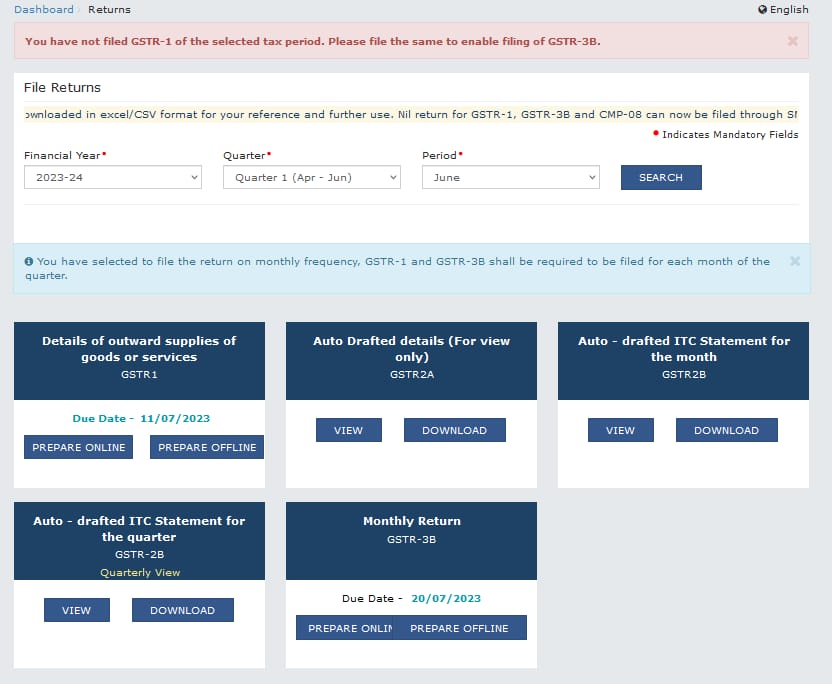

Monthly

"You have not filed GSTR-1 of the selected tax period. Please file the same to enable filing of GSTR-3B"

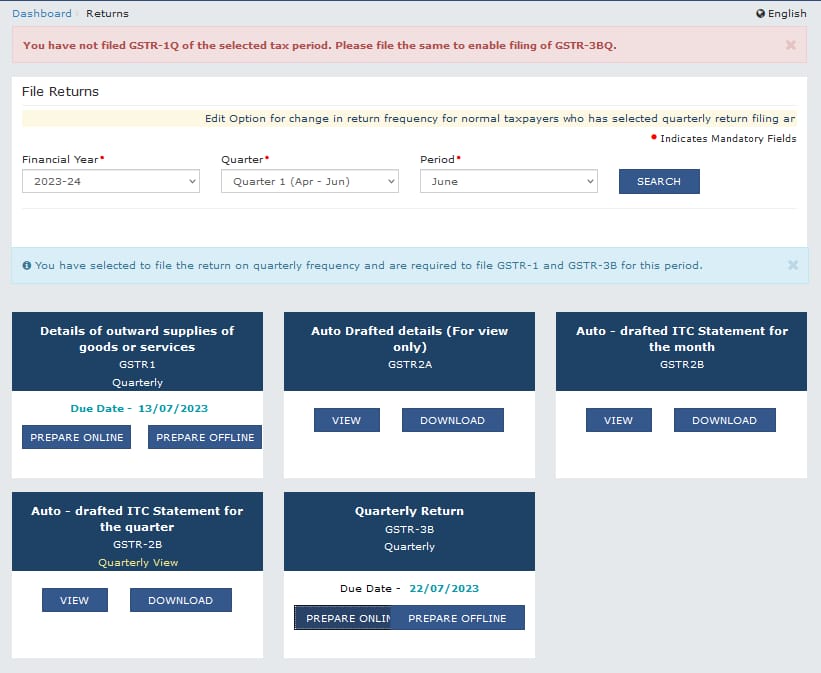

QRMP

"You have not filed GSTR-1Q of the selected tax period. Please file the same to enable filing of GSTR-3BQ"

"

CAclubindia

CAclubindia