GSTN has implemented a validation process for cases where a taxpayer attempts a non-core amendment to update bank account details. Taxpayers are requested to follow the procedure outlined in the link provided below while adding bank account details on the portal.

Advisory is as follows

Dear Taxpayer,

GSTN has implemented a validation process for cases where a taxpayer attempts a non-core amendment to update bank account details. Taxpayers are requested to follow the procedure outlined below while adding bank account details on the portal.

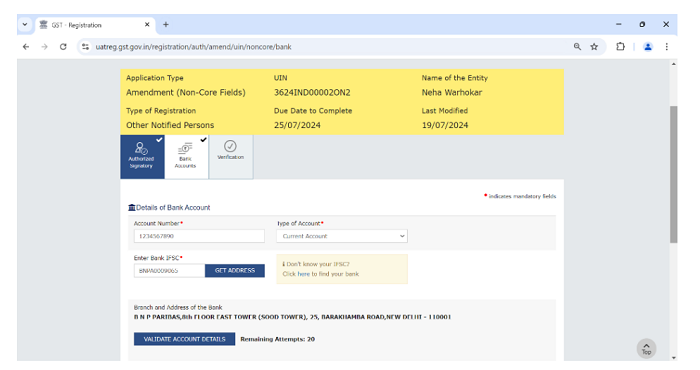

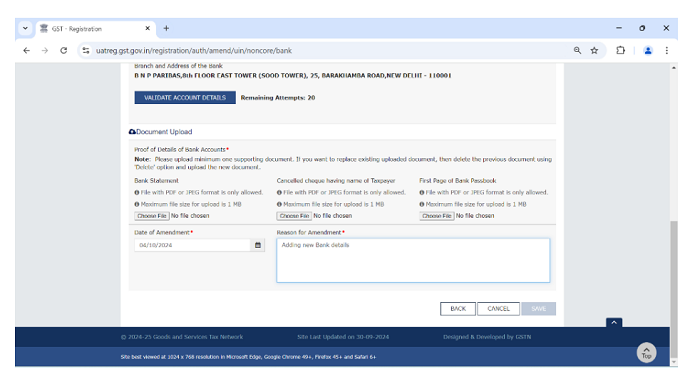

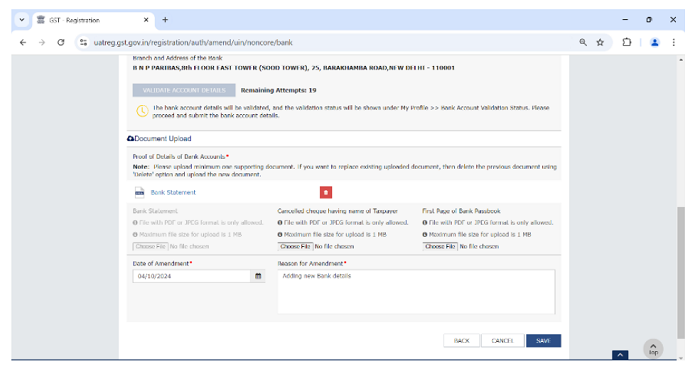

(I) When the bank account details are entered, the taxpayer is required to click on"VALIDATE ACCOUNT DETAILS" button.

(II) Prior to clicking the "Validate Account" button, the "Save" button at the bottom of the screen as shown remains disabled.

(III) The "Save" button will become active only after the "Validate Account Details" button is clicked.

Thanks,

Team GSTN

CAclubindia

CAclubindia