GSTN has introduced an update to facilitate the registration compliance for buyers of metal scrap through form GST REG-07. This update follows the new GST provisions for metal scrap buyers as outlined in the advisory issued on October 13.

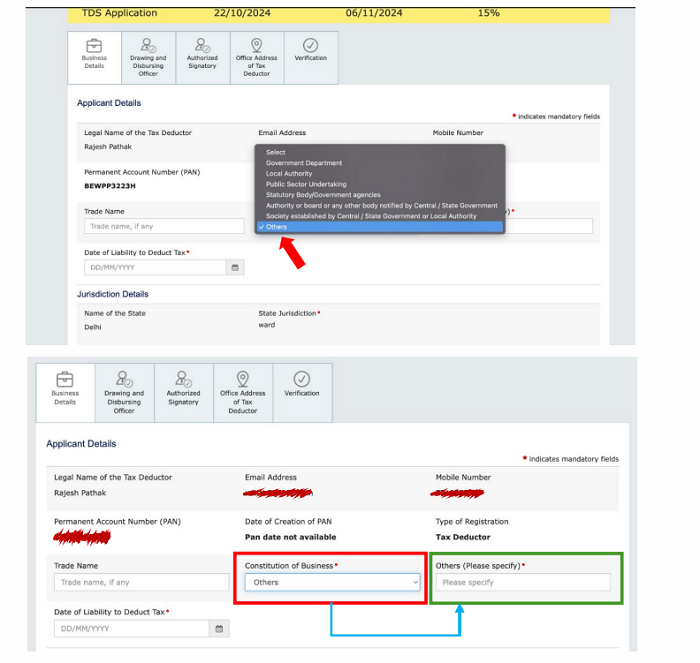

Taxpayers in this category are required to select "Others" in Part B of Table 2 under the "Constitution of Business" section. A text box will appear where the taxpayer must enter "Metal Scrap Dealers." This entry is mandatory for those selecting the "Others" option. Once this is completed, the remaining details in form GST REG-07 should be filled and submitted on the common portal to meet the registration requirements as per Notification No. 25/2024 - Central Tax, dated October 9, 2024.

Advisory for GST REG-07

In pursuance the advisory issued on October 13 regarding the "New GST provision for metal scrap transactions," the GST portal has been updated to facilitate registration compliance for buyers of metal scrap through form GST REG-07.

Taxpayers in this category are required to select "Others" in Part B of Table 2 under the title "Constitution of Business" section.

This selection will open a text box where the taxpayer must enter “Metal Scrap Dealers”. Please note that this entry is a mandatory field for those selecting "Others" in Table 2.

Once this is completed, the remaining details in the GST REG-07 form must be filled and submitted on the common portal to comply with registration requirements as per Notification No. 25/2024 - Central Tax, issued on October 9, 2024.

A screenshot of the form GST REG-07 is enclosed below with the relevant sections highlighted:

CAclubindia

CAclubindia