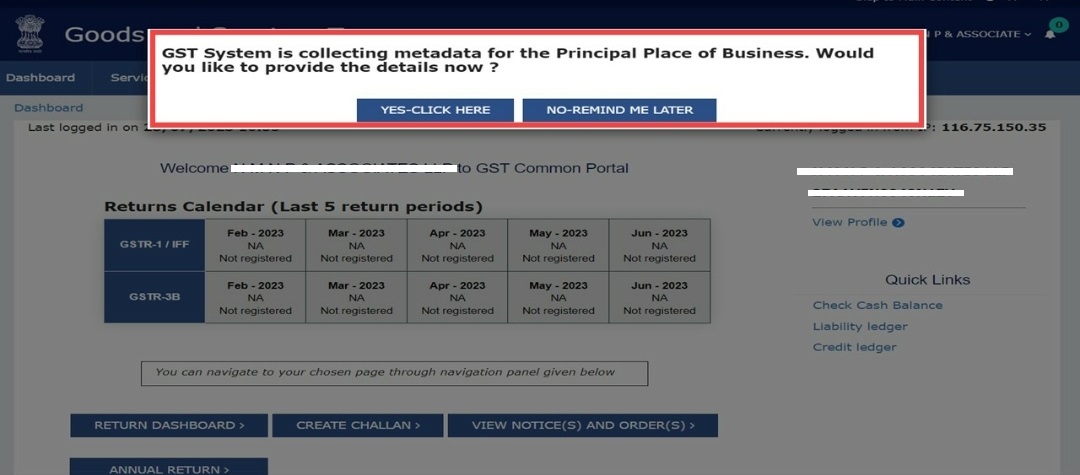

The GSTN has recently announced that it will be collecting metadata of the Principal Place of Business (PPOB) for all registered taxpayers. This metadata will include information such as the PPOB's address, contact details, and PAN number. The GSTN will use this information to improve the tracking and management of PPOBs, which will help to ensure that GST compliance is maintained.

The GSTN has stated that the collection of this metadata is necessary to improve the efficiency of the GST system. The metadata will be used to identify and flag potential compliance risks, and to provide taxpayers with better information about their GST obligations. The GSTN has also stated that the metadata will be kept confidential and will not be shared with any third parties.

Here are some of the benefits of collecting PPOB metadata

- It will help to improve the tracking and management of PPOBs, which will help to ensure that GST compliance is maintained.

- It will help to identify and flag potential compliance risks.

- It will provide taxpayers with better information about their GST obligations.

- It will help to improve the efficiency of the GST system.

CAclubindia

CAclubindia